What is Competitive Intelligence? Strategies & Insights

Maxime Dupré

10/1/2025

Imagine you're coaching a sports team. Would you send your players onto the field without studying the opponent's past games, star players, and signature moves? Of course not. You’d watch every tape you could get your hands on to understand their strategy and prepare your own.

That's the essence of competitive intelligence. It's the business world's version of studying the playbook—an ethical and systematic process of gathering and analyzing information about your market, competitors, and customers to make smarter strategic moves.

Understanding Competitive Intelligence Beyond The Buzzwords

Let's cut through the jargon. At its heart, competitive intelligence (CI) is simply about knowing your playground. It’s the structured practice of collecting publicly available information and turning it into a genuine advantage.

Think of it this way: instead of getting blindsided by a competitor’s new feature launch, a solid CI practice helps you see the signs and anticipate the move weeks or even months in advance. It’s about being proactive, not reactive.

The real work is transforming scattered bits of data—a press release here, a customer review there—into a clear picture of your competitive landscape. This allows you to spot opportunities and neutralize threats before they ever hit your bottom line.

What Competitive Intelligence Is (And What It Isn't)

It’s really important to draw a hard line here: competitive intelligence is not corporate espionage. CI is a completely legal and ethical discipline that relies on public information. There's no shady business involved.

We're talking about information that's out there for anyone to find, if they just know where and how to look. This includes:

- Public Announcements: Scrutinizing press releases, official blog posts, and company news.

- Customer Feedback: Diving into online reviews, social media chatter, and industry forums.

- Financial Reports: Analyzing public filings and updates for investors.

- Digital Footprints: Keeping an eye on a competitor’s website updates, SEO performance, and ad campaigns.

By systematically piecing this information together, you build an evidence-based view of the market. This empowers everyone, from the CEO to the marketing intern, to make confident decisions based on solid data, not just a gut feeling.

Key Takeaway: Competitive intelligence isn’t about stealing secrets. It's about connecting publicly available dots to map out your competitor's strategy, pinpoint their strengths, and find their weaknesses.

And businesses are catching on. The global competitive intelligence market was valued at USD 50.87 billion and is expected to more than double to USD 122.77 billion by 2033. This boom shows just how many organizations now see CI as a mission-critical function. You can learn more about what's driving this CI market growth and its implications.

Competitive Intelligence At a Glance

To make this even clearer, here's a quick table breaking down the fundamentals of competitive intelligence.

| Aspect | Description |

|---|---|

| What It Is | An ethical, systematic process of collecting and analyzing public information about the competitive landscape. |

| What It Isn't | Corporate espionage, spying, hacking, or any other illegal or unethical activity to obtain private information. |

| Who Benefits | Executives, marketing teams, product managers, sales teams, and anyone involved in strategic decision-making. |

| Ultimate Goal | To provide a significant market advantage by enabling proactive, informed, and strategic business decisions. |

This table provides a high-level summary, but the true value of CI is realized when it becomes an ongoing, integrated part of your company's culture and strategy.

Why Competitive Intelligence Is Your Strategic Advantage

It’s one thing to know the definition of competitive intelligence, but it’s another thing entirely to watch it deliver real-world results. A solid CI program isn't just about collecting information. It’s a growth engine that directly fuels your bottom line, helping you shift from reacting to the market to proactively shaping it.

Think about it like this: a software company notices its main rival is suddenly hiring a bunch of engineers with a very specific, niche skill set. That’s not just an interesting fact; it's a huge clue about where their product is headed. Armed with that knowledge, the company can pivot its own roadmap—either to meet the challenge head-on or to zero in on an area the competitor is clearly abandoning.

That's the real magic of CI. It connects the dots between scattered pieces of data, giving you a strategic edge to anticipate moves, dodge threats, and jump on opportunities before they become obvious.

From Playing Defense to Going on Offense

A lot of companies get into competitive intelligence to play defense. They just want to avoid being blindsided by a competitor's surprise product launch or a sudden price cut. And that's important, for sure. But the real power of CI is unleashed when you switch from a defensive crouch to an offensive strategy.

Instead of simply protecting what you have, you start hunting for ways to win more market share. A great CI program shines a spotlight on your competitors' weak spots, showing you exactly where to press your advantage.

