Google Ads Competitor Analysis a Complete Guide

Maxime Dupré

11/24/2025

A solid Google Ads competitor analysis isn't just about snooping on other businesses. It’s the process of systematically dissecting your rivals' advertising playbooks—their keywords, ad copy, bidding strategies, and landing pages—to find an edge for your own campaigns. Think of it as a proactive way to discover new keywords, sharpen your messaging, and get more mileage out of every dollar you spend.

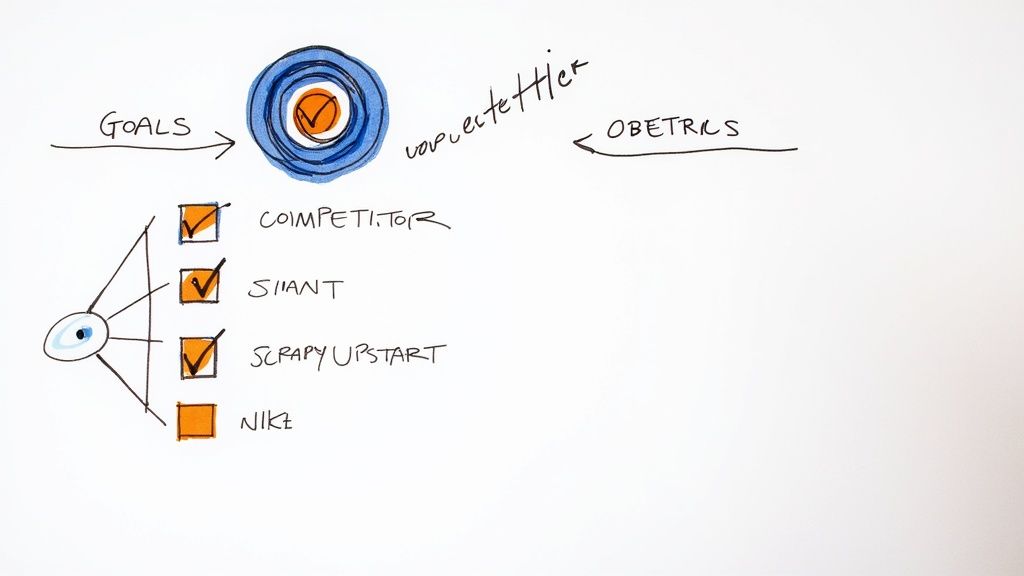

Start With a Plan, Not Just a Tool

Before you ever open a single analytics tool, you need a plan. A great analysis starts with clear objectives. Without them, you’re just swimming in a sea of data, pulling out interesting facts but finding no real direction. The goal here is to move from simple curiosity to a concrete strategy.

For a deeper dive into the foundational principles, this guide on PPC competitive analysis is a great place to start.

Define Your Core Objectives

First things first: what are you actually trying to accomplish? Your answer will dictate everything that follows, from the tools you choose to the metrics that matter. Get specific. "See what the competition is doing" is not a goal; it's a wish.

Here’s a quick look at some of the most common, high-impact objectives I see teams focus on.

Core Objectives for Your Competitor Analysis

This table breaks down some key goals to help focus your analysis, linking them to specific questions and potential outcomes.

| Objective | Key Question to Answer | Potential Action |

|---|---|---|

| Keyword Opportunity Mining | What high-intent keywords are my competitors bidding on that I've missed? | Add new, proven keywords to your campaigns. |

| Ad Copy & Offer Dissection | What messaging, CTAs, and offers are working for them? | A/B test new ad copy inspired by their top-performing ads. |

| Bidding Strategy Intelligence | How aggressively are they bidding on our shared keywords? | Adjust your bid strategy to be more competitive or find less costly terms. |

| Landing Page Benchmarking | Where are the friction points in their funnel that I can exploit? | Improve your own landing page experience to boost conversion rates. |

Setting these objectives upfront ensures your efforts are laser-focused on what will actually move the needle for your business.

This foundational work transforms your analysis from a reactive exercise into a proactive strategy. It's the difference between simply collecting data and building true competitive intelligence.

