Mastering Retailer Price Monitoring Strategies

Maxime Dupré

10/16/2025

Retailer price monitoring is all about keeping a close, real-time watch on what your competitors and the broader marketplace are doing with their prices. This isn't just a task you do once in a while anymore; it's a constant, vital part of running a business today, especially in the lightning-fast world of e-commerce.

Let’s be clear: this is not a race to the bottom by blindly matching every price cut you see. It’s about deeply understanding the market's pulse to protect your brand, your margins, and your sanity.

Navigating the New Rules of Retail Pricing

Welcome to modern commerce, where a price can change in the time it takes to grab a coffee. Gone are the days of setting your prices and maybe checking back in next quarter. Today’s digital shelf is a living, breathing thing where you can gain—or lose—an edge in an instant.

The sheer scale and speed of this shift are staggering. By 2025, global retail e-commerce sales are expected to blow past $6.8 trillion, with nearly 2.77 billion people shopping online. In a market this massive, the big players are changing prices several times a day. Trying to keep up manually is simply a fool's errand. You can learn more about how this growth impacts pricing strategies at Metricscart.com.

Beyond Simple Price Matching

Truly effective retailer price monitoring is so much more than a simple price check. It’s about assembling a complete intelligence picture of the market that helps you answer the tough questions:

- Market Dynamics: Is that price drop from a single, desperate competitor, or is the entire market shifting?

- Brand Protection: Are your retail partners actually following your pricing rules? Or are rogue discounts quietly chipping away at your brand’s perceived value?

- Strategic Decisions: Is there room to nudge your price up and improve margins without scaring off customers? Or is now the time to hold steady and defend your market share?

The goal is not just to react, but to anticipate. A robust monitoring strategy turns raw data into actionable intelligence, allowing you to make smarter, faster decisions that protect profit margins and strengthen your competitive position.

Think of this guide as your playbook for mastering this critical skill. We’ll walk you through everything from the basic principles of what to track to the advanced strategies that will give you a real competitive advantage. It's time to turn pricing from a reactive chore into one of your most powerful strategic tools.

Understanding Retailer Price Monitoring

At its most basic, retailer price monitoring is the process of tracking what your competitors are charging. But if you think of it as just "spying," you're missing the forest for the trees. This isn't about knee-jerk price matching; it's about building genuine market intelligence.

Think of yourself as a ship's captain navigating a foggy harbor. Just seeing the lights of other ships isn’t very helpful. What you really need is a radar system showing their speed, direction, and size so you can plot the smartest course. Price monitoring is that radar for your brand, turning pricing from a guessing game into a calculated, strategic move.

And make no mistake, this is critical. Today's shoppers are savvier than ever. One report found that for 37% of consumers, the ability to easily compare prices online is the single most important part of their shopping experience. If you aren't watching the market, you can bet your customers are.

Moving Beyond the Price Tag

Truly effective price monitoring goes much deeper than just grabbing a competitor's final price. It’s about collecting a whole host of data points that give you the story behind that number. A solid strategy tracks all sorts of competitive signals.

For instance, seeing a rival suddenly slash their price might trigger an immediate panic. But what if your monitoring tool also shows they're about to run out of stock? That completely changes the narrative. A potential price war just became a golden opportunity for you to hold firm and scoop up their customers.

Key data points you should be tracking include:

- Competitor Pricing: The obvious starting point, covering both direct and indirect rivals.

- Stock Availability: Knowing when a competitor is out of stock can save you from making unnecessary markdowns.

- Promotions and Discounts: Are they running flash sales, BOGO offers, or bundled deals?

- Shipping Costs and Times: This is a huge piece of the puzzle for a customer's total cost.

The Strategic Value of Real-Time Data

The real magic of retailer price monitoring happens when the data is fast and accurate. The online marketplace moves at lightning speed, with big retailers sometimes adjusting prices multiple times a day. Old-school manual spot-checks just don't cut it anymore. By the time you've put your spreadsheet together, the information is already history. This is why automation and real-time data are so essential.