- Find Product Gaps: You might dig into customer reviews and find that a competitor's top-rated product has a glaring flaw or is missing a crucial feature. That’s your opening to position your offering as the obvious, superior choice.

- Capitalize on Marketing Missteps: Maybe a rival’s new ad campaign is getting roasted on social media. Your marketing team can use that intel to craft messaging that speaks directly to those customer frustrations, positioning your brand as the one that actually gets it.

- Exploit Pricing Inefficiencies: By analyzing a competitor's pricing structure, you might find a whole segment of customers they are overcharging or completely ignoring. This is your chance to swoop in with a perfectly priced solution they can't refuse.

This offensive mindset completely changes the game. You're no longer just reacting—you're setting the pace and making everyone else react to you. It’s all about transforming strategy with smart data and turning what you know into what you do.

When a business systematically finds and acts on competitor weaknesses, it can boost its win rates by an estimated 15-20%. That’s a direct line from intelligence to revenue.

Empowering Your Entire Organization

The impact of competitive intelligence doesn't stop in the C-suite. When you share these insights across the company, CI acts as a force multiplier, lifting the performance of nearly every department. This isn't just about high-level strategy; it's about making smarter decisions every single day.

Here’s how different teams can put CI to work:

- Sales Enablement: Your sales team is in the trenches every day. Arming them with up-to-date battle cards—detailing a competitor’s products, pricing, strengths, and weaknesses—gives them the ammunition to handle objections and close more deals. They can confidently explain exactly why your solution is the better investment.

- Product Development: Product managers can use CI to gut-check their roadmaps and make sure they're building things people actually want. Knowing what your competitor is developing helps you avoid building a "me-too" feature and instead focus your resources on genuine innovation that sets you apart.

- Marketing Strategy: Marketers can use these insights to sharpen their campaigns. By understanding which channels competitors are winning on, what messaging is landing, and where their SEO focus is, your team can uncover untapped keywords, create more persuasive content, and get a better return on your ad spend.

Ultimately, a well-executed CI program creates a smarter, faster, and more unified organization. It tears down information silos and gets everyone operating from the same playbook, all pulling in the same direction.

The Four-Step Competitive Intelligence Cycle

You can't just stumble into effective competitive intelligence. The best programs aren't a chaotic scramble for data; they're a structured, repeatable discipline. It’s about creating a continuous loop that keeps insights fresh, relevant, and ready for action. Think of it as your operational playbook for turning raw information into a real strategic advantage.

This whole process is often called the CI cycle, and it’s made up of four distinct stages. Each step flows logically into the next, creating a self-sustaining system that helps your company stay agile and aware of important market shifts.

This image really nails the basic flow of turning scattered data points into smart business decisions.

From gathering information to analyzing it and finally taking action—that’s the bedrock of any solid intelligence program.

