PPC Competitor Research A Winning Ad Strategy

Maxime Dupré

11/2/2025

PPC competitor research is all about systematically breaking down what your rivals are doing with their paid ads. You're looking at their strategies, how much they're spending, and what's actually working for them. Think of it like a pro sports team studying game film of their opponent. It's the essential prep work for building a PPC strategy that doesn't just throw money at the wall but actively outmaneuvers the competition. This analysis turns your ad spend from a shot in the dark into a calculated, strategic investment.

Why PPC Competitor Research Is Your Secret Weapon

Jumping into paid advertising without knowing what your competitors are up to is like trying to navigate a new city without a map. Sure, you might stumble upon your destination eventually, but you’ll burn through a lot of time and money making wrong turns along the way. A solid PPC competitor research process is that map, showing you the most direct and efficient routes to your customers.

This kind of strategic deep-dive shifts you from a reactive stance—just bidding on keywords you hope are right—to a proactive one. When you know what your competitors are doing, you gain a massive upper hand. You can dodge the costly mistakes they've already made, jump on opportunities they've completely missed, and write ads that speak directly to the gaps in their messaging.

Benefits of Analyzing Your Competitors

Digging into your rivals' PPC campaigns gives you a clear blueprint for what it takes to succeed. Instead of relying on guesswork, you can make informed decisions backed by real-world data, leading to a much better return on ad spend (ROAS).

Here’s what you stand to gain:

- Discover Untapped Keyword Opportunities: You'll uncover profitable keywords your competitors are bidding on that weren't even on your radar.

- Avoid Costly Errors: Let them spend their budget testing ad copy and keywords. You can learn from their failures without spending a dime.

- Budget with Precision: Get a much clearer picture of what competitors are likely spending, which helps you allocate your own budget far more effectively.

- Craft Superior Ad Copy: See how they're positioning their offers and identify their unique selling points. This allows you to write more compelling ads that truly connect with your audience.

The world of digital advertising is only getting more crowded and more expensive. In fact, global paid search spending is on track to hit a staggering $351.5 billion by 2025—a pretty clear sign that the competition isn't slowing down. In this kind of environment, knowing how your rivals operate is no longer just a good idea; it's absolutely essential for survival.

By deconstructing your competitors' campaigns, you're not just copying them—you're learning their rhythm. You can anticipate their moves, identify their weaknesses, and ultimately find your own unique path to victory in the ad auction.

To really get a handle on the power of this process, check out this guide on PPC Competitive Intelligence. It lays a great foundation for everything that follows.

1. Assembling Your Competitor Research Toolkit

Trying to conduct effective PPC competitor research without the right tools is like navigating a new city without a map. Sure, you might stumble upon some interesting things, but you’re mostly just guessing. You need a proper toolkit to do this job right—a set of digital instruments that let you see exactly what your competitors are doing.

Think of it less as a one-size-fits-all software package and more like a detective's kit. You have different tools for different jobs: one for dusting for keyword "fingerprints," another for analyzing ad copy "evidence," and so on. Building this kit is the first real step toward turning a pile of raw data into a campaign that actually wins.

Core Intelligence Platforms

The bedrock of any solid toolkit is a powerful, all-in-one intelligence platform. These are the tools that give you that crucial 30,000-foot view of the competitive landscape. They’re like your satellite imagery, letting you map out the entire territory before you decide where to focus your efforts on the ground.

These platforms are non-negotiable in today's crowded paid search auctions. Tools like Semrush, SpyFu, and Ahrefs are the heavy hitters here. They can dig deep into a competitor's campaign and pull out everything from their target keywords and historical ad copy to their estimated monthly budgets and bidding strategies. You can also supplement these with resources like the Google Ads Transparency Center, which is great for seeing what ads a specific brand is currently running.

Specialized and Free Resources

Beyond the big, comprehensive platforms, a truly effective toolkit includes a mix of specialized instruments for more focused tasks. The best part? Not every tool needs to come with a hefty subscription fee. Some of the most practical resources are free and give you incredibly specific, actionable information. For a deeper dive, our guide to paid search intelligence covers additional strategies you can put to use.

Here are a few essential additions to round out your toolkit:

- Google Ads Auction Insights: This is your ground truth. It’s a free report right inside your Google Ads account that shows exactly who you’re up against in the auctions you’re already in. No guesswork, just direct data.

