Competitor intelligence is all about ethically gathering and analyzing public information on your business rivals to get a strategic edge. It’s the art of turning raw data about their marketing, pricing, and product moves into insights you can actually use. Think of it less like spying and more like smart observation.

Understanding Competitor Intelligence Beyond The Buzzwords

Let's use an analogy. If you're coaching a basketball team, you don't just drill your own players. You watch hours of game tape on your opponents, right? You study their plays, their star players' habits, and their weaknesses. You do this to build a winning game plan.

That's exactly what competitor intelligence (CI) is for your business. It’s a disciplined framework that helps you anticipate what’s coming next in your market instead of just reacting after it’s too late.

This isn't about guesswork. It's about systematically collecting clues from public sources—what new products are rivals launching? How are they tweaking prices? Where is their marketing budget going?—and then connecting the dots to see the bigger picture.

The Scope of Modern CI

Truly effective CI isn't just a few Google searches. It’s about monitoring a whole range of signals to build a complete picture of what everyone else is doing. To really get a handle on this, it's vital to know how to conduct a thorough competitive analysis.

Today, this means keeping a close eye on several key areas:

- Product and Pricing: Any change to a competitor's features, service tiers, or pricing pages tells a story about how they see their own value in the market.

- Marketing and Messaging: By looking at their ad campaigns, social media content, and website copy, you can figure out who they’re trying to reach and the story they’re telling.

- Hiring and Operations: Pay attention to job postings. A sudden search for a "German Country Manager" probably means they're expanding into Germany. A team of new AI engineers signals a major tech investment.

- Customer Sentiment: What are people saying in online reviews or on social media? This is unfiltered feedback on what customers love—or really hate—about their products.

By systematically tracking these signals, you transform scattered data points into a cohesive strategic map. This map doesn't just show you where your competitors are today; it helps you predict where they are headed tomorrow.

Intelligence vs Information

Here’s a distinction that trips a lot of people up: the difference between raw information and true intelligence.

Information is just a data point. For example: "Our main competitor lowered their price by 10%."

Intelligence is the analysis and context that gives that data meaning. For instance: "They lowered their price by 10% because of a wave of negative customer reviews about value. They're trying to stop customer churn before they launch a new feature next quarter."

See the difference? That deeper understanding is what allows you to make confident, proactive decisions. It’s how observation becomes a real competitive advantage.

Why Competitor Intelligence Is Your Strategic Advantage

Simply knowing what your rivals are doing is table stakes. The real magic of competitor intelligence happens when you turn those raw observations into a concrete strategic advantage that drives real growth. It's the difference between reacting to the market and actually shaping it.

Think about it this way: your main competitor suddenly rolls out a new product feature that speaks directly to your best customers. Without CI, you’re flat-footed, scrambling to put out fires. But with a solid CI strategy, you would have spotted the early signals—maybe new job postings for specialized developers or a subtle change in their marketing copy—months ago. That's time you could have used to prepare a counter-move.

This kind of proactive thinking sharpens every corner of your business. It lets you see threats coming, avoid expensive mistakes by learning from someone else’s blunders, and spot underserved market needs before they become obvious to everyone.

Aligning Your Entire Organization

Great competitor intelligence isn't just a task for the marketing department. When done right, its insights ripple through the entire company, getting everyone on the same page about where you stand in the market. This creates a powerful feedback loop that results in smarter, more unified decisions.

Here’s how different teams can put it to work:

- Marketing: Can build campaigns that laser-focus on your unique value, hitting competitors where they’re weakest.

- Sales: Can walk into calls knowing a rival's shortcomings, giving them the edge they need to close the deal.

- Product Development: Can design better products by identifying feature gaps or jumping on negative customer feedback about competitor offerings.

This company-wide impact is exactly why businesses are pouring resources into CI. The global market for competitive intelligence was valued at USD 50.87 billion in 2024 and is expected to more than double by 2033. This explosion in growth shows just how essential CI has become for leadership. You can find more details in the competitive intelligence market growth report from DataHorizzon Research.

From Reactive Tactics to Proactive Strategy

At the end of the day, competitor intelligence is about shifting your business from a follower to a leader. Instead of constantly playing defense and responding to others, you start setting the tempo. You make the moves that force them to react.

A well-run CI program gives you the foresight to not just survive market shifts but to capitalize on them. It’s about making smarter, faster, and more confident decisions that secure long-term, sustainable growth.

This strategic foresight helps you put your resources where they’ll have the most impact, investing in high-potential opportunities instead of fighting losing battles in saturated spaces. It gives you the clarity to cut through the noise of a crowded market, ensuring every decision is grounded in a deep understanding of the competitive landscape. That’s how intelligence becomes a genuine, lasting advantage.

The Key Signals Every Business Should Monitor

Knowing you need to keep tabs on the competition is the easy part. The real challenge is figuring out where to look. The internet is a firehose of information, and if you don’t know what you’re looking for, you’ll drown in irrelevant noise. A smart approach means focusing on the specific signals that actually tell you something important—the breadcrumbs that reveal a competitor's strategy and what they’re planning to do next.