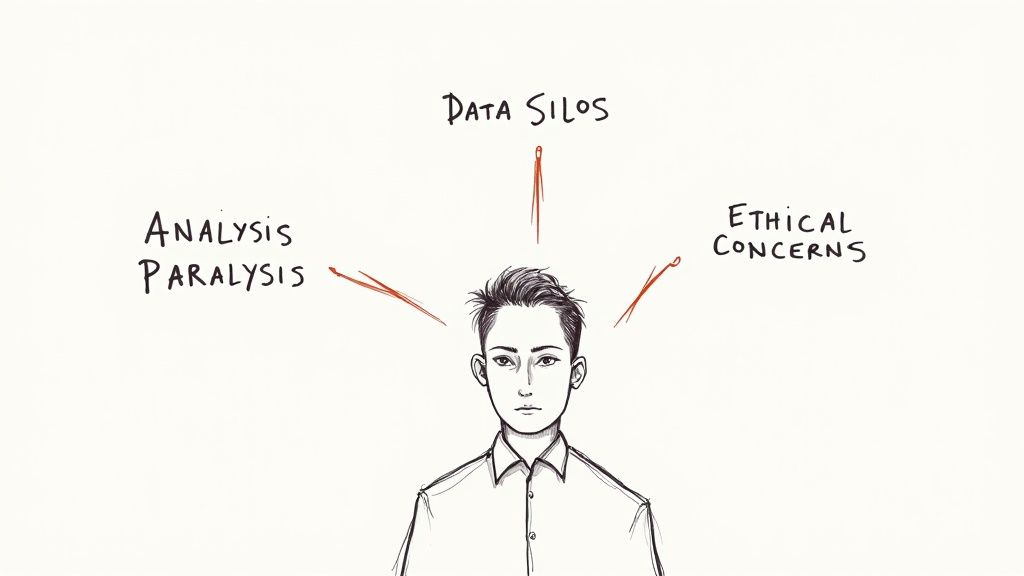

Step 1: Direction and Planning

Before you even think about collecting a single piece of data, you need to know exactly what you’re looking for and, more importantly, why. This initial planning phase is absolutely the most critical step because it sets the direction for everything that follows. Skip this, and you'll quickly find yourself drowning in irrelevant information—a classic case of "analysis paralysis."

The main goal here is to define your Key Intelligence Questions (KIQs). These are the big-picture, strategic questions that, if answered, would genuinely impact your business decisions.

Good KIQs sound something like this:

- What new markets are our top three competitors seriously considering entering in the next 12 months?

- How is our main rival positioning their new product against ours in their latest ad campaigns?

- What are the most common complaints people have about our competitor’s service, and how can we use that to our advantage?

By focusing on specific, high-impact questions, you create a clear scope for your efforts. It ensures your team’s time and energy are spent finding information that truly matters.

Step 2: Collection of Raw Data

Once your KIQs are set, it’s time to go out and gather the data. This part of the process must always be ethical and legal, focusing only on information that’s publicly available. The whole field has grown far beyond just tracking a few competitors; it’s now about understanding the entire market and competitive landscape.

The CI software market for small and medium-sized businesses (SMBs) was valued at USD 2.56 billion and is expected to hit USD 6.02 billion by 2030. That growth tells you just how accessible these powerful data collection tools have become for companies of all sizes.

So, where do you look for this data? The sources are everywhere:

- Company Websites: Keep an eye on changes to their pricing pages, product features, and even who they're hiring for leadership roles.

- Social Media: Monitor what companies are saying on platforms like LinkedIn and X (formerly Twitter), but also listen to what customers are saying about them on places like Reddit.

- Public Records: Dig into financial filings, patent applications, and official press releases.

- Digital Footprints: Analyze their SEO strategies, backlink profiles, and online ad campaigns. If you want to get into the weeds on this, our guide on how to find backlinks on Google is a great place to start.

The trick is to use a mix of sources to get a complete picture. Relying on just one or two can leave you with a skewed or dangerously incomplete view of what’s really going on.

