Create a Winning Competitive Intelligence Report Today

Maxime Dupré

10/8/2025

At its core, a competitive intelligence report is a document that pulls together and makes sense of information about your competitors, the market they operate in, and the bigger industry trends. It's designed to turn a mountain of raw data into sharp, actionable insights that help you see market shifts coming, spot opportunities, and make smart decisions ahead of time.

Why a Competitive Intelligence Report Is a Game Changer

Let’s get past the textbook definition for a minute. A truly great competitive intelligence report isn’t just a file stuffed with data—it's a strategic roadmap. It shows your entire organization how to secure a stronger position in the market. It’s the real difference between just guessing what your competitors will do next and actually knowing their likely moves before they even make them.

Think of it as your company's ultimate playbook. It gives every team, from product and marketing to sales, the specific insights they need to win their battles. This isn't about just watching your rivals; it's about actively outmaneuvering them.

From Reactive Moves to Proactive Strategy

Too many businesses get stuck in a reactive loop. A competitor launches a new feature, and the immediate reaction is to scramble and build something just like it. They slash their prices, and you feel the pressure to do the same. This never-ending game of catch-up is exhausting, drains resources, and guarantees you'll always be one step behind.

A solid CI report is what breaks that cycle. It gives you a forward-looking perspective, helping you anticipate what’s next—like a rival's upcoming product launch, which you might predict from their recent job postings or new patent filings. This kind of foresight gives you the breathing room to build a counter-strategy or even launch your own campaign first.

A well-crafted competitive intelligence report is your early warning system. It turns potential market threats into clear growth opportunities by giving you the time and information needed to act decisively.

Uncovering Hidden Opportunities

One of the biggest wins from a CI report is its ability to uncover market gaps that nobody else sees. When you dig into customer reviews, analyze social media chatter, and pinpoint the limitations of your competitors' products, you start to see the unmet needs they're completely overlooking.

For example, your report might flag that customers of a top competitor are constantly complaining online about terrible customer support. That’s not just an interesting tidbit; it’s a wide-open strategic opportunity. You can immediately start positioning your own brand around superior service, creating a powerful differentiator that directly appeals to that frustrated slice of the market. Understanding these dynamics is key to proving the value of Business Intelligence ROI.

Fueling Smarter Business Decisions

The insights from a competitive intelligence report cascade through every part of your business, making everyone sharper.

- Product Teams can build roadmaps that directly address competitor weaknesses and jump on emerging market trends.

- Marketing Teams can create messaging that hammers home your unique value and targets specific competitor vulnerabilities.

- Sales Teams get armed with battle cards that give them the exact ammo they need to counter competitor claims in the field.

- Leadership can make confident, data-backed calls on everything from entering a new market to overhauling a pricing model.

A quick look at the advantages your business gains when you implement a structured CI reporting process.

Core Benefits of a Strategic CI Report

| Benefit | How It Impacts Your Strategy |

|---|---|

| Proactive Decision-Making | Moves you from reacting to competitor actions to anticipating them and acting first. |

| Market Opportunity Identification | Uncovers unmet customer needs and market gaps your competitors are ignoring. |

| Reduced Risk | Provides a clearer view of the market, minimizing the chances of a failed product launch or marketing campaign. |

| Enhanced Product Development | Informs your product roadmap with real-world data on what customers want and what competitors lack. |

| Stronger Sales Enablement | Equips your sales team with the intelligence they need to win more deals against key rivals. |

| Strategic Alignment | Ensures everyone—from leadership to marketing—is working from the same playbook with a shared understanding of the competitive landscape. |

Getting this kind of strategic alignment is more important than ever. The global competitive intelligence market is on track to hit around USD 122.77 billion by 2033, a surge driven by the demand for deeper, AI-powered insights. This isn't just a trend; it's a clear signal that companies are investing heavily in CI to get and stay ahead. To learn more, check out our guide on what is competitive intelligence and why it's so critical.

