The Product Market Expansion Grid Growth Guide

Maxime Dupré

11/6/2025

Ever feel like your business has hit a growth ceiling? You're doing well, but the question "What's next?" keeps you up at night. Do you push your current products harder, dream up something new, or maybe even dive into a totally new customer base?

These are big, consequential questions. Making the wrong move can be costly, but standing still isn't an option either. This is where a classic, time-tested tool called the Product Market Expansion Grid comes in.

Your Strategic GPS for Business Growth

You might also know it as the Ansoff Matrix. Think of it as a GPS for your company's growth journey. It lays out four clear, distinct routes you can take by looking at two simple variables: what you sell (your products) and who you sell to (your markets).

Without a map like this, expansion efforts can feel like guesswork, leading to wasted time and money. To really get a handle on it, it helps in understanding what constitutes a strategic framework. It’s not a rigid rulebook; it’s a way of thinking that cuts through the noise and helps you make a deliberate, informed choice.

This powerful grid isn't some new-fangled business school trend. It was developed way back in 1957 by a brilliant mind in strategic management, Igor Ansoff, and published in the Harvard Business Review. The idea was so logical and effective that by the 1970s, it was being taught in over 80% of top business schools around the world. It’s a foundational piece of modern business strategy.

The Four Pathways to Expansion

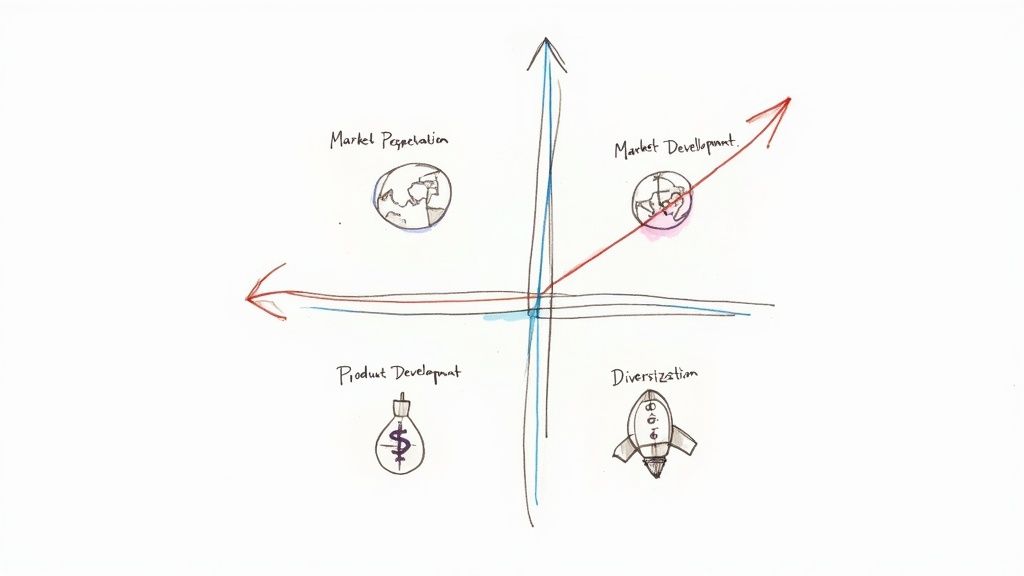

The grid is elegantly simple. It's built on a 2x2 matrix that pits your products (existing vs. new) against your markets (existing vs. new). This creates four core growth strategies:

- Market Penetration: Selling more of your current products to your current customers.

- Market Development: Taking your current products and finding new markets for them.

- Product Development: Creating new products to sell to your current customers.

- Diversification: The big one—launching new products in entirely new markets.

Each of these paths comes with its own level of risk and potential payoff, which is exactly why the grid is so useful for weighing your options.

Here’s what the classic Product Market Expansion Grid looks like.

As you can see, the visual layout makes the choices crystal clear. It helps you see the entire landscape of growth possibilities, from the safest bet (market penetration) to the riskiest, but potentially most rewarding, leap (diversification). Next, we’ll break down exactly what each of these quadrants means for your business.