Identify the Right Competitors to Track

Your competitive landscape is probably wider than you think. It's a mistake to only track the 800-pound gorillas in your industry. A truly comprehensive analysis includes a mix of players, all fighting for your customer's click.

- Direct Competitors: These are the obvious ones. They sell a similar product to a similar audience. You’re likely fighting over the same keywords day in and day out.

- Indirect Competitors: They solve the same problem as you but with a different solution. For a project management software, this might be a company selling physical whiteboards or specialized notebooks.

- Aspirational Competitors: These are the brands you look up to. They might not be direct competitors today, but their marketing sophistication and brand presence are something to learn from.

The sheer dominance of Google makes this work critical. As of 2025, Google holds an 89.73% share of the global search engine market. That massive audience has fueled a search ad market projected to hit $483.50 billion by 2029. A well-executed competitor analysis is how you carve out your piece of that massive pie.

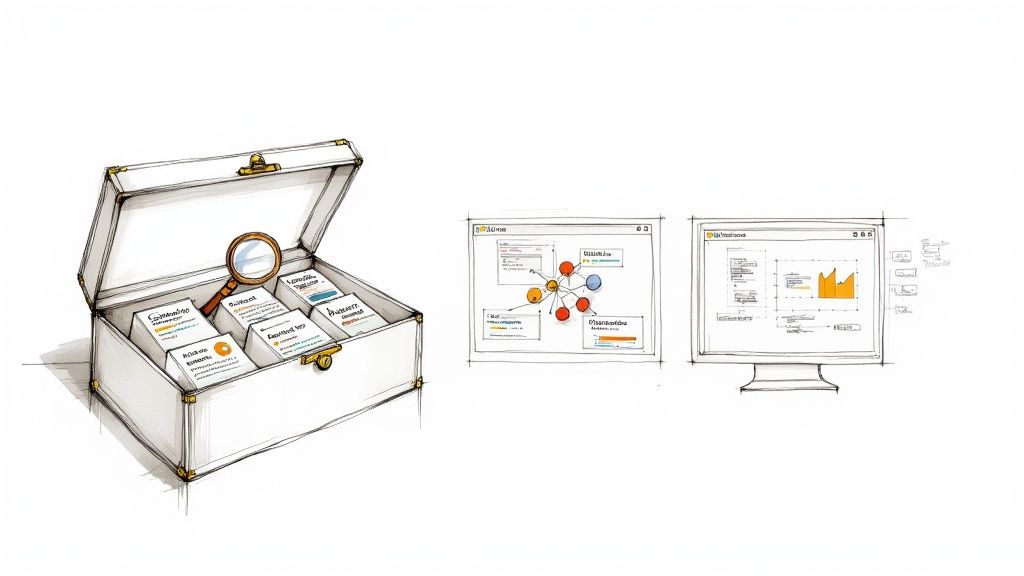

Assembling Your Competitor Intelligence Toolkit

If you want to truly understand what your rivals are doing on Google Ads, you can’t rely on a single source of information. The best insights come from layering data from a few different places. Each tool, whether it’s built into Google or a third-party platform, gives you a different piece of the puzzle.

Your first stop should always be your own Google Ads account. It's the most direct and reliable source you have, even if it feels a little limited at first.

Start with Google’s Auction Insights

The Auction Insights report is your ground truth. Forget estimates—this is real data from Google showing exactly who you’re up against in the ad auctions. It tells you which domains are consistently bidding on the same keywords you are.

When you dive in, you’ll want to keep an eye on a few key metrics:

- Impression Share: What percentage of the time did your ads show up when they were eligible? If a competitor has a sky-high impression share, it’s a dead giveaway they have a serious budget and are bidding hard on your shared terms.

- Overlap Rate: This tells you how often a competitor’s ad showed up in the same auction as yours. A high overlap rate means you’re in a direct, head-to-head fight for the same eyeballs.