Anatomy of a Powerful CI Report

What’s the difference between a CI report that gets filed away and one that actually sparks action? It all comes down to the story you tell. A great report doesn’t just dump data on someone's desk; it builds a narrative that points leaders toward smart, decisive moves.

Think of it like an engine. Every part has a specific job, and they all need to work together for the machine to run smoothly. Your CI report is the same. Let's break down the essential components that make a report truly effective, starting with the parts that matter most to your busiest stakeholders.

Start with a Punchy Executive Summary

Let's be honest: your executive summary might be the only thing a busy C-suite leader reads in full. That makes it the most valuable real estate in your entire report. This isn't just an introduction; it's the entire report distilled into its most potent form.

You have to lead with your biggest "so what?" findings. What are the top 2-3 insights that demand immediate attention? Don't bury the lead. Frame them as clear, urgent takeaways. For example, "Competitor X's new pricing is eroding our mid-market share," or "Emerging Disruptor Y is dominating TikTok, a channel we've completely ignored."

Your goal is to get the core message across in 60 seconds. I always use bullet points here to highlight:

- Urgent threats that need to be on the next leadership meeting agenda.

- Time-sensitive opportunities we risk losing if we wait.

- Top-level recommendations for specific teams (e.g., "Marketing needs to counter Competitor X's messaging," "Product should investigate feature gap Z immediately").

Build Comprehensive Competitor Profiles

Once you have their attention, it's time to provide the context. A good competitor profile is so much more than a list of their products. You need to create a 360-degree picture of how they operate, think, and compete in the market.

For each key rival, I make sure to cover:

- Organizational DNA: Who are these guys, really? I'm talking company size, estimated revenue, key leadership figures, and any recent funding. This information gives you a sense of their war chest and how aggressively they can move.

- Product and Service Analysis: What are they selling, and how does it really compare to what we offer? I focus on their unique value proposition, pricing psychology, and any key differentiators.

- Go-to-Market Strategy: How do they actually get customers? You need to dig into their sales channels, marketing campaigns, and brand messaging. Are they brand-led, sales-led, or a product-led growth machine?

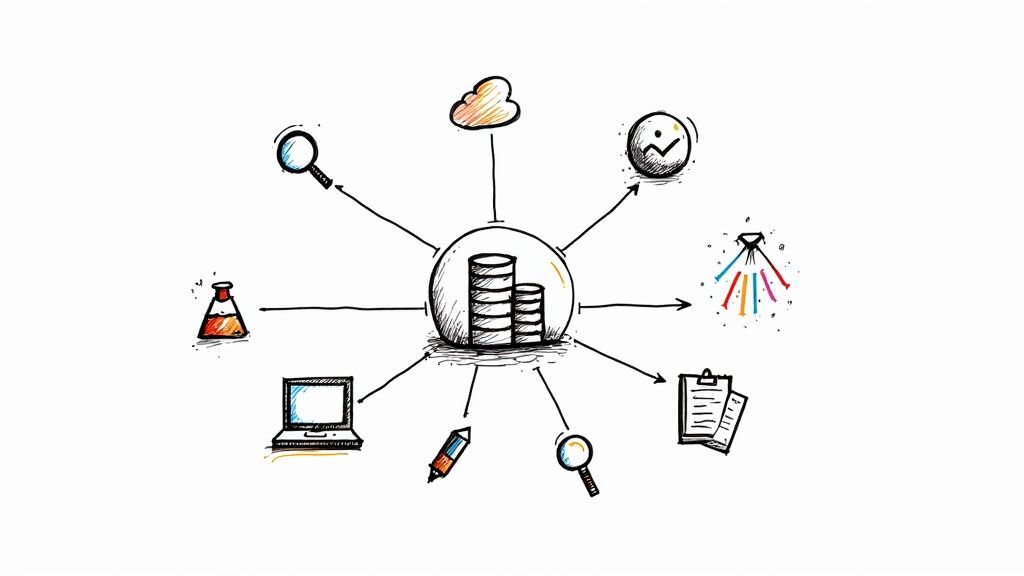

This visual shows how different analytical techniques come together to paint a clear picture of the market.