Exploring the Four Core Growth Strategies

The product market expansion grid isn't some abstract business school theory; it’s a practical roadmap for growth. Think of it as a compass pointing in four distinct directions. Each path represents a strategic choice with its own unique landscape of opportunities, challenges, and risks. Getting to know the mindset behind each one is the first step toward making a smart, deliberate decision about where your company is headed next.

At its core, the grid lays out four fundamental pathways: Market Penetration, Market Development, Product Development, and Diversification. Each one is a direct result of pairing what you sell (your products) with who you sell to (your markets).

This simple 2x2 matrix provides a surprisingly powerful framework for figuring out your next move.

Market Penetration: Selling More to Your Current World

Let's start with the most common—and safest—path. Market Penetration is all about one simple goal: sell more of what you already have to the customers you already serve. It’s about doubling down on what you know works, in a market you understand inside and out.

This strategy neatly sidesteps the high costs and guesswork that come with creating new products or exploring unfamiliar turf. Instead, you focus on grabbing more market share. You aren't trying to reinvent the wheel; you're just finding ways to make it spin faster and more efficiently in your corner of the world.

Common tactics for market penetration include:

- Aggressive Marketing Campaigns: Ramping up your ad spend or launching new promos to win over your competitors' customers.

- Refining Your Pricing Strategy: Offering bundles, volume discounts, or strategic price adjustments to encourage people to buy more, more often.

- Enhancing Distribution Channels: Making your product easier to get, whether that means partnering with new retailers or smoothing out your online checkout process.

- Implementing Loyalty Programs: Creating rewards for repeat customers to keep them coming back and boost their lifetime value.

Essentially, this is about optimizing your current game to carve out a bigger slice of a very familiar pie. It’s the natural starting point for most businesses looking for steady, sustainable growth.

Market Development: Introducing Your Product to New Worlds

What happens when you've squeezed all you can out of your current market, but you know your product is still a winner? That's where Market Development comes in. This strategy is all about taking your existing, proven products and introducing them to entirely new markets.

These "new markets" can take a few different forms:

- Geographic Expansion: Taking a product that’s a hit in one country and launching it in another.

- New Demographic Segments: Targeting a different age group, income level, or lifestyle that you haven't focused on before.

- New Use Cases: Finding and promoting new ways for people to use your existing product, which in turn appeals to a whole new set of customers.

Market Development carries a moderate level of risk. Your product is solid, but you're now facing the challenge of understanding the culture, regulations, and buying habits of a new audience. Success here demands serious homework and a willingness to adapt your sales and marketing playbook.

A 2022 study by Appinio Research really drives home the impact of these strategies. It found that market penetration strategies were the most common, making up 42% of all growth initiatives. Market development was next at 28%, and companies that pursued it saw an average revenue bump of 12.4% in the first year.

Product Development: Creating New Solutions for Your Current World

Your loyal customers already know and trust your brand. Product Development is about cashing in on that trust by creating brand-new products or services just for them. It’s a strategy built on innovation and adding more value to the audience you know best.

You're not trying to find new customers here; you're focused on serving your existing ones more deeply. This could mean launching a complementary product that fits right into your current lineup or making major upgrades to what you already sell. To pull this off, a well-thought-out product launch plan is non-negotiable.

This path has its own moderate risks. R&D can burn through cash and time, and there's no guarantee your new idea will click, even with a loyal fanbase. The same study noted that while product development led to a 9.8% average revenue growth, it also came with a sobering 22% failure rate.

Successful product development all comes down to truly understanding your customers' shifting needs and pain points. You have to innovate to solve real problems for the people who already believe in you.

Diversification: Venturing into Brave New Worlds

Finally, we have Diversification—the most ambitious and riskiest strategy on the grid. This is when you decide to launch entirely new products into completely new markets. You’re taking on the challenges of both product and market development at the same time.

This is the high-stakes quadrant where companies step way outside their comfort zones. Businesses often go this route to break into high-growth industries or to stop being so dependent on a single product or market. It’s about building a more resilient, varied business portfolio.

There are two main flavors of diversification:

- Related Diversification: Entering a new space that has some connection to your current business, like shared technology or distribution networks.