- Position Above Rate: When you and a competitor both appeared, how often did their ad rank higher than yours? This is a direct scorecard for who’s winning the SERP, a result of both their bid and their Quality Score.

Here's a pro tip: Don't just pull the account-wide report. The real magic happens when you segment. Look at Auction Insights at the campaign and even ad group level. You'll quickly see who’s fighting you for those high-intent, bottom-of-funnel keywords versus the broader, top-of-funnel terms.

Broaden Your Horizons with Third-Party Tools

Auction Insights tells you who is in the ring, but third-party tools help you understand how they’re fighting. Platforms like Semrush, Ahrefs, and SpyFu are my go-to's for this. They scrape and analyze massive amounts of search data to estimate what would otherwise be a black box.

These tools are brilliant for directional insights you just can't get from Google, such as:

- Estimated Ad Spend: Get a ballpark figure for what your competitors are likely spending on paid search every month.

- Full Keyword Lists: Uncover every keyword a competitor is bidding on—not just the ones where you overlap. This is gold for finding new opportunities.

- Historical Ad Creative: See how their messaging and offers have changed over time. If you spot an ad they've been running for six months straight, you can bet it's working for them.

It's crucial to treat this data as directional, not gospel. Ever since 2020, when Google started limiting the search term data it shares, conducting a google ads competitor analysis has gotten trickier. We can no longer rely on a single source for exact figures. Now, the game is all about blending insights from multiple tools to paint a complete picture, a topic covered well in this insightful guide on Google Ads competitor research.

Don’t Skip the Manual Research

Finally, you have to get your hands dirty. No automated tool can replicate the actual user experience or grasp the strategic thinking behind a campaign. This means you need to put on your customer hat and do some old-fashioned digging.

Click on their ads. Sign up for their demos. Abandon a shopping cart. This is how you analyze their landing pages, dissect their conversion funnels, and really understand the journey they’ve built. It provides the qualitative “why” that raw data and estimated metrics can never give you.

Decoding Your Competitor’s Ad Strategy

Alright, you've identified your rivals and have your toolkit ready. Now for the fun part: the actual detective work. This is where we go beyond surface-level metrics and start taking apart the strategic choices your competitors are making day in and day out.

The goal here isn't to just copy them. It's to figure out the why behind their campaigns so you can build something smarter, better, and more profitable.

We're going to focus on the big three: their ad creatives, their landing pages, and the keywords they're betting on. These are the pillars of any Google Ads campaign. A crack in just one of them is an opportunity you can drive a truck through.

Reverse Engineering Their Ad Copy and Offers

Think of your competitor's ad copy as a direct window into their marketing brain. It's their best guess at what will make your shared audience click. When you start digging through their ads—using tools like Semrush or Google's own Ads Transparency Center—your job is to spot the patterns.

What you're really looking for are the themes they keep coming back to.

- Core Value Propositions: Are they always talking about speed? Price? Quality? Customer service? Their main angle will be hammered home in their most-used ads.

- Emotional Triggers: Look for the psychological levers. Are they creating urgency ("Limited Time Offer"), scarcity ("Only 3 Left"), or building trust with social proof ("Join 10,000+ Happy Customers")?

- Calls-to-Action (CTAs): What, exactly, do they want people to do? "Shop Now," "Get a Free Quote," and "Learn More" all point to very different campaign goals.

For instance, if a competitor's headlines are constantly things like "24/7 Support for Small Teams," it’s a safe bet they're targeting a user who values accessibility over a laundry list of features. That’s a powerful insight you won't get from a spreadsheet.

A study found that 61% of companies have missed a strategic opportunity because they didn't fully understand their market and competitors. Think of this analysis as your first line of defense against becoming part of that statistic.