Price monitoring lets you flip the script from a reactive stance—"They cut their price, we have to follow!"—to a proactive one—"The market is shifting, so here's our next move." It gives you the intelligence to protect your margins and stand by your pricing with confidence.

Modern systems use automated tech to constantly scan the web, gathering this data and translating it into clear, actionable insights. For a closer look at the tech that makes these instant updates possible, this resource on A Practical Guide to Real-Time Data Streaming is a great read. This constant flow of information is what fuels a truly dynamic and responsive pricing strategy.

Ultimately, this entire process is a key piece of a bigger puzzle called competitive intelligence—gathering and analyzing information about your entire market. You can learn more about how this drives business decisions in our guide on what is competitive intelligence. By seeing the full picture, you can get ahead of market trends, protect your brand's reputation, and turn pricing into one of your most powerful tools for growth.

Unlocking Key Business Advantages

A smart price monitoring strategy does more than just give you a spreadsheet of competitor prices. It’s about turning that data into a powerful offensive tool, allowing you to make calculated decisions that directly boost your bottom line, strengthen your market position, and protect your brand.

When you get it right, you move from just tracking prices to actively driving profitability. You get the clarity to make confident, data-backed choices that defend your margins without scaring away shoppers. It’s the difference between guessing and knowing.

Maximize Profit Margins

One of the quickest wins from price monitoring is the ability to grow your profit margins without killing sales. By keeping a constant eye on the market, you can spot the perfect moments to adjust your prices upwards—like when a competitor runs out of stock or when demand for a certain product suddenly spikes.

Think about it: a competitor’s hot-selling electronic gadget goes out of stock. Your monitoring tool sends you an alert. Instead of leaving your price as is, you could bump it up by 5-10%. You'll capture the sales from customers who need that item now and are willing to pay a little extra for it. That small, strategic increase, applied across hundreds of products over time, can add up to some serious revenue.

The goal isn’t always to be the cheapest; it's to be the smartest. Retailer price monitoring gives you the intelligence to know exactly when you can command a higher price and when you need to hold steady.