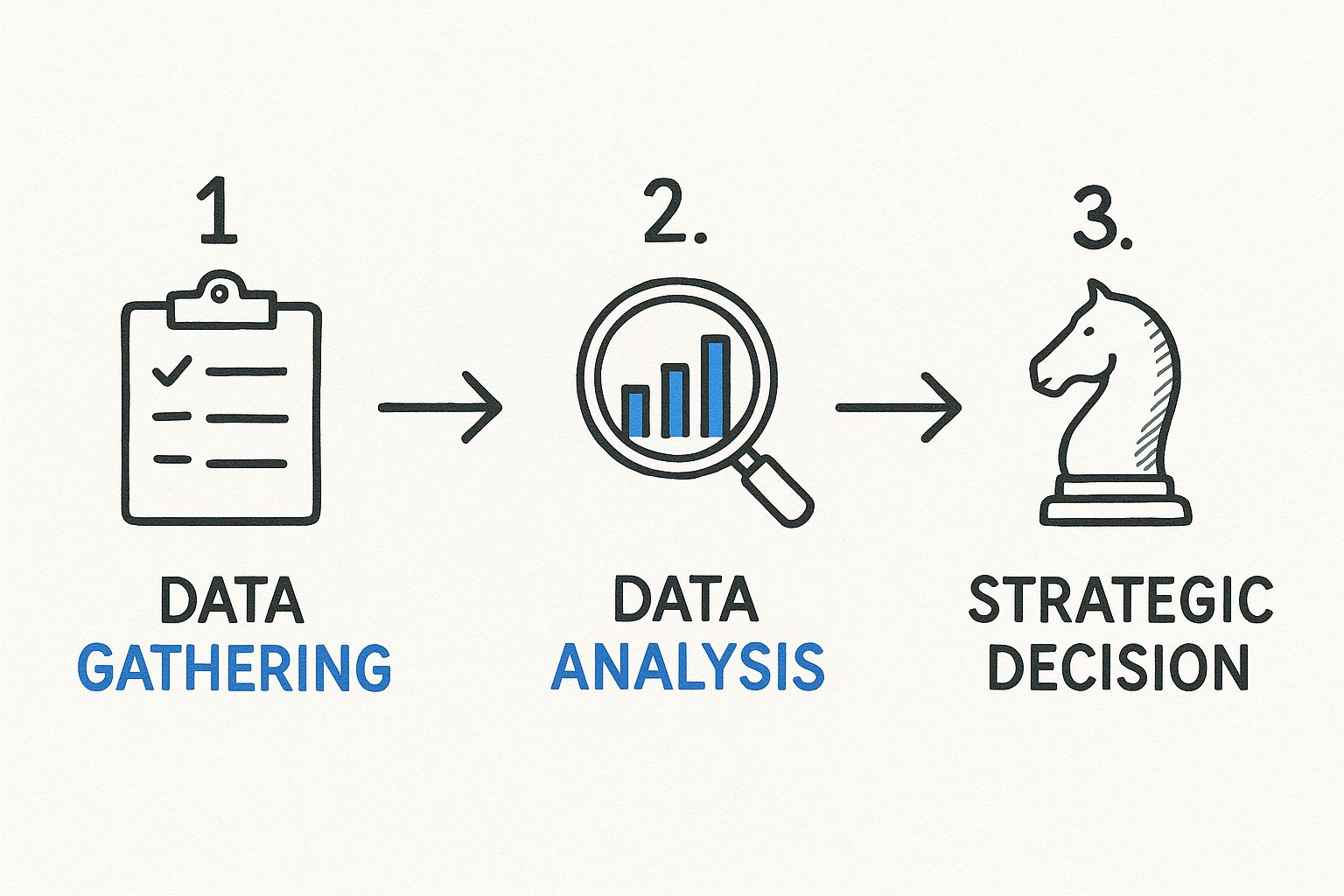

Step 3: Analysis and Insight Generation

Let's be honest: raw data is just noise. The analysis phase is where you turn that noise into a clear signal. This is where your team organizes, interprets, and connects the dots between all the information you’ve collected to finally answer those KIQs you started with.

This is the moment you go from knowing what is happening to understanding so what.

Insight Is Actionable: An interesting fact isn't an insight. An insight is a conclusion you draw from data that points directly to a business action. For instance, "Our competitor's website traffic is up 20%" is just data. "Our competitor's traffic is up 20% because of their new blog series on Topic X, an area we completely ignore" — now that is an insight.

Analysts often use frameworks like a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to structure their thinking. It’s a simple but effective way to categorize information about a competitor and figure out what it means for your own business strategy.

Step 4: Dissemination and Action

Here we are at the final—and most important—step. It's all about getting the right insights to the right people at the right time. An amazing intelligence report that just sits on a server gathering digital dust is completely useless. The goal is to deliver sharp, relevant findings to key stakeholders in a format they can actually use.

This can take many forms:

- Sales Battle Cards: One-page cheat sheets for the sales team that highlight a competitor’s weak spots.

- Product Briefings: Quick presentations for the product team showing them gaps in the market they can exploit.

- Executive Summaries: High-level reports for leadership that cut to the chase on major strategic threats and opportunities.

Once those insights are delivered, the feedback from stakeholders is what helps you refine your KIQs for the next round, starting the cycle all over again. This continuous loop ensures your CI program evolves with the market and keeps delivering real value.

Choosing Your Competitive Intelligence Toolkit

A modern competitive intelligence program is only as good as its technology. Think of it like a detective's kit—you can't solve the case without the right tools for gathering clues and piecing together the big picture. Trying to do CI without a solid tech stack is like working in the dark.

Fortunately, the market for these tools is booming. The competitive intelligence tools market was valued at a respectable USD 37.6 million back in 2019 and is on track to hit USD 121.37 million soon. As you can see in this detailed market forecast, this growth means we have more powerful and accessible options than ever before.

The key is picking software that directly answers your most pressing questions—your Key Intelligence Questions (KIQs). Let's walk through the main categories of tools you'll encounter.

SEO And Content Analysis Platforms

These are your spyglasses for the digital world. Tools in this category are the bread and butter for decoding a competitor's online marketing strategy. They let you reverse-engineer what's driving their search engine traffic and content success, showing you exactly where they’re capturing your audience’s attention.