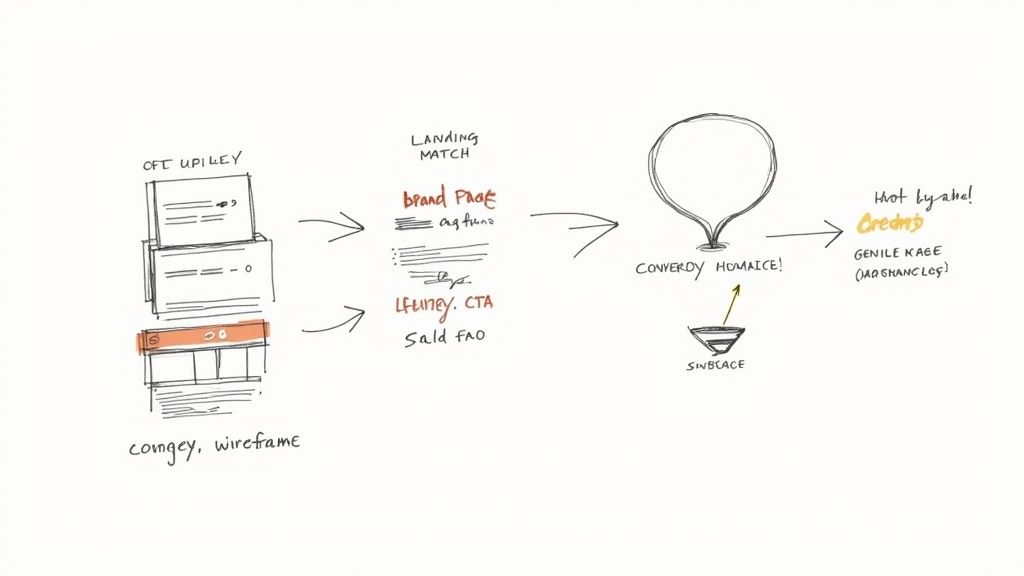

Assessing Their Landing Page Experience

The ad earns the click, but the landing page is what secures the conversion. From my experience, this is where you’ll find the most glaring weaknesses in a competitor's strategy. A killer ad that dumps a user onto a slow, confusing landing page is just burning money.

When you click through their ads, put on your most critical user hat and scrutinize the entire journey.

- Message Match: Does the headline on the page echo the promise from the ad? Any disconnect here is a huge red flag. It creates confusion and sends bounce rates through the roof.

- Conversion Focus: Is the page ruthlessly focused on one clear action? Or is it a chaotic mess of navigation links, competing CTAs, and distracting images? Clean and simple almost always wins.

- User Experience (UX): How fast does it load? Is the form a nightmare to fill out? Crucially, how does it look and feel on a phone? These little friction points are conversion killers.

A savvy competitor will have dedicated landing pages for specific ad groups, tailoring the message perfectly. If you see them sending all their ad traffic to their generic homepage, you've just found a lazy competitor. That's a golden opportunity to win with a more focused approach.

Deconstructing Their Keyword Strategy

Finally, you need a clear map of the keywords they’re bidding on. This is where third-party tools are non-negotiable, as they show you the entire battlefield, not just where your territories overlap. As you pull their keyword lists, start bucketing them into strategic groups.

- Brand Keywords: These are terms that include their company name. They bid on these to play defense and stop you from poaching their most qualified traffic.

- Generic Keywords: Think high-volume, broad terms like "project management software." These are expensive, competitive, and usually target people at the very top of the funnel who are just starting to look around.

- Long-Tail Keywords: These are the super-specific, multi-word phrases like "Gantt chart software for construction teams." The search volume is lower, but the user intent—and conversion rate—is typically much, much higher.

As you dissect their campaigns, think about the bidding strategies they’re likely using. Someone blowing their budget on generic terms is probably chasing brand awareness. Another who is aggressive on long-tail keywords is hunting for immediate, high-quality leads. Understanding their approach to Google Ads Bidding Strategies helps reveal their core business objectives, which in turn helps you sharpen your own.

Benchmarking Performance to Find Opportunities

Looking at competitor data in a vacuum is like collecting baseball cards—it's interesting, but it doesn't win you the game. The magic happens when you hold that data up against your own performance. This is where you find the real opportunities. Benchmarking is what turns a pile of stats into a strategic roadmap, showing you exactly where you’re crushing it and, more importantly, where you’re leaving money on the table.

