Your Guide to a Competitive Intelligence Analyst Career

Maxime Dupré

10/18/2025

Think of a Competitive Intelligence Analyst as a company's strategic detective. They're the ones on the ground, ethically gathering and piecing together clues about competitors, customers, and the broader market. They take raw information—a rival’s pricing change, a flurry of new job postings, or a freshly filed patent—and turn it into a clear picture that shapes executive decisions, product strategy, and sales tactics.

Beyond Data: The Real Impact of a CI Analyst

It’s easy to think a CI analyst just collects data, but that's only a small part of the story. Their real value is in connecting seemingly random pieces of information to tell a compelling strategic narrative. They use data to predict a competitor's next big move, spot market shifts before they happen, and find opportunities that everyone else missed.

For example, imagine a key competitor suddenly starts hiring engineers with a very specific, niche skill set in a new city. To most, that’s just noise. But to a CI analyst, it's a powerful signal. They'll dig deeper, combining that hiring data with other market whispers to figure out what's really going on. The likely conclusion? The competitor is probably building a new product to enter an untapped regional market.

From Signal to Strategy

This is the heart of the job: turning faint signals into actionable strategy. It's a proactive role, not a reactive one. A deep understanding of the market is non-negotiable, which is why CI analysts often conduct a thorough competitive landscape analysis to map out key players and trends. The ultimate goal is to give leadership the foresight they need to make bold, decisive moves.