By layering different types of data visualization, you can uncover insights that would be invisible in a single chart.

By layering different types of data visualization, you can uncover insights that would be invisible in a single chart.

Conduct a Meaningful SWOT Analysis

The SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a classic for a reason, but it's often done poorly. Vague statements like "strong brand" or "increasing competition" are completely useless. A report that drives action gets specific and backs everything up with evidence.

Ditch the generic points and use concrete data instead:

- Strengths: "They're rated #1 for customer support on G2 with an average score of 4.9/5."

- Weaknesses: "Their mobile app has a 2.3-star rating, and 75% of negative reviews complain about the user experience."

- Opportunities: "No major player is actively targeting the SMB market in the APAC region."

- Threats: "Competitor Z just acquired a data analytics firm, which means they could launch a competing feature within six months."

A great SWOT analysis doesn't just list facts; it connects them. For example, a competitor's weakness (poor support) directly creates a market opportunity for you to exploit by highlighting your superior service.

Provide a Forward-Looking Market Trends Analysis

Finally, a truly strategic report lifts its gaze from the current battlefield to the horizon. This section is where you show foresight and help the company prepare for what's coming, not just react to what's already here.

Zero in on the major forces shaping your industry. This could be new technologies, shifts in customer behavior, regulatory changes, or economic headwinds. For every trend, you need to explain its likely impact on your business and your competitors. For instance, how might the explosion of AI tools disrupt your industry's traditional business model?

The goal here is to shift the conversation from reporting on the past to providing a clear, evidence-based roadmap for the future. This is what turns your CI report from a simple update into an indispensable strategic guide.

Gathering Your Intelligence the Smart Way

A killer competitive intelligence report lives and dies by the quality of its data. But let's be clear: this isn't about stalking your competitor's every move. It’s about being smart and strategic, focusing your energy on the sources that actually matter.

The real goal is to build a repeatable, ethical process for collecting intelligence. It's about quality over quantity—knowing exactly where to look for those golden nuggets of information that spark genuine strategic breakthroughs.

Tapping into Publicly Available Secondary Sources

You can get started right away by digging into secondary sources. This is all the data that's already out there, just waiting for you to find it. You'd be amazed at what companies share publicly if you just know where to look.

I always recommend starting with these high-signal areas:

- Company Websites and Blogs: This is your first stop. Pore over their product pages, pricing, and "About Us" section. Their blog is even better—it’s a direct window into their content strategy, who they're trying to reach, and the problems they claim to solve.

- Press Releases and News Mentions: Keep an eye on announcements about new partnerships, product updates, or big-name hires. These are often clear signals about where the company is heading next.

- Industry Analyst Reports: Don't sleep on reports from firms like Gartner or Forrester. They give you a brutally honest, third-party view of the market and where your competitors really stand, warts and all.

- Social Media and Online Forums: Of course, you should monitor their official social channels. But the real magic happens when you see what other people are saying. Reddit, LinkedIn, and niche industry forums are goldmines for unfiltered customer complaints and praise.

Gathering Primary Intelligence Ethically

Secondary sources tell you what companies claim to be doing. Primary research, on the other hand, tells you what’s actually happening in the real world. This is where you gather new data yourself—but it's crucial to always be ethical and transparent about it.

Industry trade shows and conferences are fantastic for this. You can watch product demos, hear how their sales team pitches, and see how the audience reacts during keynotes. It gives you a feel for their market position that a website just can't replicate.

Another great tactic is talking to customers—yours and theirs. Survey your own customers who switched from a competitor. Ask them what they loved and what drove them crazy. Your sales team's "win/loss" data is another direct pipeline into why a prospect chose you or went with the other guy.

The most powerful insights come from combining primary and secondary data. You might read a press release about a new feature (secondary), then talk to a few customers who’ve actually used it to see if it lives up to the hype (primary). That’s how you get the full picture.