- Unrelated Diversification: Jumping into a totally new industry where you have no prior experience, which is often done by acquiring another company.

The risk is definitely highest here, but so are the potential rewards. That Appinio research showed that while only 10% of companies tried diversification, those that succeeded saw an average revenue growth of 15.6% over three years. This path isn’t for the faint of heart; it demands deep pockets, meticulous planning, and a strong stomach for uncertainty.

To wrap your head around these four distinct paths, this table breaks down each strategy at a glance.

The Four Quadrants of the Product Market Expansion Grid

| Strategy | Description (Product/Market Focus) | Risk Level | Example Tactics |

|---|---|---|---|

| Market Penetration | Existing Products in Existing Markets | Low | Price adjustments, loyalty programs, increased promotion |

| Market Development | Existing Products in New Markets | Moderate | Expanding to new geographic regions, targeting new demographics |

| Product Development | New Products in Existing Markets | Moderate | Creating new product features, launching complementary products |

| Diversification | New Products in New Markets | High | Entering a new industry, acquiring an unrelated business |

Each quadrant offers a different way forward. Choosing the right one depends entirely on your company's resources, risk tolerance, and long-term vision.

How Winning Brands Use the Expansion Grid

It's one thing to understand the theory behind the product market expansion grid, but it’s another to see it in action, powering the growth of global giants. The four quadrants aren't just boxes in a textbook; they're the real-world blueprints behind some of the most iconic business decisions ever made.

When you look at how companies like Apple, Coca-Cola, and Starbucks have moved through these four pathways, the grid’s power comes to life. These examples show how a simple 2x2 matrix can guide multibillion-dollar decisions, turning smart strategy into massive success.

Apple: A Masterclass in Every Quadrant

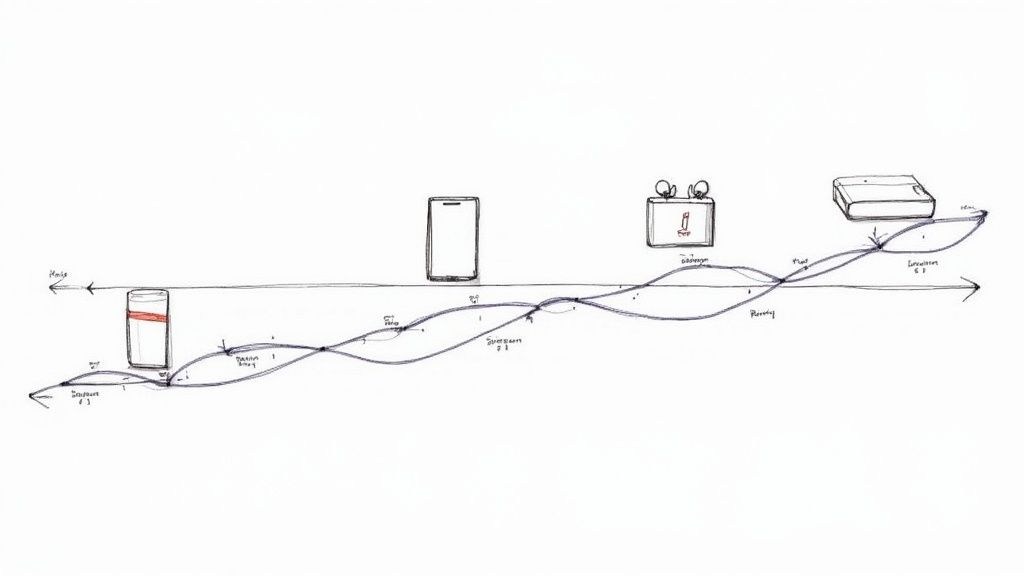

If you want a perfect case study on how to execute every single strategy in this framework, look no further than Apple. The company's evolution from a niche computer maker to a world-dominating tech titan is a masterclass in using the grid for sustained, long-term growth.

For years, Apple's game with the iPhone was pure Market Penetration. They relentlessly marketed new models—the iPhone 4, 5, 6, and so on—to their existing customers in established markets like North America and Europe. The whole focus was on upgrades and winning over users from competitors. This built an incredibly loyal—and profitable—customer base.