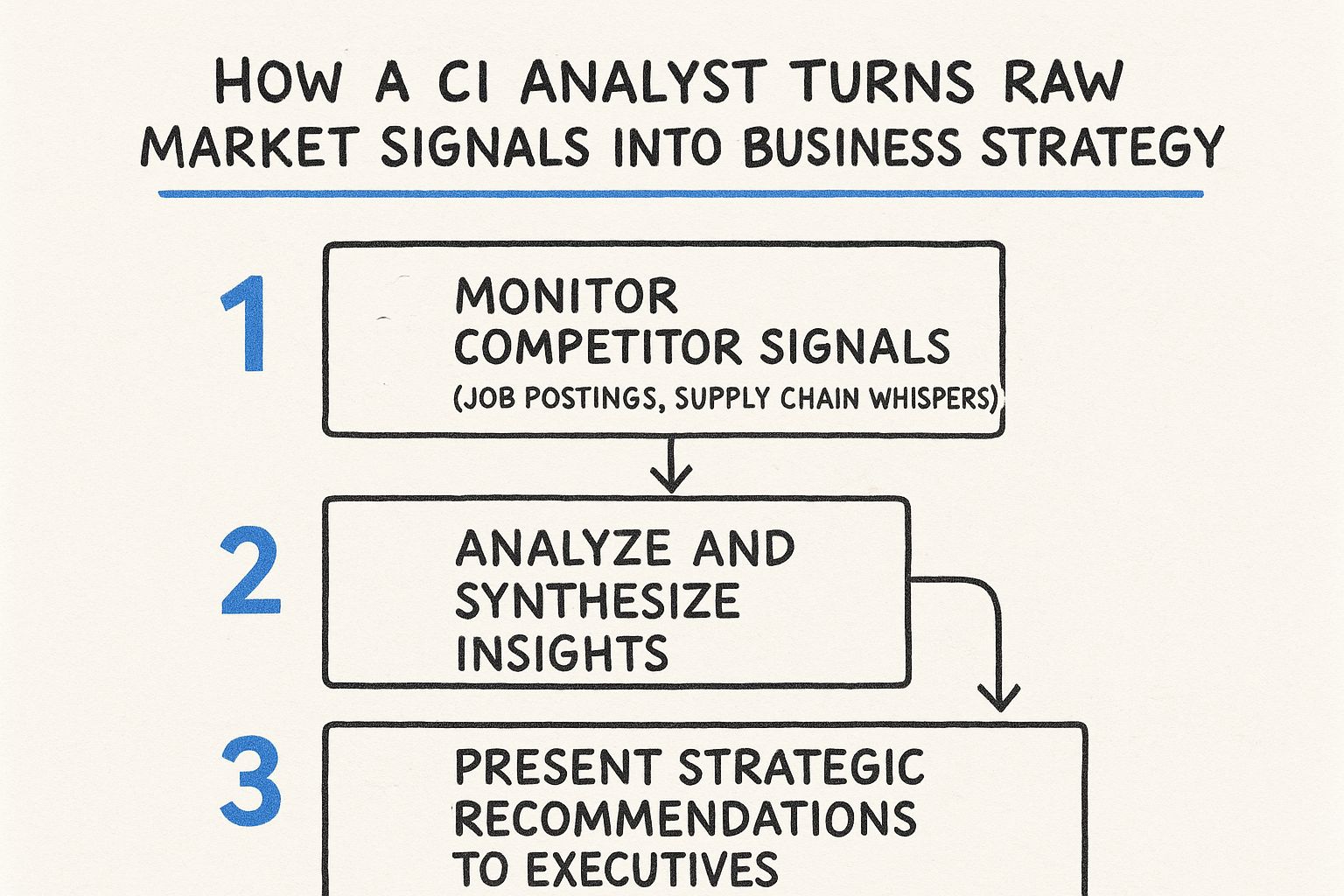

This infographic breaks down how an analyst converts raw market signals into tangible business strategy.

As you can see, the analyst is the critical link between what’s happening in the market and where the company needs to go next.

Influencing Key Business Functions

The insights from a CI analyst create a ripple effect that touches almost every part of the business. Here are a few key areas they directly impact:

- Executive Decision-Making: They arm leadership with clear, evidence-based scenarios for potential market disruptions, acquisition targets, or emerging competitive threats.

- Product Roadmaps: They keep product teams in the loop on competitor feature launches and customer pain points, helping ensure the company's own products stay ahead of the curve.

- Sales Enablement: They create battle cards and key talking points for the sales team, highlighting competitor weaknesses and differentiating their own solutions in make-or-break deals.

Ultimately, a great CI analyst ensures a company is never caught by surprise. They provide the crucial context and foresight to navigate a crowded market, turning what could be a threat into a genuine strategic advantage.

To get a better handle on the core concepts, you can explore our guide on https://champsignal.com/blog/what-is-competitive-intelligence. This role isn't just about what happened yesterday; it's about getting ahead of what's coming tomorrow.

A Day in the Life of a CI Analyst

If you're picturing a predictable 9-to-5 desk job, think again. The life of a competitive intelligence analyst is a dynamic mix of detective work, data science, and strategic storytelling. No two days are ever the same because the market never stands still.

The morning rarely starts with sifting through emails. Instead, it’s about diving straight into the data streams—the digital pulse of the competitive landscape. This is where the proactive intelligence gathering happens, scanning automated alerts for everything from a competitor’s new social media campaign to subtle changes on their website.

Let's imagine a CI analyst working for a B2B SaaS company. Their first hour might be spent digging into a dashboard alert: a key rival quietly dropped a popular feature from their mid-tier pricing plan overnight. To most people, it's a minor website edit. To a CI analyst, it’s a bright, flashing signal.

From Signal to Investigation

That one small change triggers a full-blown investigation. The analyst’s job isn't just to report what happened, but to uncover the why behind it. They'll start pulling on different threads, often all at once.

- Social Listening: Are customers complaining about this feature on X (formerly Twitter) or Reddit? Maybe it was buggy or costing them a fortune in support tickets.

- Review Mining: A quick scan of recent reviews on G2 or Capterra could reveal if users found the feature clunky or irrelevant.

- Financial Clues: If the competitor is a public company, their latest quarterly report might hint at a strategic pivot away from that product area.

This is all about connecting the dots. You’re trying to build a narrative from scattered pieces of information, moving from a simple observation to a deep understanding of your competitor’s strategy.

The real value of a CI analyst isn't in finding data—it's in knowing the difference between market noise and a true signal of strategic intent.

This investigative work relies on a combination of different intelligence-gathering techniques. Some information is publicly available, while other insights require a more direct approach. This is the difference between primary and secondary intelligence.