This isn’t about stroking your ego with vanity metrics. It’s about finding quantifiable gaps you can exploit. When you stack your key performance indicators (KPIs) against your rivals and industry averages, you can zero in on specific weaknesses that, once fixed, will actually move the needle for your business.

Establish Your Baselines and Industry Context

Before you go head-to-head with your top rival, you need to understand the playing field. What’s considered a “good” click-through rate in e-commerce is worlds apart from what you’d see in legal services. This is why grabbing some industry-wide benchmarks is so valuable.

Recent data gives us a great snapshot. Across all industries, the average click-through rate (CTR) on Google Ads is about 6.66%, with conversion rates hovering around 7.52%. But look closer: an Arts & Entertainment brand might see a CTR of 13.1%, while a law firm is more likely to be around 5.97%. Knowing these numbers helps you set realistic goals instead of chasing ghosts. You can find more up-to-date figures in this breakdown of the latest Google Ads benchmarks on Wordstream.

Benchmarking isn't a one-and-done audit; it's an ongoing discipline. Keep a constant pulse on your performance relative to the market. This is how you adapt faster, spot trends before they’re obvious, and build a real competitive edge.

Once you have that 30,000-foot view, it's time to zoom in on the metrics that tell the real story.

Key Metrics for Your Competitive Scorecard

Now we get to the fun part: a direct comparison with the competitors you spotted in your Auction Insights report. This is where you build out your competitive scorecard, focusing on a few core metrics that tell you who’s winning the click—and why. For a deeper dive into this process, check out our complete guide to competitive benchmarking.

Here's where to focus your attention.

Impression Share: Think of this as a direct proxy for budget and aggression. If a competitor has a 70% impression share on your most important keywords while you’re stuck at 30%, they are simply outspending and outbidding you. It's a raw measure of market dominance.

Click-Through Rate (CTR): When you compare your CTR to a competitor's on the same keywords, you're putting your ad copy and offer in a cage match with theirs. If your CTR is lower, it’s a blunt signal that their message is hitting home with your audience more effectively. That’s your cue to start A/B testing new headlines, fast.

Top-of-Page Rate: This tells you how often an advertiser's ad shows up above the organic results. A competitor who consistently owns this spot is likely playing an aggressive bidding game or has a fantastic Quality Score. Either way, it tells you they’re willing to pay a premium to be the first thing a searcher sees.

This data is essential for understanding the "why" behind performance. The table below breaks down what to look for and how to think about it.

Key Metrics for Competitive Benchmarking

| Metric | What It Tells You | Actionable Insight |

|---|---|---|

| Impression Share | A direct measure of budget and bidding aggression on target keywords. | If a competitor's is much higher, they're outspending you. You can either increase your budget or find less competitive keyword gaps. |

| Click-Through Rate (CTR) | How well an ad's copy and offer resonates with the target audience. | A lower CTR means your messaging is weaker. It's time to analyze their ads and A/B test new value propositions. |

| Top-of-Page Rate | Who is prioritizing (and paying for) the most prominent ad positions. | If a rival consistently beats you here, they're bidding for maximum visibility. Evaluate if that position is worth the higher CPC for you. |

| Conversion Rate (Est.) | A proxy for the effectiveness of their landing page and overall offer. | While you can't see this directly, a high ad spend suggests a positive ROI. Analyze their landing page UX and offer for weaknesses. |

By tracking these metrics over time, you move from simply reacting to the market to proactively shaping your position within it.

Turning Benchmarks into Actionable Insights

The whole point of this exercise is to walk away with a prioritized to-do list. Your google ads competitor analysis should lead directly to clear, concrete actions for your campaigns.

Start by asking a few simple, powerful questions based on what you found:

- Where are we getting beat? If your CTR is consistently lagging, the immediate task is to dissect their ad copy and landing page offers. What are they saying that you aren't?

- Where are they not even showing up? If you find valuable keywords where your competitors have little to no impression share, you’ve struck gold. This is your chance to own that conversation and capture market share at a much lower cost.