Think of yourself as a detective. You wouldn't just wander around a crime scene aimlessly; you’d look for specific clues like fingerprints, footprints, or something out of place. In the same way, your job is to find the digital fingerprints your competitors leave behind. That requires looking beyond their homepage and zeroing in on the areas where their strategic moves first become visible.

When you do this right, monitoring stops being a vague concept and becomes a practical playbook for making better decisions. This is where you can see the real-world benefits come to life.

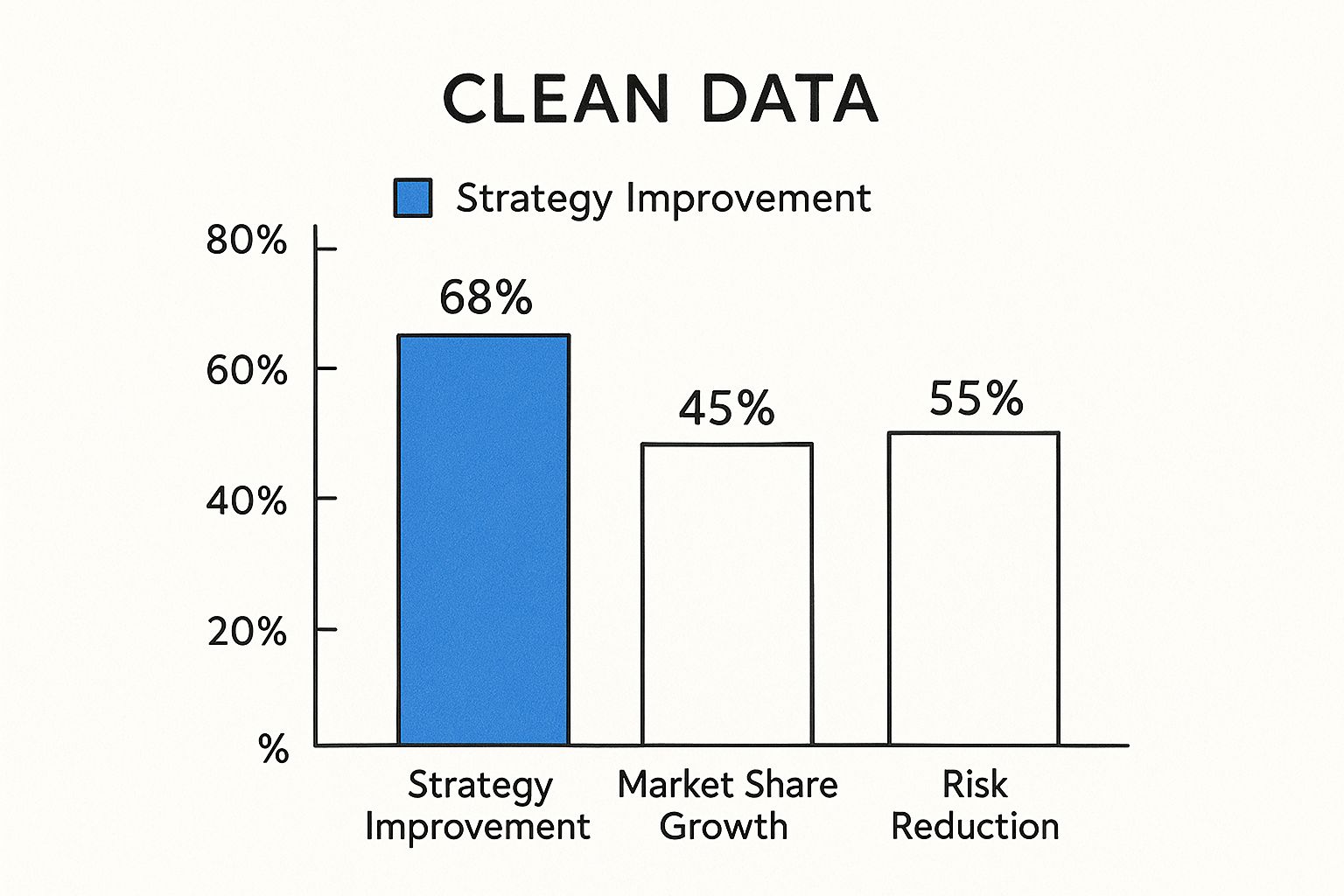

As the data shows, growing market share is a fantastic outcome, but the most powerful advantages often come from sharpening your own strategy and sidestepping potential risks. Let's break down where to find these signals.

Product and Pricing Changes

A company’s product and pricing pages are goldmines for competitive intelligence. Any changes you see here are almost never random. They’re the end result of weeks or months of internal planning and directly signal a shift in direction.

For example, if a competitor suddenly rolls out a new, high-ticket "Enterprise" plan, you can bet they're making a play for bigger, more lucrative clients. On the flip side, a sudden 15% discount on everything might mean they’re desperate to hit quarterly numbers or are aggressively trying to scoop up new users before a funding announcement. Keeping an eye on these pages tells you exactly how they see their own value and who they’re trying to attract.

