Master competitive intelligence analysis: A practical guide

Maxime Dupré

10/31/2025

Competitive intelligence analysis is all about ethically gathering information on your competitors and the wider market, then turning that raw data into actionable insights. Think of it less as simple spying and more as building a strategic playbook that uncovers threats, spotlights opportunities, and helps you make smarter, more proactive decisions.

Going Beyond Basic Competitor Tracking

Let's be real for a moment. Just knowing what your competitors are up to isn't going to win you the game. So many companies get stuck in a reactive loop of passive monitoring—peeking at a rival's pricing page or making a note of their latest marketing campaign. That's just basic tracking.

True competitive intelligence analysis is a different beast entirely. It’s a strategic discipline that shifts you from being a spectator in the stands to a key player on the field. It’s about building a complete 360-degree view of your market, allowing you to anticipate customer needs, new tech, and competitive threats before they even hit your radar.

The Strategic Shift From Tracking to Intelligence

The real difference comes down to the why. Tracking tells you what just happened. Intelligence analysis explains why it happened and, more importantly, what you should do about it.

For example, seeing a competitor slash their prices by 15% is just tracking. That’s an observation. But intelligence is discovering they lowered prices to offload old inventory because their recent patent filings and new job postings for specialized engineers point to a massive product overhaul coming next quarter. See the difference? That deeper insight lets you prepare for their next big move, not just react to a temporary sale.

A common mistake is treating competitive intelligence as a one-off project. To be effective, it must be an ongoing, systematic process integrated into your company’s strategic planning cycle. It’s a continuous loop of gathering, analyzing, and acting.

A Multi-Billion Dollar Discipline

This strategic importance is exactly why the competitive intelligence field has blossomed into a massive ecosystem. The global market was estimated at a staggering $8.2 billion in 2023. This isn't just a niche practice anymore; it's a core business function. You can read more about the growth of the competitive intelligence industry on Sendview.io.

Companies are investing heavily in this area because the payoff is huge. Product marketing teams use CI to sharpen their messaging, sales teams rely on it for creating effective battle cards, and leadership uses it for high-stakes risk assessment. To get the most out of your efforts, integrating robust business intelligence best practices can seriously elevate the quality of your insights. It’s all about creating a system that connects the dots.

To truly move past simple tracking, a modern CI program needs to be built on a few core pillars. It's not just about one thing; it's about seeing the whole picture.

Core Components of Modern CI Analysis

| Pillar | Description | Key Outcome |

|---|---|---|

| Market Intelligence | Understanding broad industry trends, regulatory changes, and economic shifts affecting everyone. | Context for your strategic planning; early warnings of market-wide disruptions. |

| Competitor Intelligence | A deep dive into specific rivals' strategies, performance, products, and operational capabilities. | The ability to anticipate competitor moves and exploit their weaknesses. |

| Technological Intelligence | Monitoring new and emerging technologies that could disrupt the market or create opportunities. | A roadmap for innovation and a defense against being made obsolete. |

| Customer Intelligence | Analyzing customer feedback, reviews, and sentiment related to your competitors' offerings. | Insights into unmet customer needs and your competitors' vulnerabilities. |

By weaving these four elements together, you stop just watching your competitors and start outmaneuvering them. This comprehensive approach is what builds a real, sustainable competitive edge, helping you grab opportunities and dodge risks before they become problems.

Building Your Intelligence Gathering Framework

A solid competitive intelligence program doesn't start by gathering a mountain of data. It starts by asking the right questions. Without a clear focus, you'll just end up drowning in information overload, wasting hours on research that goes nowhere. The trick is to build a structured framework that guides your efforts toward what actually matters for your business.

This entire process kicks off by defining your Key Intelligence Topics (KITs). Think of KITs as the big, critical questions your leadership team needs answered to make smart calls. They’re the bridge between your day-to-day intelligence work and your company's high-level strategic goals, ensuring your efforts have a real, tangible impact.

Defining Your Key Intelligence Topics

Instead of a vague goal like "track our competitors," a KIT-driven approach gets specific. For instance, a SaaS company might shift from a broad objective to a highly focused KIT:

- General Goal: "We need to know what Competitor X is doing."

- Specific KIT: "What is Competitor X's product roadmap for the next 12 months, and how will their upcoming features impact our market share in the enterprise segment?"

This level of specificity is a game-changer. It turns your intelligence gathering from a passive monitoring chore into an active investigation with a clear purpose. You can get a better handle on the fundamentals by exploring what competitive intelligence is and how it shapes business strategy.