Centralizing Data for a Single Source of Truth

As you start pulling in information from all these different places, you'll hit a wall. Fast. If your data is scattered across a dozen spreadsheets, random documents, and your team's notebooks, you're going to miss things.

This is why centralizing your intel is a non-negotiable step. Using a dedicated platform to bring everything together creates a single source of truth for your entire company. When all your competitive data is in one dashboard, you start seeing patterns you never would have noticed otherwise.

For example, you might see a trend in negative G2 reviews mentioning a specific missing feature. At the same time, your sales team's win/loss notes show you’re losing deals for that exact same reason. When those two data points sit side-by-side, they create an undeniable insight that can—and should—drive your product roadmap. A unified view is what turns raw data into the sharp, actionable intelligence needed for a winning competitive intelligence report.

Using Modern Tools for Deeper Insights

Let's be honest: the days of manually scraping competitor websites and getting lost in endless spreadsheets are over. Thank goodness. Today’s technology gives us a massive strategic advantage, completely changing how we build a competitive intelligence report. It automates the grunt work and, more importantly, uncovers the kind of insights that used to stay buried.

When you have the right tools, you move faster and make decisions with more confidence. You’re basing your strategy on what’s happening right now, not on data that was stale last quarter. It’s the difference between driving while looking in the rearview mirror versus seeing the whole road ahead.

Building Your Competitive Intelligence Tech Stack

Your tech stack doesn't need to be overly complex, but it absolutely has to be strategic. The goal is to bring together a few key tools that cover your competitive landscape from every angle—marketing, product, sales, the works. A well-rounded setup usually includes a mix of specialized platforms.

I find it helpful to think about tools in terms of the intelligence they gather:

- Marketing and SEO Platforms: You can’t go wrong with tools like Ahrefs or Semrush. They are perfect for reverse-engineering a competitor’s digital marketing strategy. You can see the exact keywords they rank for, where their backlinks come from, and even get a peek at their ad copy.

- Social Listening and Sentiment Analysis Tools: To understand the conversation around your competition, platforms like Meltwater or Sprinklr are fantastic. They let you tap into real-time brand mentions, see how customers are feeling, and spot emerging trends before they blow up.

- Dedicated CI Platforms: A new breed of tools is built specifically for automated competitive intelligence. These platforms do the heavy lifting of tracking everything from website updates and pricing changes to new feature announcements and marketing campaigns.

The Rise of Automated and AI-Powered Platforms

The real game-changer here is automation and AI. Modern CI platforms don't just dump raw data on you; they analyze it and filter out the noise, delivering only the high-signal alerts that matter. Instead of you having to remember to check a competitor’s site every day, an automated tool does it and flags only the significant changes.

This kind of monitoring is what keeps your team nimble. Imagine getting an email the second a key rival changes their pricing page or pushes a new feature live. That’s the power we're talking about. Platforms like ChampSignal are built for this, giving you a central dashboard to track every critical move.

Here’s a look at how a platform like ChampSignal gives you a clean, centralized view of competitor activity. What’s so powerful here is the historical log of changes. That timeline provides crucial context when you’re putting together your competitive intelligence report.

The market for these tools is exploding. As of 2024, cloud-based solutions accounted for over 78% of the revenue in the competitive intelligence tools market. That market is projected to skyrocket from USD 0.59 billion in 2025 to USD 1.46 billion by 2030. This isn't just an enterprise game anymore; small and medium-sized businesses are adopting these tools to level the playing field.

The biggest shift I've seen is from simple data collection to true insight generation. Modern tools free you from the mind-numbing research so you can focus on the strategic "so what?" behind the data.

Turning Technology into Actionable Strategy

At the end of the day, the tools are only as good as the strategy they enable. The real value isn't in having a dozen dashboards but in connecting the dots between them.

