A Guide to Competitive Benchmarking

Maxime Dupré

10/27/2025

Competitive benchmarking is simply the process of measuring your company's performance against your top competitors. You look at everything—products, services, internal processes—and compare it to the best in your field. It's not about copying what others do. It’s about understanding what "great" looks like in your market so you can define a clear path to get there yourself.

The Strategic Value of Looking Sideways

Imagine driving a race car with blacked-out windows and no leaderboard. You might feel like you're going fast, but you have no clue if you're leading the pack or about to get lapped. Competitive benchmarking gives you that leaderboard, the rearview mirrors, and the pit crew's analytics, all rolled into one. It turns your internal data from a pile of numbers into genuine strategic insight.

At its heart, benchmarking is about asking the right questions. How does our customer acquisition cost stack up against the industry leader? Are our product features lagging behind our closest rival? What efficiencies have others figured out that we're completely missing? Answering these forces you to move from guesswork to smart, data-driven decisions.

Setting a Baseline for Success

Without a benchmark, your goals are just shots in the dark. Sure, you can aim for a 10% bump in website traffic, but what if your main competitor is growing by 30%? Your "ambitious" goal actually means you're falling further behind. Benchmarking helps you set targets that are both realistic and genuinely ambitious because they're grounded in market reality.

This process is more than just a surface-level comparison. It’s an active investigation into the how and the why behind your competitors' success. This kind of deep analysis is a cornerstone of any solid competitive intelligence strategy. To dig deeper, check out our guide on what competitive intelligence is and why it matters.

By systematically measuring your performance against the best in class, you establish a clear standard of excellence. This helps foster a culture of continuous improvement, where every team knows what 'good' truly looks like and has a roadmap to achieve it.

Fueling Innovation and Growth

Benchmarking isn’t just a defensive tactic to avoid falling behind; it’s a powerful offensive tool for sparking innovation. When you see how others solve common problems, you can adapt their winning strategies or—even better—spot a gap they’ve completely overlooked. This sharp focus on data-backed strategy is exactly why the competitive benchmarking market is exploding.

The market was recently valued at USD 55.56 billion and is projected to grow at a 9.07% CAGR, which shows just how essential this practice has become. You can explore more details on this growth at 360iResearch.com.

In the end, competitive benchmarking delivers three huge advantages:

- It Identifies Performance Gaps: You get a crystal-clear picture of where you’re underperforming compared to your rivals.

- It Validates Your Strategic Direction: It provides real-world proof that your current strategies are either working or need a major rethink.

- It Uncovers New Opportunities: It can reveal untapped customer segments, overlooked product features, or more efficient ways of working.

Choosing the Right Benchmarking Framework

Once you're sold on the idea of competitive benchmarking, you’ve got to figure out how you're going to do it. Not all benchmarking is created equal, and your approach will completely shape the project. Think of it like training for a marathon. You could track your own progress over time, race against your biggest rival, or even study the techniques of an elite athlete in a totally different sport.

Each method gives you a different kind of insight and pushes you in a unique way. Benchmarking frameworks work the same way—they help you look inward at your own operations, sideways at your direct competition, or outward to unrelated industries to find the smartest path to getting better. Picking the right one from the get-go makes sure your efforts are focused and your goals are relevant.

Internal Benchmarking: Look Within First

Before you ever start spying on your rivals, it’s a good idea to look in the mirror. Internal benchmarking is all about comparing performance metrics within your own company. This could be as simple as comparing the sales numbers from your Chicago office to your Dallas office, or looking at customer satisfaction scores between different support teams.

The real goal here is to find what’s already working brilliantly inside your walls and replicate it everywhere else. If one retail store in your chain consistently crushes it with low employee turnover and high sales, internal benchmarking helps you figure out why and turn those lessons into the company standard. It's easily the most accessible place to start since all the data is yours.

Internal benchmarking helps you standardize excellence across your organization. It’s about finding your own top performers and turning their successful processes into the company-wide standard.

This approach is perfect for setting a solid baseline and making quick, controlled improvements without the headache of chasing down external data.

Competitive Benchmarking: Sizing Up The Competition

This is what most people picture when they hear “benchmarking.” Competitive benchmarking is a direct, head-to-head comparison against the companies you compete with every day—the ones selling similar stuff to the same customers. You’re digging into their pricing, product features, marketing campaigns, and customer service to see how you stack up.