- Social Media Ad Libraries: If your competitors are on social, the Meta Ad Library is a goldmine. You can see the exact creatives, copy, and offers they're pushing on Facebook and Instagram.

- Landing Page Analysis Tools: While you can't run these on competitor sites, you can use tools like heatmaps or session recorders on your own pages to test ideas you’ve spotted in their designs.

For the really deep-dive, technical analyses, some experts even use advanced methods to gather data at scale. It’s worth understanding how professionals are leveraging proxies for web scraping data to maintain a competitive edge.

The goal isn't just to have a list of software; it's to build a workflow. A smart toolkit combines a primary intelligence platform for the big picture with several specialized tools that let you zoom in on keywords, ad copy, and landing pages. That’s how you get the complete picture.

Essential PPC Competitor Research Tool Comparison

Choosing the right tools can feel overwhelming, so I've put together a quick comparison of the most common platforms. This table breaks down what each tool is best for, so you can pick the ones that align with your specific goals.

| Tool Name | Primary Use Case | Key Features | Best For |

|---|---|---|---|

| Semrush | All-in-one SEO & PPC intelligence | Keyword gap analysis, ad copy history, display advertising research, traffic analytics | Marketers who need a comprehensive tool for both paid and organic channel analysis. |

| SpyFu | Deep PPC competitor analysis | "Kombat" feature for keyword overlap, full ad history tracking, lead generation tools | PPC specialists focused purely on competitor ad strategies and keyword discovery. |

| Ahrefs | SEO-focused with strong PPC features | Paid keyword discovery, top PPC ads report, landing page analysis, backlink data | Teams with a strong SEO focus who also want to integrate their paid search intelligence. |

| Google Ads Auction Insights | Direct competitor identification | Impression share, overlap rate, outranking share, position above rate | Advertisers who want a free, direct-from-the-source view of their immediate auction competitors. |

| Meta Ad Library | Social media ad transparency | Ad creative and copy library, campaign activity tracking, filter by platform and date | Anyone running social ads who needs to see what competitors are doing on Facebook and Instagram. |

Ultimately, the best toolkit is the one you actually use. Start with one core platform and a couple of free resources. As you get more comfortable with the process, you can add more specialized tools to refine your workflow and uncover even deeper insights.

Uncovering Your Competitor’s Keywords and Bidding Strategy

This is where the real detective work begins. Getting a look at the keywords your competitors are bidding on is like finding their playbook—it shows you exactly where they're placing their biggest bets to win over customers. These aren't just random words; they're the bedrock of their entire paid search operation, telling you who they want to reach and which terms they believe are most profitable.

By digging into these keyword lists, you go from just watching your rivals to making calculated moves of your own. You’re not just compiling words; you're hunting for patterns. The goal is to find those high-intent keywords that lead straight to sales, spot untapped long-tail opportunities they've overlooked, and get a feel for the budget they're putting behind their top terms.

Sifting Through Core and Long-Tail Keywords

First things first, you need to make sense of the mountain of keywords your competitors are buying. Your spy tools—like SpyFu or Semrush—will give you a massive data dump. Your job is to sort that data into meaningful buckets to understand their strategy.

- High-Intent "Money" Keywords: Think of terms like "emergency plumbing services" or "buy running shoes online." These phrases scream commercial intent and usually come with the highest price tags because they connect with people who are ready to pull out their wallets.

- Top-of-Funnel Research Keywords: These are broader, more informational searches like "how to fix a leaky faucet" or "best running shoe brands." Competitors use these to get on a potential customer's radar early in the game, building familiarity long before the final purchase decision.

- Branded Keywords: This is simply their own brand name and its variations. If you see them bidding heavily here, it's a defensive play to keep rivals from poaching their hard-earned traffic.

Sorting their keywords this way gives you a clear map of their customer journey. You can see where they’re casting a wide net to generate awareness and where they’re laser-focused on sealing the deal. For a deeper dive into this kind of sorting, our guide on competitive PPC analysis offers some great frameworks.

Reading Between the Lines of Bids and Budgets

A list of keywords is only half the picture. To truly understand their game plan, you need to figure out how much they're willing to pay for clicks. This is where you put on your financial analyst hat and piece together the clues.