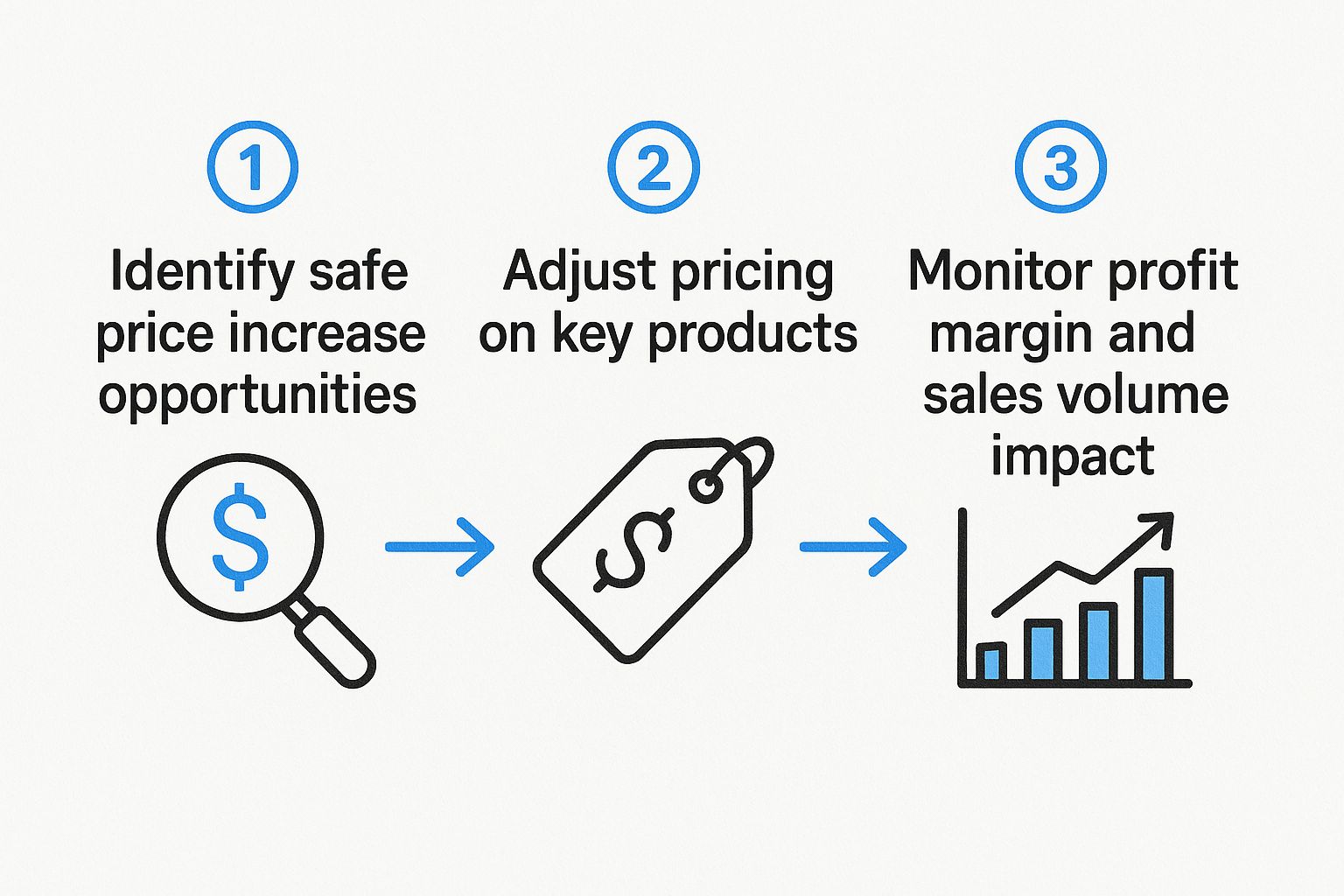

This turns pricing from a static number into a dynamic lever you can pull to optimize profits. The process becomes a continuous loop of gathering data, making smart adjustments, and analyzing the impact.

As the infographic shows, it’s a simple but powerful cycle: you monitor the market, which informs your pricing adjustments. You then analyze how those changes affect your profits and sales, creating a feedback loop for constant improvement.

Boost Sales Volume and Market Share

Of course, sometimes the game isn't about margin, but about growth. Price monitoring is your secret weapon here, too. It helps you figure out which of your products are most sensitive to price changes and where a carefully planned discount could lead to a massive jump in sales.

Let's say you notice a competitor has been slowly creeping up the price of a popular accessory. Your monitoring tool flags the trend. This is your cue. You can run a targeted promotion on your own version of that product, positioning it as the obvious choice for value. This move can bring in a flood of new customers and help you carve out a bigger piece of the market for yourself.

This tactic works especially well for:

- Key Value Items (KVIs): Price these high-visibility products strategically. Shoppers often use them to judge your store's overall value.

- Seasonal Campaigns: Get a jump on the competition by undercutting them just before a major holiday to grab those early-bird shoppers.

- New Product Launches: Price a new item aggressively right out of the gate to build momentum and rack up those all-important customer reviews.

The table below breaks down how these benefits translate into real-world business outcomes.