At the same time, they were pushing hard on Market Development. Apple took its hit product, the iPhone, and introduced it into huge new territories, most famously China and India. This wasn't easy. It meant adapting their marketing and dealing with complex local rules, but the payoff was enormous, unlocking fresh revenue streams from a product they already knew was a winner.

Apple’s deliberate use of this framework guided its explosive growth. From 2000 to 2020, its market penetration strategy accounted for an incredible 55% of its revenue growth. Meanwhile, its focus on market development led to a 22% increase in international sales between 2015 and 2020. You can read more about how these strategies fueled Apple's success.

But Apple didn't just stop at selling more iPhones in more places. They knew their customers were hooked, so they leaned into Product Development. This is where things like the Apple Watch and AirPods came from—brand new products created specifically for their existing iPhone users. This move didn't just sell more gadgets; it deepened customer loyalty and built a powerful, interconnected ecosystem that generated a staggering $36 billion in 2020 alone.

Finally, Apple took the leap into Diversification by launching new services into new markets. Services like Apple TV+ and Apple Arcade were a bold jump from hardware into the cutthroat world of content streaming. It was a new product type for a totally different kind of market, and it paid off, adding another $53 billion to its revenue in 2020. They played every corner of the grid, and it worked.

Coca-Cola: Conquering the Globe One Market at a Time

The story of Coca-Cola is a perfect lesson in how to use Market Penetration and Market Development to achieve total global dominance. For decades, their core strategy was simple but brutally effective.

Market Penetration: In its home market, Coca-Cola’s mission was to get people to drink more Coke. They did this with wall-to-wall advertising, offering new package sizes like the mini-can, and running constant promotions to make sure Coke was always the first choice.

Market Development: This is where Coca-Cola became a legend. The company took its standardized, iconic red-and-white brand and systematically pushed it into nearly every single country on the planet. It was a massive logistical challenge that required smart, localized marketing, but it's how they turned a single soda into a global phenomenon.

Only later did Coca-Cola lean heavily into Product Development, introducing Diet Coke, Coke Zero, and different flavors to keep its loyal customers interested as their tastes changed.

Starbucks: Brewing Up New Experiences

Starbucks built its coffee empire on a genius blend of Market Penetration and Product Development. Their first big win was penetrating urban markets by creating a "third place" between home and work, turning the daily Starbucks run into a cultural ritual.

Once they had that loyal, daily audience, they went all-in on Product Development. This is where their menu exploded:

- They introduced iconic new drinks like the Frappuccino and seasonal must-haves like the Pumpkin Spice Latte.

- They expanded their food offerings to include pastries, sandwiches, and other lunch items.

- They started selling merchandise like mugs, tumblers, and bags of their coffee for people to brew at home.

All this constant innovation gave their existing customers more reasons to show up and more things to buy when they did. From there, the company pursued Market Development by expanding aggressively, first across the U.S. and then around the world, tweaking store designs and menus to fit local tastes.

From Apple’s four-pronged attack to Coca-Cola’s focused global march, these brands show that the product market expansion grid is much more than a business school concept. It’s a proven recipe for smart, intentional, and triumphant growth.

Putting the Product Market Expansion Grid to Work

Knowing the four quadrants of the product market expansion grid is a great start, but the real magic happens when you actually apply it to your business. This isn't some dusty academic model; it's a practical tool meant to cut through the noise and bring focus to your growth strategy. Let's walk through how to move from theory to a real-world plan of attack.

The journey doesn't start by looking at a map of new markets. It starts by looking in the mirror. You need an honest, unflinching assessment of where you are right now before you can decide where you're going next.

Start With an Internal Deep Dive

Before you even think about new territories, you need to map out your own backyard. This internal reality check grounds your strategy, making sure your plans are both ambitious and, more importantly, achievable. The goal here is to get brutally honest about your resources, strengths, and weaknesses.

Get your team together and start asking the tough questions:

- Product Performance: Which of our products are the rock stars, and which are just taking up space? What makes our best stuff so valuable to customers?