For example, your SEO tool might show a competitor suddenly ranking for a new cluster of keywords. Your social listening tool could then pick up on customer chatter around that same topic, confirming a deliberate shift in their market focus.

By weaving these different data streams together, you build a much richer, more nuanced picture of what your competitors are planning. For a deeper look at the options out there, check out our guide on the best competitive intelligence software to round out your stack. This holistic view is what transforms a standard analysis into a predictive and powerful competitive intelligence report.

Presenting Your Findings for Maximum Impact

Even the most brilliant competitive intelligence report is worthless if it doesn't inspire action. Your final challenge isn't just the analysis; it's turning all that data into a compelling story that leadership will actually listen to—and act on. You have to make your key insights impossible to ignore.

A report that just lists data points is destined to gather digital dust. You need to think of yourself as a storyteller. Your job is to connect the dots between a competitor’s move, a market trend, and a specific, tangible action your company must take.

Tailor the Message to Your Audience

The secret to a high-impact presentation? Knowing that different stakeholders care about different things. A one-size-fits-all report almost always fails because it tries to speak to everyone and ends up resonating with no one. You have to customize your delivery.

- For the CEO and Leadership Team: They need the big picture, and they need it fast. Lead with the top three strategic threats and opportunities. Frame everything in terms of market share, revenue, and risk.

- For the Product Team: These folks live and breathe features, roadmaps, and usability. Highlight specific competitor product weaknesses you've found, customer complaints from G2 or Reddit, and any emerging tech they can build into the next sprint.

- For the Marketing and Sales Teams: They need battlefield intel. Arm them with direct comparisons of messaging, pricing models, and customer reviews they can use in campaigns and sales calls tomorrow.

By tailoring the content this way, you make sure each team gets relevant, actionable intelligence they can put to use immediately. This is how your competitive intelligence report becomes a vital tool instead of just another document.

Visualize Your Data to Tell a Story

Let's be honest, humans are visual creatures. A simple chart often says more than a dense paragraph of text ever could. Don't just show the data; use visuals to highlight the "so what?" behind the numbers.

For instance, instead of just stating that a competitor's share of voice is growing, show it. A line graph comparing your brand’s share of voice against a rival's over the last six months instantly tells a powerful story of momentum—either yours or theirs. If you're looking for inspiration on how to present data clearly and interactively, exploring various business intelligence dashboard examples can really help.

The goal of data visualization isn't to be fancy; it's to be clear. A well-designed visual should make your main point obvious within seconds, guiding your audience to the same conclusion you reached.

Lead with Recommendations, Not Observations

This is the single biggest mistake I see analysts make: burying their recommendations at the very end of the report. Your audience is busy. You need to flip the traditional structure on its head.

Start with your conclusions. Your executive summary—and the beginning of each section—should state the recommended action first. Then use the data to back up why it’s necessary.

Try framing each key finding this way:

- The Recommendation: "We need to launch a free trial tier within the next quarter."

- The Core Insight: "Our top two competitors are acquiring new users 30% faster since introducing their freemium models."

- The Supporting Evidence: "Our analysis shows their website traffic from organic search has doubled, and social media mentions related to 'easy onboarding' have surged."

This approach immediately focuses the conversation on solutions and strategy rather than getting bogged down in the data. It ensures your competitive intelligence report becomes a catalyst for decisive action that moves the business forward.

Future-Proofing Your Competitive Intelligence

Winning today is one thing, but consistently staying ahead is what truly separates the best from the rest. Think of your competitive intelligence report not as a one-time project, but as the pulse of an ongoing program. To build a real, lasting advantage, your CI function needs to be a living, breathing part of your company culture, not just a static analysis that collects dust.

This means you have to look beyond your direct competitors. The modern market demands a much wider lens—one that examines entire ecosystems, including partners, up-and-coming technologies, and even adjacent industries that might not seem like a threat today.