Core Benefits of Retailer Price Monitoring

This table outlines the key advantages of implementing a price monitoring strategy and links them to specific business outcomes.

| Benefit | Business Impact | Example Scenario |

|---|---|---|

| Maximize Profit Margins | Increased Revenue | A competitor runs out of a top-selling item; you slightly increase your price to capture higher-margin sales from eager buyers. |

| Boost Sales & Market Share | Customer Acquisition | You notice a rival has raised their price on a key product, so you run a promotion to attract their price-sensitive customers. |

| Protect Brand Value | Enhanced Brand Equity | You instantly detect a third-party seller violating your MAP policy and take action, preventing a price war and brand devaluation. |

| Improve Competitiveness | Informed Strategy | Data reveals your pricing on a whole category is too high; you adjust to better align with the market and regain lost sales. |

Ultimately, each benefit works together to create a more resilient and profitable retail operation.

Protect Your Brand's Perceived Value

Finally, consistent price monitoring acts as a bodyguard for your brand. In the wild west of online marketplaces, unauthorized discounts from third-party sellers can quickly cheapen the brand image you've worked so hard to build. This is a huge issue for brands that enforce a Minimum Advertised Price (MAP) policy.

Without monitoring, a single rogue seller can set off a race to the bottom, forcing all your other retail partners to match their lowball price just to compete. This not only devalues your product in the eyes of consumers but also damages your relationships with your authorized retailers.

By using monitoring tools, you can spot MAP violations the moment they happen and take action. This ensures your products are sold at a consistent, fair price everywhere, which protects both your brand’s premium feel and your profit margins. It sends a clear signal that your brand’s value isn't up for debate, building trust with customers and partners alike.

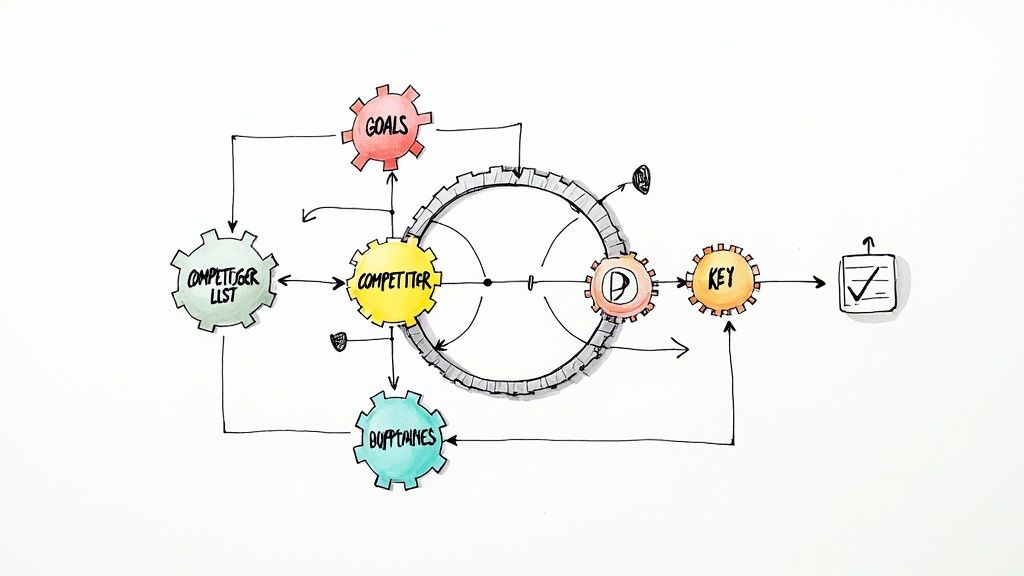

Building Your Price Monitoring Framework

Alright, let's move from theory to action. Building a solid retailer price monitoring framework isn't about flipping a switch and hoping for the best. It's a deliberate process, a structured system that needs to be aligned with your business goals from the very beginning. This framework becomes your strategic blueprint, guiding everything from which competitors you watch to how you react when the market moves.

Think of it like building a house. You wouldn't just start laying bricks without a solid foundation and a detailed plan. Your pricing strategy is that foundation, and this monitoring framework is the structure you build on top of it. Get it right, and you'll have a system that's stable, scalable, and does exactly what you need it to.