- Market Position: How much of the market do we actually own? Are we a big name with our current customers, or are we just one of many options?

- Core Competencies: What are we genuinely better at than anyone else? Is it our engineering, our marketing, our customer service? These are the pillars you can build on.

- Resource Availability: What kind of budget are we working with for growth? Do we have the people, the tech, and the operational muscle to back up a big move?

Getting this foundation right prevents you from building a growth strategy on a house of cards. It makes sure your ambition is connected to your reality.

Scan the Horizon for Opportunities

Once you have a clear picture of your internal world, it’s time to look outside. This phase is all about doing your homework—systematic market research to pinpoint real opportunities in each of the four quadrants. You're looking for untapped potential and sizing up the competition.

Your external analysis has to be thorough. For instance, if you're seriously considering market development, you'll need a solid grasp of things like international business company formation to make sure a global launch goes smoothly.

Key areas to dig into include:

- Customer Gaps: Where are our current customers feeling pain that we're not addressing? This is fertile ground for Product Development.

- Adjacent Markets: Are there groups of people or places that look a lot like our core audience but that we’re completely ignoring? Hello, Market Development.

- Competitor Weaknesses: Where are our competitors dropping the ball? What market segments have they overlooked that we could swoop in and claim? That's your opening for Market Penetration.

Brainstorm and Evaluate Your Moves

With both your internal and external homework done, you can start brainstorming actual initiatives for each quadrant. Think of it as a creative session with some serious guardrails. Come up with a list of potential moves, then put each one under the microscope.

A common mistake is to chase exciting ideas without a proper risk assessment. The grid forces you to balance high-risk, high-reward plays like diversification with lower-risk, steadier options like market penetration.

For every idea you generate, run a quick risk-reward analysis. Give it a score for potential impact (like revenue or market share) and another score for risk (like the financial cost or operational headache). This simple system helps you compare totally different options—like a new ad campaign versus launching in Germany—on a level playing field. The insights you get here are the building blocks of a powerful https://champsignal.com/blog/product-marketing-strategy.

Following these steps transforms the grid from a static chart into a dynamic workbook for your business. It gives you a clear path from introspection to ideation and, finally, to confident action.

How Competitor Actions Shape Your Grid Strategy

Think of your product market expansion grid as a detailed map for your company's growth. It's a fantastic tool, but you have to remember you aren't the only one on the road. Your competitors are making moves, too, and their actions are a goldmine of intelligence that should directly shape your own strategy.

Ignoring your rivals is like planning a cross-country road trip without checking the traffic report. You might have the perfect route picked out, but a competitor’s surprise announcement can create a massive roadblock. On the flip side, it could also reveal an unexpected shortcut you hadn't considered.

Decoding Competitor Moves Through the Grid

You can—and should—interpret every significant move a competitor makes through the lens of the four quadrants. When you start seeing their actions this way, you shift from being a reactive observer to a proactive strategist. It’s about understanding the why behind their moves, not just the what.

For example, imagine a rival suddenly slashes prices while launching an aggressive new ad campaign. This isn't just a simple price war; it's a dead giveaway of a Market Penetration strategy. They are making a direct play to steal market share right from under your nose. This should force you to reconsider your own penetration efforts. Maybe it's time to double down on loyalty programs or highlight your superior customer service to defend your turf.

Or what if a competitor who has only ever done business in North America suddenly starts hiring a sales team in Europe? That’s a classic Market Development play. Their move acts as a powerful signal, potentially validating that European market you've been hesitant to enter. It tells you a serious player believes there's a real opportunity there.

Reading the Signals for Strategic Advantage

The key is to tune into the right signals and connect them back to your product market expansion grid. This isn't about mindlessly scrolling through news feeds; it's about focused, purposeful intelligence gathering.

Here are the critical competitor actions you should be tracking:

- Hiring Patterns: Are they suddenly hiring a bunch of international sales reps or engineers with a specific, niche skill set? This can telegraph their next move, whether it's building a team for Product Development or gearing up for geographic expansion.