- Is their offer beatable? Click through their ads. If their landing page is clunky, slow, or has a weak call-to-action, you’ve found an opening. You can win the conversion with a better user experience, even if you can’t outbid them on every single click.

This simple framework shifts you from just watching your competitors to actively outmaneuvering them, ensuring your analysis actually drives real-world results.

Building an Automated Competitor Monitoring System

A one-off competitor analysis is great, but its insights get stale fast. The market doesn't stand still. Your rivals are tweaking their ads, testing new landing pages, and chasing new keywords every single day. If you're not keeping a constant watch, you're falling behind.

To stay ahead, you need to shift from periodic research to continuous monitoring. But this doesn't mean you need to spend hours manually spying on your competition. It's about building a smart, automated system that acts like an early warning signal, flagging important moves so you can react when it counts.

https://www.youtube.com/embed/9S6Uq2UVvYA

Setting Up High-Signal Alerts

Automation is the heart of any good monitoring system. You simply can't scale manual checks. The real goal is to create "high-signal" alerts—notifications about genuinely strategic moves, not just minor, everyday tweaks.

You want to filter out the noise and focus on the changes that truly matter. Here are the essential alerts I always recommend setting up first:

- New Keyword Bids: Get pinged the moment a competitor starts bidding on new keywords, especially long-tail phrases that show high intent. This is often the first smoke signal that they're targeting a new customer segment or rolling out a feature.

- New Ad Creatives: An alert for a new ad campaign gives you an instant window into their latest messaging. You can see their new value propositions, promotional offers, and the pain points they're trying to solve right as they launch.

- Landing Page Overhauls: Keep an eye on their key landing pages. When one gets a major rewrite, it’s a huge tell. It could signal a big strategic pivot or that their old page just wasn't converting.

- Pricing and Offer Changes: You absolutely need to track their pricing pages and promotional banners. An alert about a new 20% discount or a restructured pricing model is something that requires an immediate huddle with your team.

These alerts are your front line, transforming a static analysis into a live stream of competitive intelligence.

Integrating Alerts Into Your Operational Workflow

Getting a hundred email alerts a day is just as useless as getting none. The data is only valuable if it lands where your team actually works. You have to pipe these notifications directly into your daily tools, like Slack and Asana.

Think about this scenario: A competitor launches a new campaign with a massive discount.

- The Wrong Way: An email alert hits a marketing manager's inbox, which they might not see for hours. They forward it to the team, and by the time anyone discusses it, the competitor has a full day's head start.

- The Right Way: An automated alert instantly posts to a dedicated

#competitive-intelSlack channel. The entire GTM team sees it. A Zapier or webhook integration then automatically creates a task in Asana, assigning it to the head of paid acquisition to investigate and draft a response.

This is the critical difference between passively watching and actively responding. When you embed competitive intel directly into your operational stack, you shrink the time from insight to action from days to minutes.

This whole process is about turning data into action.

As you can see, comparing your performance is just step one. The real wins come from analyzing the gaps and actually optimizing your campaigns.

Creating a Simple Triage and Reporting Framework

Not every move a competitor makes is a five-alarm fire. To avoid burnout and knee-jerk reactions, you need a simple way to triage alerts and report up to leadership.

First, get a quick triage process in place. When an alert comes in, the owner should immediately decide if it's high, medium, or low priority. A competitor testing a new button color? Low priority. A competitor suddenly bidding on your top-performing, most profitable keyword? That’s a high-priority alert that needs immediate attention.

Second, create a dead-simple reporting template. No one has time for a 10-page document. A weekly or bi-weekly summary shared with founders and GTM leads is all you need.

Your report should have three simple parts:

- Key Observation: What happened? (e.g., "Competitor X launched a new campaign around 'AI-powered automation.'")

- Potential Impact: Why do we care? (e.g., "This message directly challenges our core value prop and could steal high-intent leads.")

- Recommended Action: What should we do? (e.g., "Proposing an A/B test on our ad copy to counter their messaging. We'll check results in 7 days.")