Start by looking at metrics like estimated cost-per-click (CPC) and ad position. Is a competitor always snagging the top ad spot for a really expensive keyword? That’s a huge tell. It means they’ve likely got a hefty budget and believe that prime visibility is worth the cost. This insight is critical, especially as ad costs keep climbing. While the average CPC on Google Ads globally is $5.26, it can skyrocket to $8.58 in hyper-competitive industries like legal services. You can learn more about these benchmarks in this 2025 Google Ads report.

By keeping an eye on a competitor's estimated CPC and share of voice over time, you can get a sense of how committed they are. A sudden jump in their bids on a specific set of keywords could mean they're launching a new product or kicking off a big promotion—something you definitely want to know about.

In the end, your goal is to walk away with a list of actionable opportunities. Pinpoint the valuable keywords they own, find the gaps they've completely missed, and build a smarter strategy to compete. It's not always about outspending them; it's about outthinking them.

Decoding Competitor Ad Copy and Offers

Winning a crowded ad auction isn’t just about having the highest bid. Your ad copy is the first real handshake between you and a potential customer, and in the world of PPC, it’s a critical battleground. A huge part of solid PPC competitor research is breaking down these messages to figure out how your rivals grab attention and earn clicks.

Think of it like this: every ad your competitor runs is a carefully constructed pitch aimed at solving a specific problem. By methodically dissecting their headlines, descriptions, and offers, you can essentially reverse-engineer their value proposition. This process uncovers the psychological triggers they’re pulling and the specific promises they’re making to their audience.

What’s Their Core Message?

First things first, you need to identify the central theme of their advertising. What’s their angle? Are they the cheapest option on the block, the most premium provider, or the fastest and most convenient solution? Nailing this down is the key to understanding how they position themselves in the market, which in turn helps you find a way to stand out.

To figure this out, look for words and phrases that pop up again and again across all their ads.

- Price-Focused: Are you seeing terms like “affordable,” “discount,” “sale,” or specific price points like “under $50”? That's a clear signal they’re competing on cost.

- Quality-Focused: Language like “premium,” “expert,” “certified,” or “guaranteed” tells you they’re leaning on their superior quality or expertise.

- Urgency-Focused: Phrases such as “limited time,” “today only,” or “fast shipping” are classic tactics to create a sense of scarcity and push for an immediate click.

Once you spot these patterns, you start to understand the promises they’re making. If every competitor is screaming about low prices, maybe there’s a gap for you to come in with a message about premium service and reliability.

Your competitors' ad copy is a direct window into their Unique Selling Proposition (USP). When you decode it, you’re learning what they think their biggest advantage is. That gives you a clear target to build a stronger, more compelling message against.

Analyzing Calls to Action and Special Offers

Beyond the headline, the call-to-action (CTA) and any special offers are where your competitors try to turn a casual searcher into a lead or a customer. A CTA tells you exactly what they want the user to do next. Is it “Shop Now,” “Get a Free Quote,” or “Learn More”? Each of these targets someone at a completely different stage of their buying journey.

It’s also smart to keep a running log of their promotions. By tracking their offers over time—seasonal discounts, free trials, BOGO deals—you can start to anticipate their marketing calendar. This intel is gold. It lets you plan counter-offers or launch your own promotions when they’re quiet, giving your ads a much better chance to shine. This piece of your PPC competitor research is all about crafting copy that doesn't just compete, but actually connects with people and gets them to convert.

Analyzing Landing Pages for Conversion Clues

A killer ad is only half the battle. Think of the ad as the promise and the landing page as the delivery. This is where the conversion actually happens, and even the most persuasive ad on Google can't salvage a clunky or confusing page. Your PPC competitor research has to go beyond the ad itself and dive deep into this final, critical step.

By breaking down your competitors' landing pages, you're essentially getting a masterclass in what makes their audience tick. You're not just looking at pretty designs; you're reverse-engineering their conversion engine to figure out what you can apply to your own campaigns.

The Message Match Test

First things first: does the landing page deliver on the ad's promise? This is called message match, and it’s the bedrock of a good user experience. If someone clicks an ad for "50% Off Running Shoes," they better land on a page that screams "50% Off Running Shoes." Anything else feels like a bait-and-switch and is a surefire way to send your bounce rate through the roof.

Check for consistency across these key areas:

- Headlines and Subheadings: The main headline should feel like a direct continuation of the ad they just clicked.