- Marketing and Ad Campaigns: Take a close look at a competitor's ad creative and where they're spending their money. A shift in messaging could signal an attempt to reach a new demographic—a Market Development strategy you can learn from.

- Feature Rollouts and Patents: New features or recent patent filings are the clearest evidence of a Product Development strategy. They show you exactly where your competitor sees unmet needs in your shared customer base.

- Strategic Partnerships: When a competitor partners with a company in a completely different industry, it can be a major red flag for a Diversification strategy. They might be planning a bold leap into an entirely new arena.

By systematically tracking these competitor actions, you're not just spying; you're gathering field intelligence. Their successes validate opportunities, and their failures offer invaluable, low-cost lessons on what to avoid.

Turning Intelligence into Action

This approach transforms your grid from a static planning document into a dynamic, living framework. It helps you ask smarter, more pointed questions. Did your main competitor's expansion into Southeast Asia actually work, or did it fizzle out? Why? The answers to that question can directly inform your own Market Development plans.

This process of systematic observation and analysis is the very heart of effective competitive benchmarking. To get ahead, you need a structured way to compare your performance and strategy against the best in your field. To learn more, check out our in-depth guide to competitive benchmarking and how to implement it.

At the end of the day, your competitors are constantly revealing their hand. By mapping their moves back to the product market expansion grid, you can better anticipate market shifts, learn from their experiments, and make smarter, more confident bets for your own business.

Putting the Expansion Grid to Work: Your Questions Answered

Understanding the four quadrants is one thing, but actually putting the product market expansion grid into practice is where the real questions pop up. It’s a fantastic framework, but its power lies in how you adapt it to your specific situation—whether you're a scrappy startup with limited cash or a legacy company mapping out your next five-year plan.

Let's dig into some of the most common questions people have. Getting these right can be the difference between a strategy that just looks good on paper and one that actually delivers results.

Which Quadrant Is Best for a Startup?

For most startups, the journey almost always begins with Market Penetration. It’s the most logical and lowest-risk starting point. Why? Because you're dealing with the fewest unknowns: a product you've just built and a market you've already identified.

The goal here is simple: get a foothold. By focusing all your energy on winning over customers and carving out market share, you can build a stable revenue stream. That initial success is what will eventually bankroll your bigger, riskier moves down the road.

One of the classic and most expensive mistakes a new company can make is jumping straight to a high-risk strategy like diversification. Build your foundation first. Get one thing right before you try to do everything.

How Often Should We Revisit Our Grid Analysis?

Think of your grid analysis as a living map, not a framed picture on the wall. At a minimum, you should dust it off and give it a serious look during your annual strategic planning. But in reality, you need to be ready to pull it out any time the ground shifts beneath your feet.

What kind of shifts? Things like:

- A disruptive new competitor suddenly appears on your radar.

- A major tech innovation changes how your industry works.

- Customer behavior takes a sharp turn (think pandemic-level changes).

- New regulations get passed that directly affect your market.

Treating the grid as a dynamic tool keeps your strategy nimble and grounded in what’s happening now, not what you assumed was true six months ago. A static plan is a fragile one.

Can a Company Pursue Multiple Strategies at Once?

Absolutely. In fact, it's pretty standard for larger companies with deep pockets to have active plays in several quadrants at the same time. Picture a big tech company: they might be running aggressive ad campaigns for their flagship phone (Market Penetration), while simultaneously launching that same phone in Southeast Asia (Market Development), and also have their R&D team prototyping a completely new foldable device (Product Development).

The key ingredient here is resource allocation. A business has to be big enough—with enough cash, people, and operational bandwidth—to chase multiple goals without dropping the ball on any of them. For smaller businesses, the smarter move is to focus on dominating one quadrant first. Nail that, and then use your momentum to expand into the next.

Making these strategic decisions blind is a recipe for disaster. You need to know what your competition is doing. ChampSignal delivers high-signal alerts on competitor moves—from pricing changes to new ad campaigns—so you can adapt your own product market expansion grid strategy with real-time intelligence. Start your free 30-day trial today.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$29 /month

Start with a 14-day free trial. No credit card required.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and Google Ads creatives

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works