This framework is absolutely essential for understanding your real position in the market. For instance, a SaaS company might benchmark its customer churn rate against its top three competitors to see if its retention strategy is actually working. By pulling data from public reports, industry tools, and dedicated competitive intelligence research, you can spot critical gaps and massive opportunities.

This method is ideal for:

- Gaining a Market Edge: Find out where your competitors are slipping up so you can swoop in.

- Setting Realistic Goals: Base your performance targets on what the best in your industry are already doing.

- Validating Your Strategy: Get a reality check on whether your current approach is keeping you in the game.

Strategic Benchmarking: Thinking Outside The Box

While competitive benchmarking keeps you on your toes, strategic benchmarking is what sparks genuine innovation. This is where you look at best-in-class companies completely outside of your industry to find game-changing ideas you can adapt. The goal isn’t to compare apples to apples; it's to find inspiration.

The classic example is Southwest Airlines studying NASCAR pit crews to radically shorten its plane turnaround times. Or a hospital studying the five-star customer service model of a luxury hotel chain like The Ritz-Carlton to improve its patient experience. This approach forces you to break free from the "that's how we've always done it" mindset.

Strategic benchmarking is incredibly powerful when you're aiming for a massive leap in performance, not just a small step forward. It helps you answer the question, "Who is the absolute best in the world at this one thing, regardless of what they sell?"

Comparing Benchmarking Frameworks

Choosing the right framework depends entirely on what you want to achieve. The table below breaks down the three approaches to help you decide which one (or which combination) is the right fit for your goals.

| Framework Type | Primary Goal | Who You Compare Against | Example Use Case |

|---|---|---|---|

| Internal | Improve efficiency and standardize best practices | Your own departments, teams, or locations | A national retail chain comparing inventory turnover rates across all its stores to identify the most efficient processes. |

| Competitive | Gain a market advantage and understand industry standards | Direct and indirect competitors in your industry | A software company comparing its product's feature set and pricing against its top three rivals. |

| Strategic | Drive innovation and achieve breakthrough performance | Top-performing companies from any industry | An e-commerce business studying Amazon's logistics and fulfillment process to improve its own delivery speeds. |

Ultimately, the best strategy often involves a mix of all three. You can start internally to get your own house in order, then look to your competitors to sharpen your edge, and finally turn to other industries to inspire long-term, game-changing innovation.

Identifying Key Metrics for Meaningful Comparison

Competitive benchmarking isn't about collecting a mountain of data just for the sake of it. That's a surefire way to get lost. Think of it like a doctor checking a patient's vital signs—they focus on heart rate and blood pressure, not every single cell in the body. The real skill is zeroing in on the handful of metrics that actually tell a story about performance.

To do this, you have to look past the "vanity metrics" like raw website traffic or the number of social media followers. While those numbers can feel good, they rarely connect to what really matters: the health of the business. A much smarter approach is to group your metrics by core business functions. This gives you a complete, 360-degree view of where you stand.

This way, you stop chasing numbers that don't move the needle and start focusing your efforts on areas that directly impact your growth and position in the market.

Financial Health Indicators

Let's start with the bottom line. Financial metrics are the ultimate truth-tellers. They cut through all the marketing fluff and tell you whether your business model is actually working compared to your rivals. They directly answer the big question: "Who is better at turning a dollar of revenue into actual profit?"

Here are the essentials to track:

- Profit Margins: This is a simple percentage showing how much profit you squeeze out of your total revenue. Comparing your gross, operating, and net profit margins against a competitor’s will quickly reveal who runs a tighter ship and has better control over costs.

- Return on Investment (ROI): This tells you how effectively you're spending your money. Whether it's a marketing campaign or a new product line, benchmarking your ROI shows who is making smarter bets with their capital.

- Customer Acquisition Cost (CAC): How much does it cost to bring a new customer through the door? Knowing your CAC versus a competitor’s is huge. A lower CAC is often a sign of a powerful and efficient marketing and sales machine.

Operational Efficiency Metrics

This is all about what happens behind the scenes. A company can have a fantastic product, but if its internal processes are slow, clunky, or expensive, it’s going to struggle. Benchmarking your operations helps you spot those internal bottlenecks and find opportunities to get leaner and faster.