Industry staples like Ahrefs and Semrush are masters of this. With them, you can:

- Track Keyword Rankings: See precisely which search terms your competitors own and find the keyword gaps you can swoop in and claim.

- Analyze Backlink Profiles: Discover who is linking to your rivals. This is basically a ready-made roadmap for your own digital PR and outreach.

- Audit Content Performance: Pinpoint which of their articles, blogs, or landing pages are getting the most traffic and social shares.

These platforms help you answer critical questions like, "What topics is my competitor the go-to authority on?" and "Where are they putting their content marketing dollars?"

Social Listening And Brand Monitoring Tools

Your competitors and customers never stop talking online. Social listening tools are your ears on the ground, allowing you to tune into those crucial conversations happening across social media, forums like Reddit, and product review sites.

But these platforms do more than just flag brand mentions. They analyze the feeling behind the words (sentiment analysis), track spikes in conversation volume, and identify emerging themes. This gives you a real-time pulse on public perception. A sudden flood of negative comments about a competitor’s new feature could be a major product flaw—and a golden opportunity for your sales team.

Here's a Pro Tip: Set up an alert for your competitor's name paired with terms like "frustrated," "broken," or "wish it had." You'll create an automated feed of customer pain points that your product and marketing can directly solve.

Dedicated Market Intelligence Platforms

While SEO and social tools are fantastic for specific channels, dedicated CI platforms offer a more holistic, 360-degree view. Think of them as your central command center. Tools like Crayon and Kompyte are built to pull intelligence from dozens of sources into one unified dashboard.

This snapshot from Crayon shows how these platforms distill complex information into a clean, easy-to-scan format.

You can see intelligence "cards" that summarize everything from a competitor's website copy changes to their latest marketing campaigns, making it much easier to connect the dots and spot trends.

These platforms automate a ton of the grunt work, tracking everything from pricing page updates and new ad launches to subtle shifts in messaging. Their real power lies in cutting through the noise to surface only the most significant competitive moves, saving your team from hours of manual digging.

Types Of Competitive Intelligence Tools

Choosing the right mix of tools really comes down to your budget, your team's bandwidth, and what you’re trying to achieve. When you're looking for the best competitive intelligence tools, it helps to see how they stack up.

This table breaks down the main categories to help guide your decision.

| Tool Category | Primary Function | Example Use Case |

|---|---|---|

| SEO & Content Tools | Analyzing digital marketing performance | Uncovering high-traffic keywords your competitor ranks for but you don't. |

| Social Listening Tools | Monitoring brand perception and conversations | Tracking customer complaints about a rival's service to inform sales pitches. |

| Market Intelligence Platforms | Aggregating and analyzing cross-channel data | Receiving an automated alert when a competitor launches a new product feature. |

Many of these tools are also getting smarter, using AI to automate data collection and spot patterns a human analyst might otherwise miss. It's also worth noting the difference between competitive intelligence and the broader field of business intelligence. Our business intelligence tools comparison dives deeper into platforms that focus more on your own company's internal data.

Ultimately, your toolkit should be built to do one thing well: help you answer your KIQs efficiently and turn raw data into decisive action.

Building Your CI Program from the Ground Up

Starting a competitive intelligence program from scratch can feel daunting. I get it. The good news is you don’t need a massive team or a six-figure budget to make a real impact. The secret is to think small, prove your value early, and build momentum from there.

It’s a bit like building with LEGOs. You don’t dump out a thousand-piece set and try to build a spaceship on day one. You start by snapping a few key bricks together. Your first mission is to find and deliver a small, tangible win that makes key decision-makers sit up and take notice.

By starting with a practical, results-focused mindset, you can get a CI function off the ground in any organization. Once you show people how powerful this information can be, building out your program becomes a whole lot easier.

Securing Stakeholder Buy-In

Before you dive into analyzing a single competitor, your first job is actually an internal sales pitch. You have to get stakeholders on board, and the fastest way to do that is by speaking their language: results.

Forget vague promises about "better market awareness." Instead, tie your proposal directly to solving a painful, specific problem. For instance, frame your CI efforts around boosting the sales team's win rate against that one competitor everyone hates going up against. Suddenly, your project isn't a research "nice-to-have"—it's a direct path to more revenue.