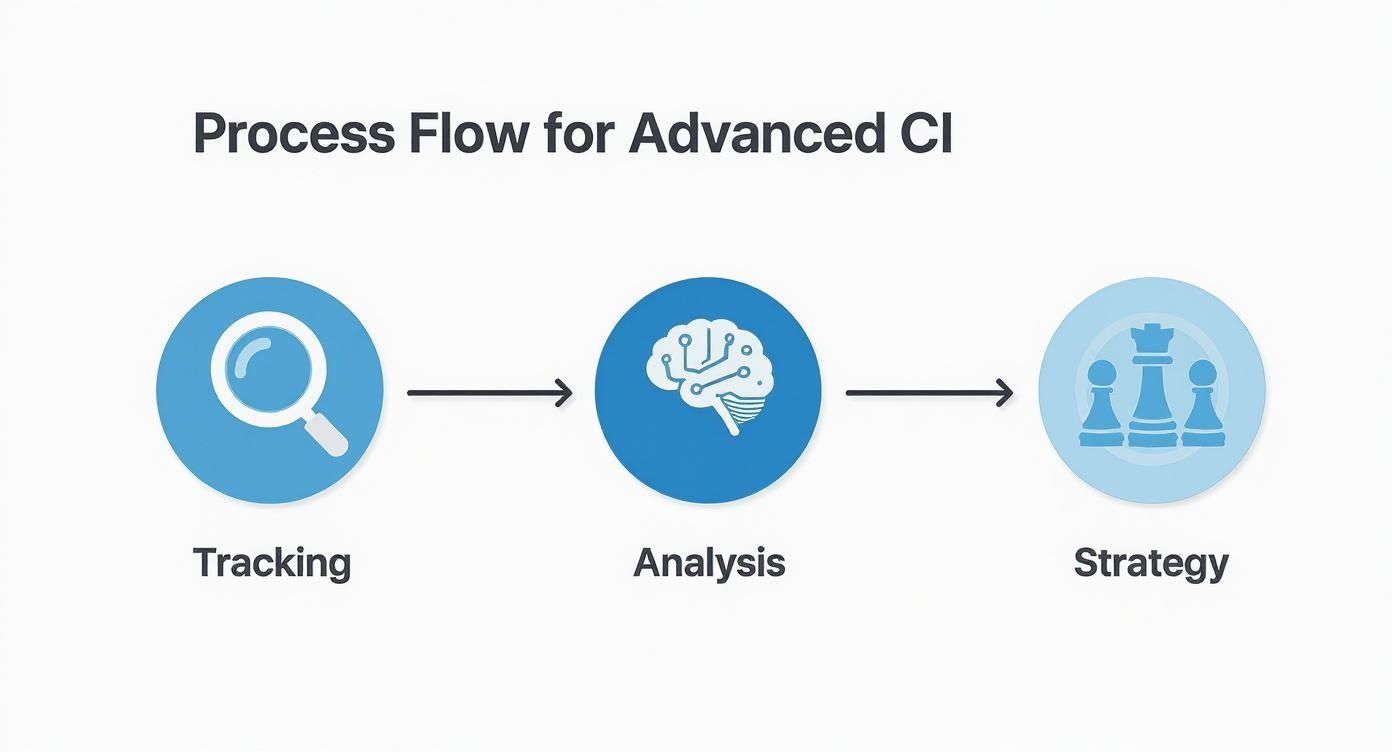

This whole process is really a continuous cycle—you track, you analyze, and you strategize to stay ahead of the curve.

The visual above drives home a key point: just gathering data is the first step. The real value comes from turning that information into strategic action.

Tapping Into Primary and Secondary Sources

Once you have your KITs locked down, you can start identifying the best places to find the answers. A truly effective intelligence plan relies on a healthy mix of both primary and secondary sources, as each gives you a totally different piece of the puzzle.

Primary sources are all about direct interaction and observation. This is where you get information straight from the horse's mouth—raw, unfiltered, and full of context.

- Customer Interviews: Don't just ask customers why they chose you; ask them why they didn't choose a competitor. Their specific words can reveal a rival's biggest weaknesses.

- Sales Team Feedback: Your sales reps are on the front lines every single day. They hear objections and competitor names constantly, giving them a real-time pulse on market sentiment.

- Industry Events: Some of the best intel comes from casual conversations at trade shows and conferences. These off-the-record chats can give you a peek into a competitor’s culture and what they’re planning next.