Define Your Strategic Pricing Goals

First things first: before you even think about tracking a single price, you have to answer one critical question. What are you actually trying to achieve? Your answer to this will shape your entire approach. Without that clarity, you're just collecting data for the sake of it, and you’ll quickly find yourself drowning.

Are you trying to be the undisputed low-price leader in your niche, pulling in customers who are always hunting for a bargain? Or is your brand positioned as a premium option, where monitoring is less about being the cheapest and more about protecting your brand's value?

Your objective will likely fall into one of these common buckets:

- Price Leadership: Consistently being the cheapest on key products to drive sales volume and attract budget-conscious shoppers.

- Profit Maximization: Finding those sweet spots where you can nudge prices up without hurting sales, often by watching competitor stock levels.

- Brand Protection: Making sure your retailers stick to MAP policies and stopping unauthorized discounts that cheapen your brand's image.

- Market Share Growth: Using strategic pricing to steal customers from your rivals, even if it means taking a temporary hit on your margins.

Your strategic goal is your north star. It ensures that when a competitor makes a move, your response is a calculated step toward your objective, not a panicked reaction.

Identify Key Competitors and Products

Once you know why you're monitoring, the next step is to figure out who and what to watch. You can't—and shouldn't—track every single competitor and every last product. That's a classic rookie mistake that leads straight to analysis paralysis. The key is to focus on what actually moves the needle.

Start by sorting your competitors into tiers. You have your direct competitors, who sell similar stuff to the same customers, and indirect competitors, who might offer different solutions to the same problem. From there, pinpoint your Key Value Items (KVIs). These are the high-profile products shoppers use to size up your brand's overall value.

Focusing your efforts like this ensures your resources are aimed where they'll have the biggest impact. This is especially true in a massive market like the U.S., where retail sales are projected to hit $7.26 trillion in 2024. In an arena that vast, shoppers have no problem switching brands for a better deal, which means you have to be laser-focused on the threats that matter. You can get a deeper look at these U.S. consumer trends and market forecasts on Deloitte.com.

Choose Your Monitoring Method

With your targets locked in, you need to decide how you're going to get the data. This choice really comes down to your scale, your budget, and how quickly prices change in your market. It boils down to two main paths.

1. Manual Spot-Checks

This is the old-school approach: someone on your team manually visits competitor websites and logs prices in a spreadsheet.

- Pros: It’s cheap and easy to start.

- Cons: It’s incredibly time-consuming, riddled with human error, and completely useless in fast-paced markets where prices can change multiple times a day.

2. Automated Software Solutions

These tools do the heavy lifting for you, automatically scraping competitor sites, marketplaces, and other channels to gather pricing data around the clock.

- Pros: They're accurate, fast, scalable, and give you historical data to spot trends.

- Cons: There’s a software investment involved.

Let's be honest: for any business that's serious about competing online, automation is the only real long-term option. Manual tracking might work if you sell a handful of products and have only one or two competitors, but it falls apart almost immediately as you grow. To make a smart decision, it's worth exploring our comprehensive business intelligence tools comparison.

Connect Data to Your Dynamic Pricing Strategy

The last piece of the puzzle is creating a feedback loop. All the data in the world is useless if you don't do anything with it. Your monitoring system has to feed directly into your pricing engine, whether that’s a person making decisions or a fully automated dynamic pricing algorithm.

This is where you set up rules and alerts based on the goals you defined earlier. For example:

- If you're a price leader: Set an alert to fire the moment a direct competitor undercuts you on a KVI, so you can respond instantly.

- If you're maximizing profit: Create a rule that flags when a top competitor runs out of stock on a hot item, signaling a perfect opportunity to raise your price.

- If you're protecting your brand: Use alerts to catch MAP violations from third-party sellers the minute they happen.

By connecting real-time data to predefined actions, you turn price monitoring from a passive reporting tool into an active, revenue-driving machine. It's this systematic approach that ensures your pricing stays competitive, profitable, and perfectly in sync with your overall business strategy.