Look into metrics like:

- Production Cycle Time: How long does it take you to get a product made or a service delivered? If your cycle time is shorter than the competition's, you have a massive advantage in speed and responsiveness.

- Inventory Turnover: This metric shows how fast you’re selling what you have in stock. A high turnover rate usually points to strong sales and means you don't have cash tied up in unsold goods.

- Employee Productivity: Often measured as revenue per employee, this gives you a raw look at how much output your team generates compared to another company's team. It's a stark indicator of efficiency.

A common trap is measuring only what's easy, not what's important. Choosing the right metrics means aligning your data collection with your most critical strategic goals, ensuring every comparison provides actionable insight.

Customer Loyalty and Satisfaction

A happy, loyal customer base is like a fortress for your business—it’s one of the hardest competitive advantages to overcome. These metrics tell you if you're building lasting relationships or just handling one-off transactions.

- Net Promoter Score (NPS): This is the classic "how likely are you to recommend us?" metric. It's a powerful gauge of customer loyalty. If your NPS is higher than your rivals', it means you have more passionate advocates for your brand.

- Customer Lifetime Value (CLV): This number predicts the total amount of money you can expect to make from a single customer over their entire relationship with you. Benchmarking CLV shows who is winning the long game by keeping customers happy and coming back for more.

- Customer Churn Rate: This is the percentage of customers you lose over a certain period. A low churn rate is a strong signal that your product is hitting the mark and your customers are satisfied.

Digital Performance and Market Presence

Today, your digital footprint is everything. It's your storefront, your brand's megaphone, and your sales team all rolled into one. Digging into digital metrics shows you how well you and your competitors are grabbing attention online and turning that attention into actual business.

You'll want to watch things like website conversion rates, social media engagement rates, and where you rank for important keywords. To really grasp your position, it’s vital to learn the accurate methods and strategies for calculating share of voice. This metric gives you a clear sense of your brand’s presence in the market.

Going even deeper, analyzing your competitors' share of visibility can show you exactly how dominant they are in search results, giving you a concrete benchmark for your own SEO goals.

A Step-by-Step Guide to the Benchmarking Process

Jumping into a competitive benchmarking project without a clear plan is like trying to build a house without a blueprint. You might end up with something, but it probably won't be what you envisioned. A structured process is what separates a guessing game from a strategic initiative that delivers real results.

This roadmap breaks down the entire project into five logical stages. Following these steps will help you move from initial planning to meaningful, long-term improvement, turning raw competitor data into your own strategic advantage. Each phase builds on the last, ensuring your analysis rests on a solid foundation.

Step 1: Plan and Define Your Scope

Before you start digging for data, you need a map. The planning phase is arguably the most critical part of the entire process because it sets the direction for everything that follows. Start by asking some tough questions: What specific part of the business are we trying to improve? What answers are we looking for? Without this focus, you'll drown in a sea of irrelevant information.

Your scope needs to be razor-sharp. A vague goal like "get better at marketing" is a recipe for failure. Instead, aim for something measurable, like "reduce our customer acquisition cost to be in the top 25% of our industry."

Nailing down your scope means you have to:

- Identify the core process to benchmark: Pinpoint the exact function, whether it's customer onboarding, supply chain logistics, or content marketing performance.

- Select your key competitors: Choose a mix of direct rivals and maybe one or two aspirational leaders—even from other industries—who are crushing it in the area you're studying.

- Define the key metrics: Decide which KPIs will actually tell you the story of performance in your chosen area.

Step 2: Gather Your Data

With a solid plan in hand, it’s time to go on the hunt for information. Data gathering is a blend of art and science, requiring you to pull from different sources to build a complete, accurate picture. A crucial part of this involves using robust and ethical competitive intelligence gathering strategies to understand what makes your rivals tick.

Your data sources will generally fall into two buckets:

- Publicly Available Data: This is the low-hanging fruit—annual reports, press releases, company websites, and industry publications. This stuff is great for high-level financial and strategic insights.

- Third-Party and Proprietary Data: This is where you get granular. Think specialized software tools, purchased market research reports, or even your own customer surveys. These sources provide the deeper, operational data that companies don't just hand out.