Secondary sources, on the other hand, are all about publicly available information. While they're less direct, they offer a massive amount of scalable data you can track over time.

- Financial Reports: For public companies, quarterly earnings calls and annual reports are goldmines. They spell out strategic priorities and performance metrics in black and white.

- Patent Filings: This is like looking into the future. Patents can signal a competitor’s R&D focus and potential new products years before they ever hit the market.

- Social Media & Review Sites: Monitoring sentiment on platforms like G2, Capterra, or even Reddit can expose product gaps and customer service headaches.

- Job Postings: If a competitor suddenly starts hiring a dozen "machine learning engineers," you can bet a new AI-powered feature is in the works.

The most powerful insights often come from connecting the dots between different sources. A customer complaining about a missing feature (primary) paired with a competitor's job posting for a relevant developer role (secondary) tells a compelling story about their likely next move.

For a more advanced approach, you might also consider leveraging data scraping techniques to ethically and efficiently pull public information from websites.

Creating a Repeatable System

Finally, you need a system to keep all this information organized. This doesn't have to be some overly complex, expensive database. Honestly, a simple shared spreadsheet, a dedicated Slack channel, or a folder in Google Drive can work wonders.

The goal is to create one central place where all this raw intelligence can be stored, tagged, and easily accessed by your team. Getting organized is critical because it makes the next step—analysis—so much smoother. By building a repeatable, ethical system for gathering and storing information, you’re creating a powerful strategic asset that fuels proactive, smart decisions.

Choosing Your Competitive Intelligence Tools

Let's be honest, trying to manually track your competitors is a recipe for burnout. The right tech stack, on the other hand, can turn competitive intelligence from a soul-crushing chore into your company's secret weapon. Good tools do the heavy lifting—the endless scraping and monitoring—so you can focus on what actually matters: thinking, analyzing, and strategizing.

But with a sea of options out there, where do you even start? The trick is to stop looking for a single, magical "do-it-all" platform. Instead, think about building a CI tech stack. By layering different tools, each focused on a specific job, you can build a far more powerful and complete picture of the competitive landscape.

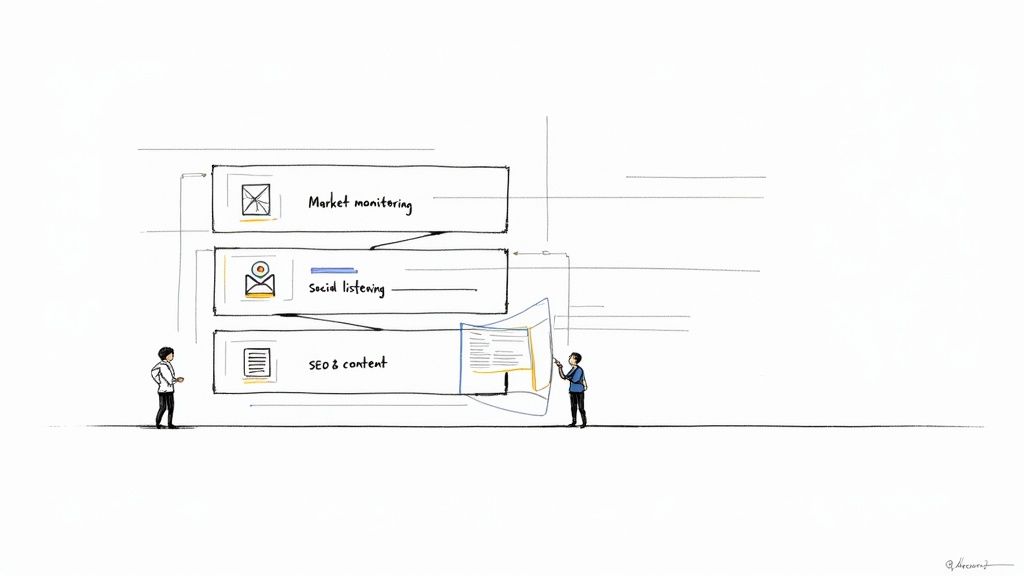

The Core Categories of CI Tools

Most competitive intelligence needs fall into a few key buckets. The most effective CI programs pull insights from a mix of these tool types, giving them a 360-degree view.

Market and Website Monitoring Tools: Think of these as your digital watchdogs. They keep a close eye on your competitors' websites, flagging changes in pricing, new product features, or shifts in messaging. Platforms like Crayon or our own ChampSignal are built for this, sending you real-time alerts so you can react before you’re left behind.