This shift is happening fast. The CI software market for SMBs is projected to explode from $2.56 billion in 2023 to a staggering $6.02 billion by 2030. This growth isn't random; it’s fueled by the urgent need for more comprehensive, ecosystem-wide analysis. You can check out more on the trends shaping competitive intelligence's future.

Creating a Sustainable CI Program

For your intelligence efforts to have any real staying power, you need a repeatable system. This isn't just about scheduling reports; it's about creating a rhythm that keeps your entire organization in the loop and moving in the same direction.

Here are a few practical ways to build a program that lasts:

- Set a Regular Reporting Cadence: Decide on a consistent schedule that makes sense for your teams. Maybe it's a monthly deep dive for sales and marketing and a quarterly executive summary for leadership. The key is consistency, so insights are always fresh.

- Build in Feedback Loops: Don't just send the report and walk away. Follow up with your key stakeholders. Ask them directly: what was most helpful? What was missing? What do you wish you knew? Use that feedback to sharpen your focus for the next report.

- Arm the Entire Organization: Share relevant findings far and wide. When everyone from product developers to customer support has access to clear, timely competitive insight, they make smarter, more aligned decisions. This is how you embed CI into your company’s DNA.

By building a culture where everyone feels empowered by competitive intelligence, you turn it from a simple reporting task into a powerful, company-wide strategic advantage that keeps you ahead of the curve.

Got Questions About CI Reports? Let's Clear Them Up.

Even with a solid plan, jumping into your first competitive intelligence report can feel a bit daunting. A few practical questions always seem to pop up. Let's walk through some of the most common ones I hear, so you can move forward with confidence.

How Often Should I Actually Run These Reports?

There’s no magic number here. The right frequency really boils down to how quickly your industry moves and what your teams need to succeed.

If you're in a fast-paced space like SaaS or consumer tech, you might need monthly or even bi-weekly updates just to keep up with everyone's product launches and marketing blitzes. On the other hand, a company in a more traditional manufacturing sector might find that a comprehensive quarterly report is more than enough to guide strategy.

The real key is to match your report schedule to your company's decision-making rhythm.

- Monthly Reports: These are perfect for sales and marketing folks. They need fresh intel on competitor messaging, new campaigns, and pricing changes to stay sharp in the field.

- Quarterly Reports: This cadence works well for leadership and product teams. It gives them a broader, strategic view of market shifts and competitor performance, which is exactly what they need for long-term planning.

- Ad-Hoc Reports: Don't forget you can spin up a report anytime something big happens. A major competitor gets acquired? A rival has a massive product recall? That’s the time for an immediate, focused analysis.

Is This Whole Thing Legal and Ethical?

Yes, 100%—as long as you’re using publicly available information. A good competitive intelligence report is all about smart, ethical research. Think of yourself as a market detective, not a corporate spy.

Ethical CI is built on a foundation of open-source information, like:

- Press releases and news coverage

- Public financial statements

- Reports from industry analysts

- Social media posts and customer reviews

- Their own websites, blogs, and marketing materials

You get into trouble when you cross the line into illegal tactics like hacking, trying to steal trade secrets, or lying about who you are to get private info. As long as you stick to public sources, you're on solid ethical ground.

Realistically, How Much Time Will This Take?

I won't lie, the time commitment can vary, but the initial setup is almost always the heaviest lift. Your very first report involves the groundwork: figuring out who your key competitors are, setting up your tracking tools, and gathering that first round of data to establish a baseline. That could easily take a few solid days of work.

But here’s the good news: once you have your process and tools in place, it gets so much easier. With modern platforms automating most of the data collection, you can shift your focus. Maintaining the report might only take a few hours each week or month to dig into the insights and tell the story behind the data. The goal is to create a repeatable system, not reinvent the wheel every single time.

Stop wasting hours manually digging for competitor data. ChampSignal puts your monitoring on autopilot, tracking everything from pricing updates to new ad campaigns. This means you can spend your time on strategy, not stuck in spreadsheets. See what you're missing by visiting ChampSignal's website.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. Cancel anytime.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, X posts, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works