Primary vs Secondary Intelligence Gathering Activities

Below is a breakdown of the different types of research a Competitive Intelligence Analyst undertakes daily. Understanding both is crucial, as secondary research often points you toward the questions you need to answer with primary research.

| Activity Type | Description | Examples |

|---|---|---|

| Primary Intelligence | Gathering brand-new data directly from the source. | Running customer surveys, interviewing industry experts, user testing competitive products. |

| Secondary Intelligence | Analyzing existing information that others have already published. | Reviewing news articles, competitor websites, financial reports, patent filings. |

While secondary intelligence gives you the lay of the land, primary intelligence often delivers the game-changing insights that no one else has.

Synthesizing and Reporting Insights

Once the analyst has a solid hypothesis—for instance, "the competitor is simplifying their product to go after smaller businesses"—the focus shifts. Raw data is useless until it’s translated into a story that executives can understand and act on.

The analyst distills all that complex research into a concise, actionable summary for key stakeholders. This is where the intelligence becomes a real strategic asset.

They might draft a quick brief for the product team, pointing out a potential market gap that just opened up. That brief often serves as the executive summary for a more detailed document. If you're curious about structuring these, our guide on crafting a competitive intelligence report is a great place to start.

The day could easily wrap up with the analyst in a meeting with product managers, walking them through the evidence and outlining the opportunity. By turning a small website change into a tangible business strategy, they’ve just shown everyone in the room the true power of competitive intelligence.

Skills That Define a Top-Tier Analyst

Excelling as a competitive intelligence analyst is a balancing act, a unique mix of analytical muscle and creative thinking. It's one thing to be a whiz with data, but the best analysts are the ones who can spot the patterns everyone else overlooks. They can take a dozen disconnected facts and weave them into a coherent story that points the way forward.

This dual skill set is what elevates the role from simple data reporting to genuine strategic foresight.

Think of the hard skills as your foundation. These are the tangible, measurable abilities you need to wrangle and make sense of mountains of information. Without them, you're just guessing.

A great analyst needs more than just a sharp mind; they need a solid grasp of data fundamentals. That includes a mastery of techniques like data parsing in Excel to clean and prepare information, ensuring every insight is built on a reliable base.

The Essential Hard Skills

While the specific software on your resume might change over time, a few core technical skills are absolutely non-negotiable for anyone serious about this career.

- Data Analysis and Visualization: You have to be comfortable diving into datasets and, just as importantly, presenting your findings visually. Dashboards and charts aren't just for show; they make complex information easy for non-technical leaders to understand at a glance.

- Market Research Methodologies: This means having a deep understanding of both qualitative and quantitative techniques. You might be running surveys one day and dissecting dense industry reports or financial statements the next.

- Technological Fluency: Being comfortable with a range of software is critical. This could be anything from dedicated competitor monitoring tools and data aggregators to business intelligence (BI) platforms like Tableau or Power BI.

These technical skills are more important than ever. The global competitive intelligence market is booming—it's currently valued at around USD 50.87 billion and is expected to hit USD 122.77 billion in the coming years. This explosive growth shows that CI is no longer a niche activity but a core strategic function for modern businesses.

The Soft Skills That Drive Impact

But here’s the thing: hard skills will only get you so far. The real difference between a good analyst and a great one often comes down to soft skills. These are the interpersonal and cognitive abilities that turn your analysis into actual influence.

An analyst can have the most brilliant insight in the world, but if they can't communicate it effectively, it has zero impact. Storytelling is the bridge between data and decision.

This is where the "art" of the job comes in. It’s about crafting a narrative that sticks, one that connects with your audience and convinces them to take action.

- Strategic Storytelling: This is the magic ingredient. It’s the ability to translate your complex findings into a clear, persuasive story that answers the "so what?" for leadership.

- Inquisitive Mindset: The best analysts are naturally curious. They're the ones who are always digging a little deeper, asking tough questions, and challenging the status quo.

- Influential Communication: This is more than just having slick presentation skills. It’s about building trust with stakeholders, earning credibility, and knowing how to tailor your message to what they care about most.

Let's say you uncover that a competitor’s customer complaints on Reddit shot up by 300% after they launched a new feature. A novice might just report that number. A top-tier analyst frames it as a story: "Our competitor just alienated a huge chunk of their user base. This is a golden opportunity for us to step in and win them over with a better solution." That’s how you create real business impact.