Social Listening and Sentiment Analysis Tools: This is where you tap into the public conversation. Tools like Brandwatch or Talkwalker listen in on social media, forums, and news sites to see what people are actually saying about your rivals. It's not just about what competitors announce; it's about how the market responds. You can spot PR crises brewing or find pockets of customer frustration ripe for the poaching.

SEO and Content Analysis Tools: For anyone serious about digital marketing, platforms like Semrush and Ahrefs are non-negotiable. They let you peek behind the curtain of a competitor's online strategy—which keywords they own, where their best links come from, and what content is bringing them traffic. This is gold for finding gaps in your own strategy.

There's a reason businesses are pouring money into this area. The global competitive intelligence tools market is expected to hit $121.37 million by 2031. That kind of growth tells you one thing: companies with sharp, data-driven insights are the ones winning. You can dig deeper into this market's growth on Fortune Business Insights.

Building a Tech Stack That Fits

Choosing the right tools isn’t just about the flashiest features; it's about what you actually need to achieve. A lean startup might get huge value from a simple website tracker to monitor a rival’s pricing. A global enterprise, however, may need a robust social listening platform to protect its brand reputation worldwide.

For a more detailed walkthrough, our guide on choosing competitive intelligence software can help you find the perfect match for your specific goals and budget.

The goal is to get high-signal alerts, not just more noise.

I've seen it happen time and again: a company invests in a powerful, expensive tool but doesn't have the team to manage it. You are far better off mastering a simple, focused tool that gives you truly actionable alerts than being buried under an avalanche of data from a complex platform you can't properly use.

Comparison of Competitive Intelligence Tool Types

To help you decide where to start building your stack, here’s a quick rundown of what each tool category does best. Think about your most urgent intelligence gaps and use this table to guide your first move.

| Tool Category | Primary Function | Example Tools | Best For |

|---|---|---|---|

| Market & Website Monitoring | Tracking direct changes to competitor assets like websites and products. | ChampSignal, Crayon | Getting real-time alerts on pricing, feature launches, and messaging changes. |

| Social Listening | Monitoring brand mentions, sentiment, and public conversation. | Brandwatch, Talkwalker | Understanding brand reputation, managing PR, and identifying customer pain points. |

| SEO & Content Analysis | Analyzing search performance, keywords, and content strategies. | Semrush, Ahrefs | Uncovering marketing gaps, building a stronger content plan, and improving search visibility. |

At the end of the day, the best tools are the ones you actually use—the ones that fit into your workflow and deliver insights that lead to smarter, faster decisions. Start by picking one tool that solves your biggest problem right now. You can always expand your stack as your CI program gets more sophisticated.

Turning Raw Data Into Actionable Insights

Gathering data is just step one. By itself, a pile of competitor press releases, social media chatter, and pricing updates is just a lot of noise. The real value in competitive intelligence comes when you start connecting those scattered dots to see the bigger strategic picture.

This is the point where you stop being a data collector and become a true analyst. It’s all about asking the right questions. For example, a single job posting for a "Director of EMEA Sales" is an interesting tidbit. But what happens when you combine that with their recent appearance at a big European trade show and a new multi-language update to their website? Suddenly, a powerful insight emerges: they’re getting ready for a major European expansion.

Adopting Proven Analytical Frameworks

To give your analysis some structure, it’s smart to lean on established frameworks. Think of them less as rigid rules and more as different lenses to view the data through. They help ensure you don’t miss crucial connections and provide a structured way to think through the competitive landscape.

Two of the most reliable frameworks I’ve used are the SWOT analysis and Porter's Five Forces. They push you beyond simple observation and into strategic interpretation.

A SWOT analysis is a classic for a reason, but the trick is to apply it to your competitors, not just your own company. When you map out their Strengths, Weaknesses, Opportunities, and Threats from their perspective, you can start to anticipate their next moves.

- Strengths: What do they have that gives them an edge? (e.g., strong brand recognition, a key patent)

- Weaknesses: Where are they vulnerable? (e.g., terrible customer reviews, reliance on a single supplier)

- Opportunities: What market shifts could they jump on? (e.g., a rival’s PR disaster, new regulations opening a market)

- Threats: What external factors could hurt them badly? (e.g., new government regulations, a disruptive technology on the horizon)

Forcing yourself to see the market through your competitor's eyes is an incredibly powerful way to predict their strategy before they execute it.

Understanding Broader Industry Dynamics

While SWOT is great for a head-to-head comparison, Porter's Five Forces helps you step back and analyze the entire industry's competitive heat. This framework is perfect for understanding the bigger picture and the underlying power structures at play.