- Keywords: The same keywords that triggered the ad should be front and center on the page.

- Imagery and Branding: The look and feel should be seamless, creating a smooth transition from ad to page.

A strong message match instantly builds trust. It tells the visitor, "Yep, you're in the right place," which makes them far more likely to stick around and see what you have to offer.

Decoding the Conversion Architecture

Once you've confirmed the message is consistent, it's time to look at the page's structure—its conversion architecture. Every single element should be working together to nudge the visitor toward one specific action. When you're looking at a competitor's page, pay close attention to how they reduce friction and build momentum toward that goal.

A great landing page is like a well-lit path. It uses clear signs (headlines), compelling reasons to keep walking (social proof), and an obvious destination (the CTA) to guide visitors effortlessly toward conversion.

Here’s a quick checklist you can use for your own analysis:

- Headline Effectiveness: Does it grab your attention? Is the main benefit crystal clear from the second you land on the page?

- Social Proof: Look for testimonials, reviews, client logos, or trust seals. Where are they placing them for maximum impact? Right below the headline? Near the call-to-action?

- Form Design: How much are they asking for? A simple email field is a low-friction ask, but a form demanding a phone number, company name, and budget can be a real conversion killer.

- Call-to-Action (CTA): Is the CTA button big, bold, and impossible to miss? Is the text compelling and action-oriented (e.g., "Get My Free Quote" is way better than a generic "Submit").

- Mobile Experience: Pull the page up on your phone. Is it easy to read and navigate? With so much traffic coming from mobile, a poor mobile experience is a massive, self-inflicted wound.

Turning Competitor Insights into Actionable Strategy

Collecting data is one thing; knowing what to do with it is where the real magic happens. All that competitor research is useless unless you translate those raw numbers and observations into a smart, decisive strategy that gives your campaigns a real advantage. Without a plan, your insights are just trivia—not a roadmap to winning more auctions and converting more customers.

Think of it like you're a general who has just received a full report from your best scouts. You've seen the enemy's positions, their troop movements, and their supply lines. Now, it’s time to draw up the battle plan. A simple way to get your thoughts in order is to run a classic SWOT analysis, but with a PPC twist: what are your competitors' Strengths, Weaknesses, and what Opportunities and Threats does that create for your campaigns?

From Analysis to Action Plan

Once you’ve sorted through your findings, specific strategic moves will start to jump out at you. For example, let's say your research shows a major competitor is completely ignoring a cluster of high-intent, long-tail keywords. That’s not just an observation; that's a wide-open opportunity. You can swoop in and target that keyword gap with highly specific ad copy and a dedicated landing page designed just for that audience.

Another classic move is to exploit their weaknesses. Did you notice their ad copy is generic and sounds like it was written by a committee? This is your chance to write a much better ad—one that speaks directly to a customer's pain point and highlights what makes you different. For a more aggressive approach, you can even explore the pros and cons of PPC bidding on your competitor's brand name, which can be a game-changer when done right.

To help you organize all this, I've put together a simple table. Use it to connect what you've found to what you need to do next.

Action Plan from PPC Competitor Insights

| Research Finding | Implication (Opportunity/Threat) | Actionable Task |

|---|---|---|

| Competitor X ignores long-tail keywords about "eco-friendly dog toys." | Opportunity: Untapped niche with high purchase intent. | Create a new ad group targeting these specific long-tail keywords with tailored ad copy and a dedicated landing page. |

| Competitor Y has weak, generic ad copy for top keywords. | Opportunity: Our unique selling proposition (USP) can stand out. | Rewrite our ad copy for shared top keywords to emphasize our "lifetime warranty" and "free returns." |

| A new competitor just launched a big Google Shopping campaign. | Threat: Increased cost-per-click (CPC) and lower impression share. | Monitor our Shopping campaign performance closely. Adjust bids on our top-performing products to stay competitive. |

| Top competitor runs a 20% off promotion every month. | Threat/Opportunity: Their audience is conditioned to wait for sales. | Test a non-discount offer, like a "free gift with purchase," to attract customers who value quality over price. |

This table isn’t just for documentation; it's your playbook. It turns a mountain of data into a prioritized list of actions that will directly impact your campaign’s success.

The goal is to establish a continuous feedback loop. Your PPC competitor research shouldn't be a one-off project but an ongoing process that keeps your campaigns adaptive, intelligent, and profitable in a constantly shifting market.