Inside the Modern CI Analyst's Toolkit

Let's be honest, no competitive intelligence analyst worth their salt is doing everything by hand anymore. Gone are the days of manually trawling through competitor websites every morning. Today's effectiveness hinges on a smart toolkit that automates the grunt work of data collection, helps spot patterns you'd otherwise miss, and turns a sea of raw data into actual, usable strategy.

Think of these tools as your secret weapon. They take the absolute firehose of market information and filter it down to what actually matters. Instead of spending your days checking for pricing updates or new feature announcements, automated trackers do it for you around the clock. This shift is crucial because it frees you up to focus on the most important question: "So what?"

Automation and Aggregation Platforms

At the heart of any analyst's setup, you'll find platforms designed to monitor and pull together competitive data from all corners of the web. These tools are your eyes and ears, making sure no critical move by a rival goes unnoticed.

- Market and Competitor Monitoring: I've seen teams get a ton of value from platforms like Crayon or Kompyte. They act as a central hub, automatically tracking everything from website changes and press releases to social media chatter and customer reviews, then neatly organizing it all in one place.

- Data Aggregation: Other tools are more specialized. They might focus on vacuuming up specific data types, like financial filings, new patent applications, or even a competitor's latest ad campaigns. This raw material is what fuels any deep-dive analysis.

The demand for these platforms is exploding. The market for competitive intelligence tools was valued at USD 495.2 million and is expected to hit USD 1,123.0 million by 2031, growing at a 12.4% CAGR. This growth is all about companies adopting more cloud-based and AI-powered solutions to get an edge. For a closer look at the market dynamics, Coherent Market Insights has some great data.

Here’s a peek at what a dashboard from Crayon looks like. It’s a great example of how you can visualize what your competitors are up to over time.

With an interface like this, an analyst can quickly slice and dice the data—by competitor, by type of activity, or by date—to uncover emerging trends.

The Rise of AI in Competitive Intelligence

Artificial intelligence isn't just a buzzword in this field; it's a real, practical tool we use every day. AI-powered software is changing the game by automating the most tedious tasks and helping us find insights that would be impossible to catch at scale.

For example, imagine you need to understand customer sentiment for a rival product. An AI tool can chew through thousands of customer reviews in minutes, perform sentiment analysis, pull out recurring complaints or praises, and give you a summary. Just like that, you've identified a competitor's Achilles' heel and found a strategic opening for your own team.

AI doesn't replace the analyst; it makes them better. By handling the low-level data gathering and sorting, it frees up your brainpower for high-level strategic thinking, connecting the dots, and telling a compelling story with the data.

The key is building a tech stack that fits your team's specific needs. To get a handle on all the options out there, take a look at our guide to the best https://champsignal.com/blog/competitive-intelligence-software. It breaks down the different types of platforms so you can figure out what works for you. A well-chosen toolkit is truly an analyst's greatest ally.

Building Your CI Analyst Career Path

A career in competitive intelligence isn't a straight line—it’s a journey. You start out handling the tactical, day-to-day work and eventually grow into a trusted strategic advisor who has the ear of leadership.

Most people get their start as a CI Analyst or Market Analyst. In this role, you live and breathe data. You're the one on the front lines, keeping tabs on competitor websites, tracking pricing shifts, and pulling raw information together into clean, understandable summaries. The main goal here is simple: become the absolute expert on the data and the tools you use to get it.

The Leap to Senior Analyst and CI Manager

Once you’ve proven yourself, you’ll likely move up to a Senior CI Analyst position. This is where things get interesting. Your responsibilities pivot from just gathering data to making sense of it. You’re not just answering "what happened?" anymore. Now, you’re tackling the bigger questions: "why does this matter?" and "what's our next move?" This is when you'll start presenting your insights directly to product managers and other key stakeholders.

The next major milestone is becoming a CI Manager. At this point, your perspective broadens significantly. You’re no longer just focused on your own analysis; you’re leading a team and setting the entire CI program's strategy. Your job is to define what the team should be working on, manage the budget and tools, and make sure the intelligence you produce actually supports the company's biggest goals. You'll need sharp communication and persuasion skills to work effectively with the C-suite.