It looks at five core forces that define every industry:

- Competitive Rivalry: How cutthroat is the competition between existing players?

- Threat of New Entrants: How easy is it for a new company to set up shop in your market?

- Bargaining Power of Buyers: How much control do customers have over pricing?

- Bargaining Power of Suppliers: How much can your suppliers squeeze you on costs?

- Threat of Substitute Products or Services: How easily can customers find a totally different way to solve their problem?

Running through these forces gives you a strategic map of your industry, showing you where the power really lies and what threats exist beyond your direct rivals.

The goal of analysis is not to produce a report filled with data, but to generate a handful of powerful insights that can drive a specific business decision. One actionable insight is worth more than a hundred interesting but irrelevant facts.

From Dots to a Clear Picture

The real skill here is synthesis—weaving different pieces of information into a cohesive story. This means you have to constantly look for patterns and ask "So what?" and "Why?" at every turn.

Imagine you notice these seemingly unrelated facts about a key competitor:

- Their ad copy has shifted from "affordable" to highlighting "premium features."

- They recently poached several senior engineers from a well-known luxury tech brand.

- Their latest product reviews mention a price hike but also praise the improved quality.

Individually, these are just observations. But together, they paint a very clear picture: your competitor is intentionally moving upmarket to chase a more premium customer. Now that is a highly actionable insight. It can directly inform your own pricing strategy, your product roadmap, or even a new marketing campaign aimed at the price-sensitive customers they’re leaving behind.

Once you uncover these kinds of insights, documenting them clearly is the final, crucial step. For a deeper dive on this, our guide to creating a competitive intelligence report has some great templates and practical tips.

Ultimately, turning data into insights is like being a detective. It takes curiosity, a structured process, and the ability to see the bigger story behind the individual clues. This is how competitive intelligence moves from being a simple research task to a core driver of your company's strategy.

Embedding Intelligence Across Your Organization

Even the most brilliant competitive intelligence is useless if it just sits in a PowerPoint deck or gets buried in an email chain. The whole point is to get the right information to the right people so they can actually do something with it. A raw data dump isn't a strategy; it's a chore for someone else to figure out.

The secret is to stop creating one-size-fits-all reports. Instead, think about creating tailored insights that speak directly to the needs of different teams. This means really understanding what each department cares about and how they measure success. Only then can your work spark real change across the business.

Tailoring Intelligence for Maximum Impact

Your stakeholders don't all speak the same language. The sales team needs quick, hard-hitting facts for their next call, while the product team wants deep analysis to shape their roadmap. Leadership, of course, is looking for the big-picture strategic takeaways.

If you want your CI to stick, you have to customize the delivery. For example:

- For the Sales Team: Build sharp, concise battle cards. These are cheat sheets that highlight a competitor’s key weaknesses, your product's killer features, and smart responses to common objections. They're designed for a quick glance right before a call.

- For the Product Team: A detailed gap analysis is invaluable. This report should put your product features head-to-head with competitors, using customer reviews and market feedback to pinpoint unmet needs and prime opportunities for innovation.

- For Leadership: Prepare a high-level strategic outlook. This is an executive summary that zooms in on market trends, potential disruptions, and the long-term threats or opportunities you've uncovered. Use clean visuals to tell a powerful story.

This targeted approach ensures your work doesn’t just get read—it gets used. It shifts your role from being a reporter of facts to a strategic partner who helps every team win.

The Power of Storytelling and Visualization

Facts and figures are forgettable. Stories are not. To make your competitive intelligence analysis memorable, you have to weave your findings into a compelling narrative. Don't just show a chart of a competitor's rising market share; explain the why behind it.

For instance, you could frame it this way: "Over the past six months, Competitor X grabbed another 5% of the market by going after a customer segment we've mostly ignored. Their new messaging, which hammers home 'ease of use' for non-technical users, is clearly working." This gives the data context and creates a sense of urgency.

The most effective CI professionals are storytellers. They transform complex data into clear, persuasive narratives that highlight a critical business choice: act on this insight and win, or ignore it and risk falling behind.

Evolving Beyond Simple Competitor Tracking

Modern competitive intelligence is also getting much broader. The best platforms are moving beyond just tracking direct competitors to offer a complete market and competitive intelligence (M&CI) picture. This means integrating insights from supply chains, partners, and even non-traditional players.