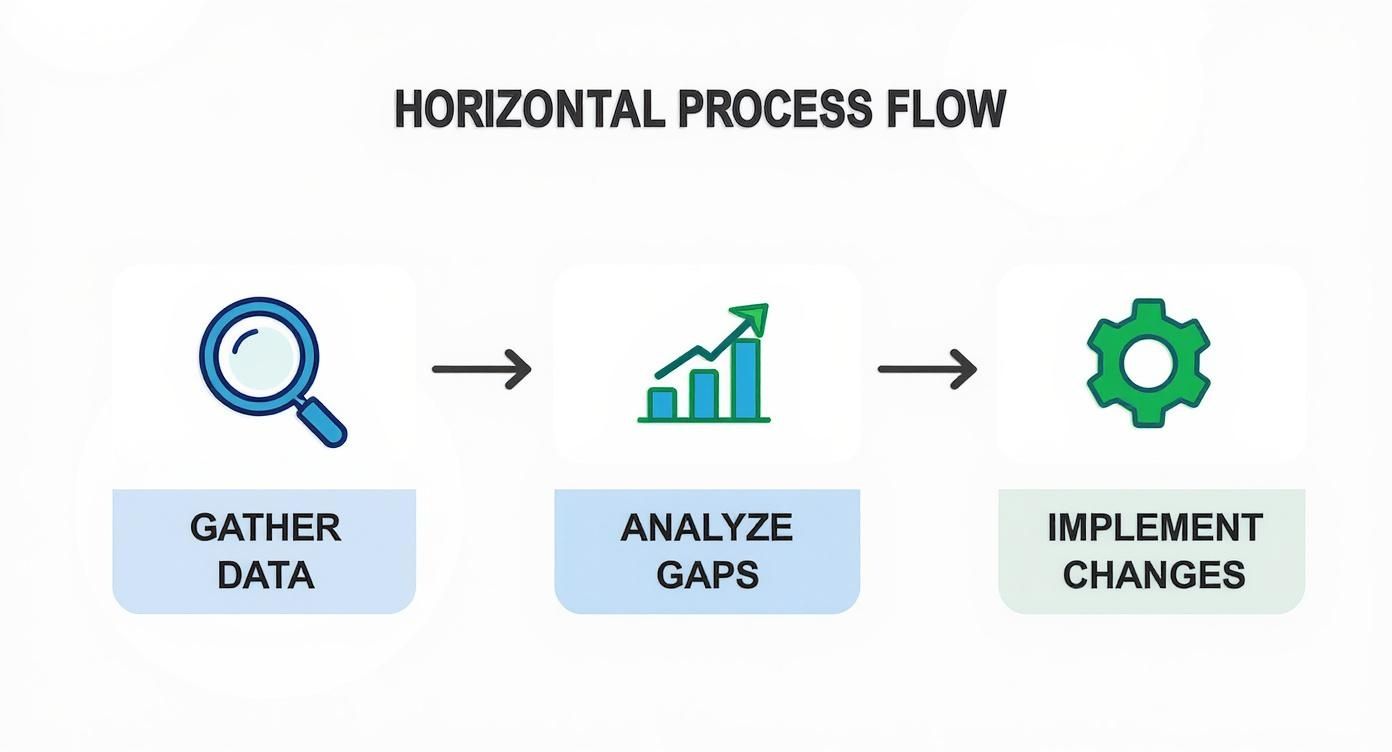

Step 3: Analyze and Find Performance Gaps

This is where the magic happens—turning raw numbers into strategic intelligence. Once you have all your data, the next job is to normalize it and run a side-by-side comparison with your own performance. The goal here isn't just to see who is "better." It's to understand the size of the gap and, more importantly, the reasons behind it.

For instance, if you find that a competitor’s customer retention rate is 15% higher than yours, your analysis shouldn't stop there. You need to dig deeper. Are they running a killer loyalty program? Is their customer support team just that much more responsive? This is all about connecting the "what" (the performance gap) with the "why" (the processes or strategies driving their success).

This is a cycle. You gather information, you analyze it to find weaknesses, and then you act on those findings.

This process makes it clear that gathering data is just the starting line; the real value is found when you analyze performance gaps to inform real, strategic changes.