This disciplined approach ensures your Google Ads competitor analysis stays focused and that insights consistently lead to action. If you're serious about building a world-class system, digging deeper into the principles of competitive tracking can give you an even stronger foundation for these workflows. By building this system, you make sure your team is always informed, aligned, and ready to move on the market shifts that truly matter.

Frequently Asked Questions

Even with a solid game plan, you're bound to have questions when you start digging into your competitors' Google Ads. Here are a few of the most common ones that pop up, with some straight answers to help you get the most out of your analysis.

How Often Should I Run a Competitor Analysis?

This is the classic "it depends" question. For most companies, a high-level check-in once a month, followed by a deeper, more strategic review each quarter, is a great rhythm. It's enough to keep you current without getting bogged down in constant analysis.

But if you're in a market that moves at lightning speed—think a hot e-commerce category or a crowded SaaS vertical—you'll want to keep a much closer eye on things. Honestly, the cadence of your formal reports matters less than having a good automated monitoring system in place. That way, you get an immediate heads-up on any big strategic moves, like a competitor launching a new product or a massive holiday sale, and can react in near real-time.

The real goal is to get into a rhythm of proactive deep dives that are backed up by reactive, real-time alerts. That's how you stay ahead of the curve and never get caught off guard.

Can I See a Competitor's Exact Budget or Bids?

The short answer is no. Google keeps this kind of sensitive data locked down, and for good reason. You’ll never be able to see exactly what a competitor spends, what their CPC is for a specific keyword, or their precise bidding strategy. It’s a black box.

Now, third-party tools can give you some incredibly useful estimates. But you have to treat them as just that—estimates. These platforms use complex models, pulling from SERP data, clickstream info, and keyword metrics to piece together a pretty good guess of what someone is spending.

Instead of obsessing over exact dollar amounts you'll never truly know, it's far more productive to focus on the things you can see with 100% certainty:

- Their ad copy and the key messages they're pushing.

- The keywords they are consistently showing up for.

- Their landing page experience and the funnel they push users into.

- The specific offers and promotions they're running right now.

This is where the real strategic gold is. This observable data tells you so much more about their actual strategy than an estimated budget ever could.

What Is the Most Important Thing to Analyze?

Everything is connected, but if you forced me to pick just one thing, it would be the "message match" between their ad copy and their landing page. This is the glue that holds a campaign together and the clearest sign you're dealing with a sophisticated advertiser who knows how to convert traffic.

When you see perfect alignment—where the headline on the landing page directly mirrors the promise made in the ad—you're looking at a well-oiled machine. It tells you exactly what value proposition they believe will resonate with that specific audience for that specific keyword.

On the flip side, when you find a competitor with a glaring mismatch (like an ad that screams "50% Off Software" but clicks through to their generic, full-price homepage), you've just uncovered a serious vulnerability. That kind of disconnect frustrates users and absolutely tanks conversion rates. It’s a golden opportunity for you to swoop in and win not just the click, but the customer, by simply providing a more cohesive experience.

Ready to stop guessing what your competitors are doing? ChampSignal delivers high-signal alerts on your rivals' ad strategies, pricing changes, and new features directly to your workflow. Start your free 30-day trial and see what you've been missing.

Stay Ahead

Don't just find competitors. Track them.

Auto-discover new competitors as they emerge. Get alerts when they change pricing, features, ads, or messaging.

Competitor Monitoring

For founders who'd rather build than manually track competitors.

Starts at

$29 /month

Start with a 14-day free trial. No credit card required.

Stop checking competitor websites manually. Get alerts when something important happens.

Auto Competitor Discovery

New competitors detected automatically as they emerge. Never get blindsided.

Website Tracking

Pricing, features, messaging, and page changes monitored daily

News & Social Monitoring

News mentions, Reddit posts, and competitor announcements

SEO & Ads Intelligence

Keyword rankings, backlinks, and Google Ads creatives

AI Signal Detection

Filters out noise, surfaces only what matters

Email & Slack Alerts

Daily digests delivered where your team already works