Think about it: a sportswear company today isn't just watching rival brands. They have to monitor tech firms, health apps, and social media influencers who are all shaping what consumers want. You can dig into more of these evolving CI trends on Competitive Intelligence Alliance. This wider view is what it takes to build a program that delivers real, lasting value.

Creating a Crucial Feedback Loop

Finally, sharing intelligence isn't a one-way street. To keep your CI program sharp and relevant, you absolutely must build a feedback loop.

After you send out a report or a new set of battle cards, circle back with the teams who used them. Ask direct questions:

- Was this useful in your day-to-day work?

- Did it actually help you close a deal or make a better product decision?

- What was missing? What else did you need?

- Looking ahead, what intelligence would be most valuable for you next quarter?

This back-and-forth does two crucial things. First, it helps you fine-tune your efforts to focus on what truly matters. Second, it constantly reinforces the tangible value of your work, proving its ROI and securing buy-in from the entire organization.

Have Questions About Competitive Intelligence? You're Not Alone.

Even with a great plan and the right software, jumping into competitive intelligence can feel a bit daunting. It's natural for practical questions to pop up as you get started. Let's walk through some of the most common ones I hear from teams just building out their CI function.

How Can We Do This Without a Big Budget?

You absolutely do not need a massive budget to get started with competitive intelligence. For smaller businesses or teams just testing the waters, it’s all about being scrappy and smart with your time.

First things first, set up Google Alerts for your top couple of competitors and a few key industry terms. It’s free, takes five minutes, and will start feeding you relevant news and mentions right away. It's a simple, powerful first step.

Next, block out a few hours on your calendar each week to do some manual digging. Check out what your competitors are posting on social media, sign up for their email newsletters, and click around their websites to see what's new. Keep track of everything you find in a simple spreadsheet. Consistency here is far more valuable than a fancy tool you only use once in a blue moon.

The most important investment for a small business starting with CI isn't money; it's time. A disciplined weekly routine of gathering and documenting public information will yield powerful insights without breaking the bank.

You can also get a surprising amount of data from the free versions of popular SEO tools. These can give you a peek into your competitors’ keywords and backlink strategies, revealing a lot about how they attract customers online—all without spending a dime. The initial goal isn't to be perfect; it's to build the habit of paying attention.

What’s the Real Difference Between Competitive Intelligence and Market Research?

This one comes up a lot. People often use these terms interchangeably, but they are fundamentally different disciplines that answer very different questions. Mixing them up can lead to a fuzzy strategy, so it’s crucial to understand the distinction.

Market research is broad. It’s about understanding the entire market landscape. You might conduct market research to gauge customer needs for a new product, figure out the total addressable market, or spot high-level industry trends. Think of it as a wide-angle lens, often used for specific, project-based initiatives.

Competitive intelligence (CI), on the other hand, is hyper-focused, ongoing, and built for action. It zeroes in on your competitors and the immediate external environment to help you make faster, smarter decisions right now. CI is what answers questions like, "What's our main rival's next move?" or "How can our sales team get a leg up in this specific deal?"

Here's a simple way to think about it:

- Market research helps you understand the playing field.

- Competitive intelligence helps you outmaneuver the other players on that field.

You need both, of course. Market research draws the map, but competitive intelligence is what helps you navigate that map to win.

How Do I Make Sure We’re Gathering Intelligence Ethically?

This is non-negotiable. Building a competitive intelligence program on a foundation of ethical behavior is the only way to operate. The moment you cross into shady territory, you risk serious damage to your reputation and can even land in legal trouble.

The guiding principle is simple: only use publicly available or ethically obtained information.

Stick to what’s known as open-source intelligence (OSINT). We're talking about a goldmine of information that's already out there for anyone to see. This includes sources like:

- Company websites and blogs

- Press releases and news articles

- Public financial filings

- Industry reports and case studies

- Social media activity

You should never, ever misrepresent who you are to get information. Things like industrial espionage, hacking, or trying to bait a competitor's employees (current or former) into sharing proprietary details are completely off-limits. These tactics aren't just unethical; they're destructive.

When in doubt, use this litmus test: "If my methods for gathering this information were published on the front page of a newspaper, would it damage my company's reputation?" If you hesitate for even a second, don't do it. Integrity is your most valuable asset.

Ready to stop guessing and start knowing what your competitors are doing? ChampSignal delivers high-signal alerts on the moves that matter, filtering out the noise so you can focus on strategy. See how it works.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. Cancel anytime.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

X Monitoring

Competitor posts and brand mentions tracked on X

Google and Meta Ads

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works