Step 4: Implement Strategic Changes

Insights are worthless if they just sit in a spreadsheet. This phase is all about turning what you've learned into a concrete action plan. Based on your analysis, you can now develop targeted initiatives to close those performance gaps. If you discovered your competitor’s checkout process is ridiculously fast, your implementation plan might involve a project to streamline your own e-commerce platform.

"The goal of benchmarking is not to imitate, but to innovate. Use the data to understand the standard, then find your unique way to exceed it."

For any of this to work, you need clear ownership, realistic timelines, and measurable goals. It's also vital to get your team on board by explaining the "why" behind the changes, showing them exactly how the data backs up the new direction.

Step 5: Monitor and Iterate Continuously

Finally, competitive benchmarking isn’t a project you complete and then forget about. It's a continuous cycle of improvement. Once you've implemented changes, you have to track their impact on the key metrics you identified way back in the planning phase. Did that new customer service protocol actually improve your Net Promoter Score? Did updating your logistics process really reduce shipping times?

This ongoing monitoring helps you validate your decisions and make small adjustments as you go. Markets change, competitors evolve, and customer expectations shift. Your benchmarking process has to be an evergreen part of your strategy, keeping you agile and ahead of the curve for the long haul.

Learning from the Best: What National and Industry Leaders Can Teach Us

Sometimes, to really get a handle on competitive benchmarking, you have to zoom way out. Forget individual businesses for a moment and think about entire economies. Countries compete just like companies do—for talent, investment, and global influence. Looking at how they measure up offers some powerful lessons you can bring right back to your own strategy.

Think of it like this: if your company is a boat, national economies are entire fleets. By watching how the most successful fleets navigate the rough seas of the global market—how they manage their resources, spur innovation, and stay afloat during storms—you can learn a ton about making your own boat faster and more resilient. This big-picture view shows you what truly builds lasting success.

How Nations Measure Success

Frameworks like the IMD World Competitiveness Ranking are a masterclass in large-scale benchmarking. They don't just look at a country's GDP. Instead, they dig deep, analyzing performance across hundreds of different factors that all roll up into a few key pillars.

These pillars usually include things like:

- Government Efficiency: How well do public institutions create a stable, predictable environment where businesses can actually get things done?

- Business Efficiency: How productive and innovative is the private sector? This covers everything from management styles to how flexible the labor market is.

- Infrastructure: Does the country have the modern backbone it needs to compete, from roads and ports to high-speed internet?

- Institutional Strength: This is all about the legal and social systems that create trust and make people feel confident investing for the long haul.

When a country gets these things right, they work together to create an incredible competitive advantage on the world stage. A nation with solid infrastructure and good governance is like a magnet for top-tier companies.

Bringing the Big Lessons Home

The real magic happens when you start applying these high-level ideas to your own business. You can benchmark your company against these very same pillars, treating your organization like its own mini-economy.

Take the latest IMD rankings, for example. Switzerland shot back to the top spot because of its incredible institutional strength and infrastructure. Meanwhile, a country like Qatar broke into the top ten by making massive improvements in its business environment and labor market. You can dig into more of these national competitiveness rankings on PlaceBrandObserver.com to see what drives the winners.

Just as a country’s success is about more than GDP, your company’s success is about more than revenue. Benchmarking your internal "infrastructure" or your company "governance" uncovers the foundational strengths and weaknesses that really matter.

Start asking yourself how these principles map to your own operations:

- Your "Government Efficiency" is your leadership and internal governance. Are your decision-making processes clear and quick, or bogged down in red tape? Do your internal policies help your teams move fast, or slow them down?

- Your "Business Efficiency" is your core operations. How do your product development cycles, supply chain, and customer service stack up against the best in the business?

- Your "Infrastructure" is your tech stack and internal systems. Are your tools empowering your people, or are they a constant source of frustration?

When you start looking at your business through this wider lens, you get past just comparing surface-level metrics. You begin to understand the deep, underlying systems that truly drive performance. You're not just copying tactics; you're learning from the world’s most successful economies to build an advantage that lasts.

Common Mistakes to Avoid in Benchmarking

Even with the best intentions, it's surprisingly easy to get benchmarking wrong. I've seen it happen time and again: a project that starts with great promise ends up as a complete waste of time and money. A few common missteps can derail the whole process, so knowing what to watch out for is half the battle.