How to Choose the Right Monitoring Tools

Picking the right software for retailer price monitoring can feel overwhelming. The market is flooded with options, from simple web scrapers to sophisticated intelligence platforms. It’s like trying to choose the right vehicle for a cross-country road trip—you need something reliable, efficient, and built for the terrain you're about to cover. Let's break down how to evaluate your options and find the perfect fit for your business.

The first thing to remember is that fancy dashboards don't mean much if the data driving them is garbage. Inaccurate or old information is worse than no information at all because it leads to bad decisions. Basing your pricing strategy on flawed data is a surefire way to lose money and fall behind.

Core Evaluation Criteria for Any Tool

Before you sign any contracts, you need to put every potential tool under the microscope. There are a few non-negotiable fundamentals that separate the professional-grade platforms from the glorified spreadsheets.

- Data Accuracy: Just how reliable is the information? Your tool needs to be spot-on when it comes to matching your products with competitors' and grabbing the correct price. You should be looking for a benchmark of 99% accuracy—anything less is a gamble.

- Refresh Frequency: How often does the data update? In a fast-paced market, prices can shift multiple times a day. If your tool only refreshes daily, you're already playing catch-up. Look for near real-time updates.

- Scalability: Can this tool grow with your business? It needs to handle an expanding product catalog and a longer list of competitors without grinding to a halt or costing a fortune.

- Integration Capabilities: Does it play nice with your other systems? The best tools plug right into your existing e-commerce platforms, ERPs, or BI software, making the flow of data seamless.

Choosing a tool isn't just a software purchase; it's an investment in your own decision-making. The goal is to find a platform that gives you more than just data. It should give you the confidence to act quickly and decisively when the market moves.

Basic Scrapers vs. Intelligence Platforms

Not all tools are built the same. On one end, you have basic scrapers, and on the other, you have full-blown intelligence platforms. Understanding the difference is crucial so you don't end up overpaying for features you’ll never use or, worse, underinvesting in a tool that can't keep up with your needs.

This is where the retail world is headed—away from static pricing and toward dynamic, AI-driven strategies. As explained in this deep dive into pricing strategies shaping retail at Nimbleway.com, modern retailers are using advanced analytics to adapt on the fly. Your monitoring tool needs to support this shift, not hold you back.

To help you figure out where you fit, here’s a look at how different tiers of tools stack up against each other.

Comparing Price Monitoring Tool Tiers

It helps to think of these tools in three tiers: the DIY option, the automated solution, and the all-in-one intelligence platform. Each one serves a different type of business with different goals.

| Feature | Manual / Basic Scrapers | Mid-Tier Automated Tools | Enterprise Intelligence Platforms |

|---|---|---|---|

| Data Collection | Manual copy-paste or simple scripts | Automated, scheduled scraping | Real-time, continuous API calls & scraping |

| Product Matching | Manual matching required | Rule-based and some AI matching | Advanced AI-powered matching with 99%+ accuracy |

| Alerts & Reports | None or very basic | Customizable email alerts | Dynamic, rule-based alerts and predictive insights |

| Historical Data | Limited or non-existent | Stores data for trend analysis | Deep historical data for forecasting |

| Best For | Very small businesses with few SKUs | Growing SMBs needing automation | Large retailers and brands needing deep insights |

Ultimately, the right tool for you comes down to your business's size, budget, and ambition. A small shop with a handful of products might get by with a basic scraper. But if you’re serious about competing and growing, you'll quickly outgrow those simple tools.

Investing in a robust platform is essential for gaining a real competitive advantage. A great next step is to explore the wider world of market intelligence tools to see what advanced features can really do for your business. The right choice here can turn raw market data into your most powerful strategic asset.

The Future of Automated Pricing Intelligence

Looking ahead, the world of retailer price monitoring is on the cusp of a major shift, and it’s being driven by artificial intelligence. We're moving away from simply reacting to what competitors do. The future is about creating a predictive engine that sees market changes coming and adjusts prices before rivals even make a move.