To really seal the deal, present a focused, bite-sized plan:

- Define a Pilot Project: Suggest a short, low-cost pilot that zeroes in on one or two high-priority competitors.

- Identify a Quick Win: Set a clear, achievable goal. Maybe it’s creating a set of killer sales battle cards to dismantle a rival’s new product claims.

- Outline the ROI: Connect the dots for them. Show how that intelligence will help the sales team close just one or two extra deals next quarter.

When you can draw a straight line from competitive intelligence to business performance, you earn the trust you need to grow.

Assembling Your Nimble CI Team

Let's be realistic: in the early days, your CI "team" might just be you. And that’s perfectly okay. A successful CI program is built on skills and mindset, not headcount.

What you need is someone with a healthy dose of curiosity mixed with analytical grit. Think of this person as part detective, part storyteller. They need the patience to dig for clues and the skill to weave those clues into a narrative that gets people to act.

Key Insight: The best CI pros I've known are naturally inquisitive. They have a real talent for connecting seemingly random dots of information to reveal the bigger, strategic picture that everyone else is missing.

Whether it’s one person or a small group, look for these core skills:

- An Analytical Mindset: The ability to sift through data and spot the patterns that matter.

- Strong Communication: The knack for turning complex findings into clear, digestible insights for sales, marketing, or the C-suite.

- Resourcefulness: The scrappy ability to find information ethically and creatively, often without fancy tools.

Once you have that foundation, you can start creating simple, repeatable processes. The goal is to get into a steady rhythm of delivering valuable insights, proving that even a small CI effort can have a massive impact.

Got Questions About Competitive Intelligence?

Even after laying out the whole process, a few key questions almost always come up when people are first dipping their toes into competitive intelligence. Let's tackle them head-on so you can move forward with a clear picture.

Isn't This Just Corporate Spying?

Absolutely not, and it’s critical to understand the difference. Think of it this way: competitive intelligence is like being a great detective, while corporate espionage is being a burglar.

Competitive intelligence is the ethical and legal gathering of public information. We're talking about things anyone can find if they know where to look: company websites, press releases, social media, public records, and industry reports. It’s all above board.

Corporate espionage, on the other hand, is illegal. It involves theft, hacking, or bribery to get at confidential information and trade secrets. A real CI program has a strict code of ethics and never, ever crosses that line. The goal is to outsmart the competition with better insights, not to steal from them.

How Can a Small Business Do This Without a Big Budget?

You don't need a massive software budget to get started. For small businesses, the secret to effective CI is being scrappy and consistent, not just throwing money at expensive tools. It's all about building a smart, repeatable process.

Here are a few ways to get going for little to no cost:

- Set up Google Alerts: This is the easiest first step. It's free, and you’ll get an email anytime your competitors are mentioned online. Simple but powerful.

- Watch Social Media and Review Sites: Make it a habit to check their social feeds. More importantly, see what their customers are saying on review sites or forums like Reddit. That’s where the real gold is.

- Use Free Versions of Pro Tools: Many top-tier SEO and analytics platforms have free plans that give you a surprising amount of data on a competitor’s web traffic and content strategy.

A consistent manual process that answers one or two critical questions is way more valuable than a big, unfocused budget. Start small, show the value, and then you can justify scaling up.

How Do You Actually Measure the ROI of CI?

This is the big one. Measuring the return on your CI efforts is all about linking what you learn to real business results. Forget about vague metrics; you need to tie your work directly to the KPIs that matter to your company.

Here’s what that looks like in practice:

- Better Sales Win Rates: Are you winning more deals against your top rival? Track how your win rate changes after you equip the sales team with CI-powered battle cards and talking points.

- Growing Market Share: Can you see a shift in market share for a product or in a region where you’ve focused your intelligence efforts?

- Smarter Marketing Campaigns: Compare the performance of marketing campaigns that were built on competitive insights against those that weren’t. The difference in conversion rates can be telling.

Don't forget the qualitative side, either. Simply keeping a log of how many times a CI report is brought into a strategy meeting is a fantastic way to show the program’s influence and prove its value to leadership.

Keeping tabs on your market shouldn't feel like a full-time job. ChampSignal sends you focused, high-signal alerts about your competitors' most important moves—from website updates to new ad campaigns. Start your free 30-day trial and see what you've been missing.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. Cancel anytime.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, X posts, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works