One of the biggest blunders is fixating on the "what" and completely forgetting about the "why." For instance, you might discover a competitor's customer acquisition cost is 20% lower than yours. On its own, that number is just a vanity metric. The real gold is in understanding how they did it. What efficient marketing channels or slick sales tactics are they using to get there?

The goal of competitive benchmarking isn't just to collect data, but to understand the story the data tells. A metric without context is just a number; a metric with context is a roadmap for improvement.

Another classic mistake is making unrealistic comparisons. A five-person startup trying to benchmark its ad spend against a behemoth like Apple or Google is an exercise in futility. Their scale, resources, and brand gravity are in a different universe, so any comparison will be utterly useless.

Keeping Your Benchmarking on Track

To get real value from this process, you have to treat benchmarking as something that's alive and breathing. It's not a report you create once and then let it collect dust on a digital shelf. Markets are constantly shifting, and your analysis needs to keep up.

Here are the most common pitfalls I've seen and how to sidestep them:

- Treating it as a one-off task: The market never sleeps, and neither should your analysis. You need to schedule regular check-ins—maybe quarterly if you're in a fast-paced industry, or annually for more stable ones. This keeps your insights fresh and actionable.

- Ignoring the process for the metric: Don't just stop at the number. Always dig deeper. If a competitor is outperforming you, put on your detective hat and investigate their systems, tools, and strategies to figure out their secret sauce.

- Making poor comparisons: Be realistic. Your most valuable insights will come from benchmarking against your direct competitors or companies at a similar size and stage. That's where you'll find relevant, practical lessons.

Lastly, and this is a big one, never compromise on ethical data collection. Using shady tactics or breaking a platform's terms of service to scrape information is a terrible idea. It puts your company at risk and torpedoes your brand's integrity. Stick to public information, reputable third-party tools, and ethical market research to build your analysis on a solid, respectable foundation.

A Few Common Questions About Benchmarking

Even with a solid plan, a few practical questions always pop up when you first dive into competitive benchmarking. Getting the answers right can be the difference between a one-off report that collects dust and a living strategy that keeps you ahead. Let's tackle some of the most common ones.

Think of this as the practical side of benchmarking—the stuff you need to know to manage the timing, scope, and common hurdles you'll face along the way.

How Often Should We Be Doing This?

Honestly, it all comes down to how fast your industry moves. If you're in a space like tech or e-commerce where things change in the blink of an eye, a quarterly review is probably your best bet. It keeps you on your toes and ready to react.

For more traditional industries—think manufacturing or professional services—a really deep dive once a year, or even every two years, can be plenty. The most important thing? Don't treat this like a one-and-done project. Benchmarking should be a continuous loop that feeds your strategy and helps you adapt.

Should We Look at Companies Outside Our Industry?

Absolutely. In fact, you should. This is called strategic benchmarking, and it’s where real innovation often comes from. When you only look at your direct competitors, you're all just swimming in the same pool, making the same small tweaks.

Looking outside your industry is how you find breakthrough ideas.

For example, an airline that wants to improve its boarding process might not look at another airline. Instead, they might study how a top-tier hotel handles check-in so smoothly. It’s about finding best-in-class solutions to common problems, no matter where they come from.

What’s the Single Hardest Part of Benchmarking?

Let's be real: getting the data. It's almost always the biggest headache. High-level stuff like annual revenue is usually public, but the really juicy details? Not so much. Things like internal production costs or specific customer satisfaction scores are often locked away like state secrets.

To get around this, you have to get a little creative and piece together the puzzle from different sources. This usually means a mix of:

- Public data: Think annual reports and press releases.

- Industry reports: Market research from firms like Gartner or Forrester.

- Third-party tools: Services that can analyze web traffic, ad spending, and SEO performance.

By pulling from all these different streams, you can triangulate the information you need and make some really solid, educated comparisons, even without having their exact internal numbers.

Ready to stop guessing what your competitors are doing? ChampSignal delivers high-signal alerts on your rivals' most important moves, from pricing changes to new marketing strategies. Start your free 30-day trial and get the competitive edge you need.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. Cancel anytime.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, X posts, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works