Think of it like a chess grandmaster. A novice player just reacts to their opponent's last move. A grandmaster, on the other hand, is already thinking several moves ahead, anticipating possibilities and positioning themselves for victory. That's what predictive pricing models do.

These AI-powered systems analyze the entire board—competitor habits, past sales figures, seasonal demand, even bigger economic trends—to forecast what’s next. They don’t just guess. They build complex models to find the sweet spot for a price, whether your goal is to maximize profit, boost sales volume, or grab more market share. This turns pricing from a defensive chore into a powerful offensive strategy.

Predictive Pricing and Hyper-Personalization

The next big leap is taking this intelligence from the market level right down to the individual shopper. This is where hyper-personalization comes in. Imagine tailoring a price not just for a demographic, but for a single person based on their shopping habits, loyalty, and what they’ve bought before.

For example, a long-time, loyal customer might see a special price on a new product as a quiet thank-you. A first-time visitor could get a one-time welcome offer to nudge them toward their first purchase.

Making this happen takes a staggering amount of data and processing power, but the rewards are huge. You're no longer offering a one-size-fits-all price; you're maximizing value for every single customer, which builds loyalty and keeps them coming back. Of course, this introduces some tricky ethical questions.

As pricing becomes more automated and personal, being transparent is non-negotiable. Companies have to walk a fine line between giving customers a great, customized deal and creating a system that feels unfair or manipulative.

Embracing an AI-Driven Future

The tools and tactics that make up smart price monitoring are getting smarter and more complex. For any business serious about growth, jumping on board with these changes isn't really a choice anymore. The future belongs to the retailers who can weave AI and predictive analytics into the fabric of their operations.

This means pricing decisions will become less about staring at spreadsheets and more about managing the sophisticated algorithms that do the heavy lifting. As this field evolves, incorporating advanced methods like the ones in this guide on 10 Key Sales Forecasting Techniques will be essential. The companies that get this new, automated approach right won't just keep up—they'll set the pace for everyone else.

Your Questions, Answered

Jumping into the world of retailer price monitoring can feel a little overwhelming, and you probably have a few questions. Let's tackle some of the most common ones that come up for businesses just like yours.

How Often Should I Be Checking My Competitors' Prices?

There's no single right answer here—it really boils down to how fast your market moves. If you're selling hot-ticket items in fast-paced categories like electronics or fashion, you might need to check prices several times a day just to keep up. The competition is fierce, and changes happen in a flash.

For other industries, a daily or even weekly check-in might be perfectly fine. The real game-changer is using an automated tool that gives you data in real-time. That way, you’re ready to react the second a competitor makes a move, not days later.

Is This Even Legal?

Yes, absolutely. Keeping an eye on publicly available prices on websites and marketplaces is a standard and completely legal business practice. Think of it as a core part of doing your homework on the market and your competition.

The key, though, is to play fair. Always use ethical data collection methods that don't harm a competitor's website or slow it down. It's also smart to respect the terms of service of any site you're monitoring.

Can a Small Business Really Get Anything Out of This?

Definitely. Price monitoring isn't just a playground for the big guys. It's a surprisingly powerful way for small and medium-sized businesses to level the playing field.

With this kind of insight, smaller retailers can:

- Set smarter prices to protect their profit margins.

- Stop getting constantly beaten on price by larger rivals.

- Spot and jump on niche opportunities that others miss.

The good news is that many tools are built specifically for smaller businesses—they're affordable, easy to scale, and give you the competitive edge you need to grow. It’s one of the most accessible strategies out there, no matter your size.

Stop wasting time on manual competitor research. ChampSignal delivers high-signal alerts on competitor pricing, feature, and promotional changes, filtering out the noise so you only react when it matters. Get your free 30-day trial at https://champsignal.com.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. No credit card required.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works