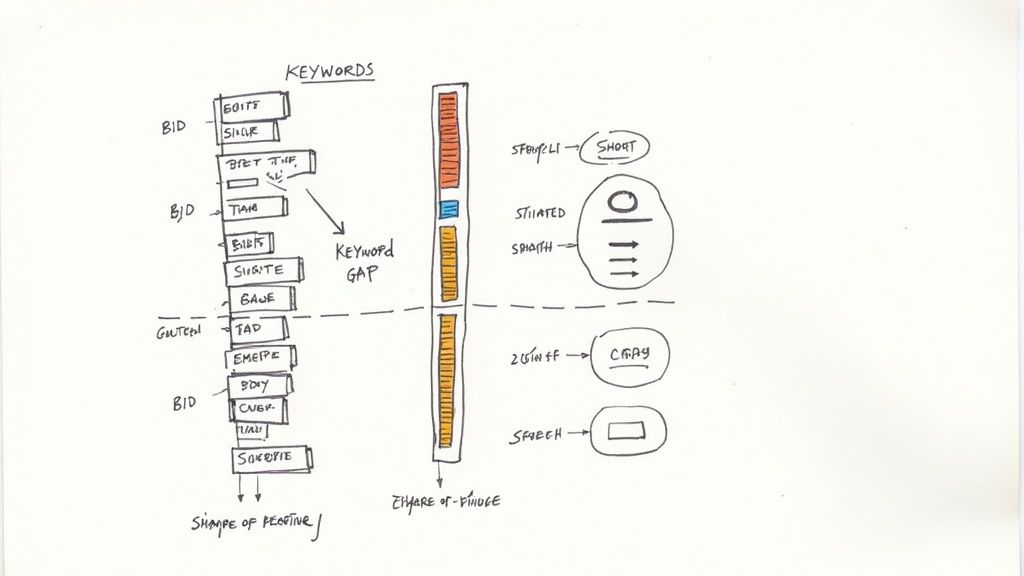

The visual below breaks down a simple workflow for analyzing what’s on a competitor’s landing page—from their headline and social proof to their call-to-action.

By deconstructing their page like this, you can spot exactly where they are succeeding or failing to guide users toward conversion. These are valuable clues you can use to make your own landing pages that much better.

Frequently Asked Questions

Even with the best game plan, you're bound to have questions once you start digging into your competitors' PPC strategies. Let's tackle some of the most common ones that come up.

Think of this as your go-to spot for quick, no-nonsense answers to help you keep moving forward.

How Often Should I Do PPC Competitor Research?

This isn't a one-and-done task. The world of paid search moves fast, with competitors constantly launching new ads, testing offers, and changing their bids. To stay ahead, you need a regular cadence.

A good rhythm to follow is a light check-in monthly and a full-blown analysis every quarter.

- Monthly Check-in: This is a quick pulse check. Look for new ad copy, any big changes in their keyword focus, and see if any new players have entered the ring.

- Quarterly Deep-Dive: Time to roll up your sleeves. This is a comprehensive review of their keywords, ad creative, landing pages, and overall strategy. The goal is to use these insights to shape your own plans for the next three months.

What Is the Most Important Metric to Track?

If I had to boil it all down to one single thing, it would be their keyword strategy. Everything a competitor does in PPC is built on the foundation of the keywords they choose to bid on. It's a direct window into who they're trying to reach and what they believe is most profitable.

By dissecting their keyword list—especially their high-intent "money" keywords—you get the most potent intelligence to build or refine your own campaigns.

When you understand their keyword playbook, you can spot gaps they’ve missed, predict their next moves, and uncover less-contested (and cheaper) keywords to win over your ideal customer. It’s the closest you’ll get to looking over their shoulder at their strategic roadmap.

Ready to stop guessing and start knowing what your competitors are up to? ChampSignal sends you high-signal alerts on your rivals' PPC campaigns, website changes, and SEO moves—right to your inbox. It takes the grunt work out of competitor research so you can focus on winning. Start your free trial today!

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$39 /month

Start with a 14-day free trial. Cancel anytime.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

X Monitoring

Competitor posts and brand mentions tracked on X

Google and Meta Ads

Keyword rankings, backlinks, and ad creatives (Google + Meta)

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works