Reaching the Director Level and Beyond

For those who stick with it, the path can lead to a title like Director of Market Insights or Director of Strategy. Up here, you're not just reporting on what the competition is doing—you are a key player in deciding how your company responds. Your work is almost entirely strategic. You’re looking at long-term market shifts, scouting potential companies to acquire, and flagging the massive threats and opportunities on the horizon.

Want to climb the ladder faster? Find a niche and own it. If you become the go-to expert on a booming sector like SaaS or fintech, you’ll make yourself invaluable. It’s the quickest way to shift from tactical work to true strategic leadership.

Why Technology Is Your Career Accelerator

Staying ahead in this field means embracing technology. It’s not a "nice to have" anymore; it's essential for getting promoted. We’ve seen a massive 76% year-over-year jump in AI adoption among CI teams, and today, 60% of them use AI-powered tools every single day.

Think about it: Generative AI can sift through mountains of unstructured data—like social media chatter or news articles—in the blink of an eye. This isn't just a tech trend; it's part of a much bigger shift where data-savvy companies are simply growing faster. A modern CI analyst uses these tools to spend less time on manual research and more time delivering real-time strategic advice. If you're serious about your career, you need to stay on top of these emerging CI trends.

Your Top Questions About CI Careers, Answered

Jumping into a new career path always stirs up a few questions. When it comes to competitive intelligence, I see a lot of the same uncertainties pop up, especially around the practical stuff—what degree do you really need? How do you even get your foot in the door? Let's tackle some of the most common questions head-on.

Most companies will look for a bachelor's degree in a related field. Think marketing, business administration, or even statistics. A master's degree can certainly give you an edge, but it's rarely a non-negotiable. In my experience, what you've actually done often speaks much louder than your diploma.

For example, a background in sales or product marketing is gold. If you've spent years on the front lines understanding customer frustrations and keeping a close eye on what the competition is up to, you already have the CI mindset baked in. The key is to frame that practical experience correctly when you're making your case.

How Can I Land a CI Job Without Direct Experience?

Breaking into a specialized role can feel like that old catch-22: you need experience to get the job, but you need the job to get experience. It's frustrating, but it’s absolutely doable. The secret is to start doing the job before you have the title.

You need to proactively build a portfolio that showcases your analytical skills. Here’s how you can get started:

- Create a sample competitive analysis. Pick two public companies in an industry that genuinely interests you. Dive deep and build a report comparing their strategies, strengths, and weaknesses.

- Publish your insights. Start a simple blog or just use LinkedIn to post your analysis of market news or a competitor's latest product launch. Show people how you think.

- Get certified. A few solid organizations offer CI certifications. This isn't just a piece of paper; it shows you're serious about the profession and have put in the work to learn the fundamentals.

Taking these steps proves you have the right kind of curiosity and the analytical mind for the role. It tells a hiring manager you’re not just passively interested—you're already in the game.

What truly makes a great competitive intelligence analyst isn't a specific degree. It's an insatiable curiosity matched with the skill to weave seemingly random bits of information into a clear, strategic story.

What’s the Difference Between CI and Market Research?

This is a big one, and it’s easy to see why people get them confused. Both roles live in the world of data and analysis, but their goals and focus are fundamentally different.

Here’s a simple way to think about it: market research paints a picture of the landscape, while competitive intelligence tells you how to win on it.

Market research tends to be broader. It looks at things like market size, customer demographics, and general industry trends. A market researcher might discover that 70% of customers in a key segment want a specific feature. That's a valuable piece of information.

A CI analyst takes that same data point and asks, "Okay, knowing this, what is our biggest competitor going to do next? And how do we beat them to the punch?" It’s all about turning that broad market knowledge into a sharp, actionable competitive edge.

Keeping tabs on every move your competitors make is the heart of the job. ChampSignal automates the grunt work by tracking website changes, new ad campaigns, and SEO shifts. It cuts through the noise and delivers only the alerts that demand your attention, so you can stop spending hours on manual checks and start making faster, smarter decisions. Find out more and start your free trial.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$29 /month

Start with a 14-day free trial. No credit card required.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and Google Ads creatives

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works