Marketing and Advertising Campaigns

The way a company talks about itself in public says everything about its priorities. By analyzing their marketing—from the copy in their Google Ads to the themes in their social media posts—you get a front-row seat to their strategic thinking.

Did their ad copy pivot from "simple and easy" to "powerful and scalable"? That’s a clear sign they’re shifting their focus from small businesses to the enterprise market. Or maybe they’ve launched an entire campaign around one specific feature. That tells you precisely where they think their biggest advantage is.

Tracking these campaigns helps you pinpoint the stories your competitors are telling the market. This creates opportunities for you to craft a counter-narrative, find gaps in their messaging, and position your own unique strengths much more effectively.

Hiring Trends and Team Structure

Job postings are probably one of the most overlooked—and most telling—signals out there. A company’s open roles are essentially a public roadmap of their future plans and where they're investing their money.

So, what should you watch for?

- Brand New Roles: A sudden opening for a "Head of APAC Sales" is a flashing neon sign that they're planning an expansion into Asia.

- Team Expansion: Are they hiring a cluster of new engineers with skills in a specific programming language? That could signal a major product overhaul or a shift to a new technology stack.

- Geographic Focus: If you see them hiring a full sales team in a new city, you know exactly which market they're targeting next.

These kinds of people-focused changes almost always happen months before a new product drops or a market entry is announced, giving you a powerful early warning system.

To pull all this together, here’s a simple checklist you can use to structure your monitoring efforts.

Actionable Competitor Monitoring Checklist

This table breaks down the most important areas to watch, what to look for, and the kind of strategic insights you can pull from the data.

| Monitoring Area | Key Data Points to Track | Strategic Questions Answered |

|---|---|---|

| Product & Pricing | New feature launches, plan restructuring, price increases/decreases, changes to free trials, new product tiers | Are they moving upmarket or downmarket? How are they positioning their value? Are they feeling pressure to compete on price? |

| Marketing & Messaging | New ad campaigns, changes in website copy/taglines, content marketing themes, SEO keyword focus, social media angles | Who is their target audience right now? What pain points are they trying to solve? Where do they see their unique selling proposition? What market trends are they trying to capitalize on? |

| Hiring & People | New job postings (especially leadership roles), team growth in specific departments, new office locations | Where are they investing for future growth? Are they building a new product or entering a new market? Are they struggling with talent retention in a key area? |

| Customer Feedback | Online reviews (G2, Capterra), social media mentions, forum discussions, customer case studies | What do customers love or hate about their product? Are there common complaints you can solve better? What features are users asking for? What is their reputation like in the market? |

| Website & Tech Stack | Website redesigns, changes to the technology they use (e.g., new analytics or marketing automation tools), SEO changes | Are they investing in a better user experience? Have they adopted new tools that give them an edge? How are they trying to improve their online visibility? Are they signaling a shift in their technical priorities? |

Using a structured approach like this ensures you're not just collecting data for the sake of it. You're actively gathering intelligence that helps you answer critical business questions and make smarter, more proactive decisions.

With a tool like ChampSignal, you can automate this entire process. Instead of manually checking dozens of websites every day, you can set up alerts to get notified the moment a competitor makes a meaningful change in any of these areas. Learn more about how ChampSignal tracks competitor signals.

Gathering Intelligence The Right Way

A truly powerful competitor intelligence program is built on a foundation of trust and ethics. The goal is to gain strategic insight, not to engage in corporate espionage. The good news is you don’t need a trench coat or any secret gadgets for this. The most valuable information is often hiding in plain sight, available to anyone who knows where to look and how to connect the dots.

This is the very heart of ethical intelligence gathering. It's all about using publicly available sources to get a clear picture of the competitive landscape. By sticking to open-source information, you can build a sustainable advantage without ever worrying about crossing legal or ethical lines. This approach makes sure your CI program is a source of strength, not a potential liability.

Your Ethical Intelligence Toolkit

So, where do you find all this game-changing public data? It’s scattered all over the digital world, just waiting for someone to collect and analyze it. A smart, ethical intelligence strategy focuses on keeping a close watch on these key public channels.

Here are some of the most potent—and completely legitimate—sources for competitor intelligence:

- Company Websites: This is ground zero. Dig into everything from their product pages and pricing tables to their "About Us" section and blog posts. You'll spot shifts in strategy and messaging.

- Public Financial Filings: For any publicly traded company, quarterly and annual reports are a goldmine. They give you the inside track on performance, strategic priorities, and even what they see as major risks.

- Patent and Trademark Applications: These public documents can tip you off to new products or branding efforts long before they ever hit the market.

- Social Media and Online Forums: Listening to what companies post on LinkedIn or what their customers complain about on Reddit gives you raw, unfiltered feedback on brand perception and product weaknesses.

- Industry Events and Trade Shows: Attending conferences—even virtual ones—lets you see firsthand how competitors present themselves, what features they emphasize, and what kinds of questions people in the audience are asking.

Ethical competitor intelligence is about being a great detective, not a spy. It’s the art of piecing together publicly available clues to see the full picture and anticipate what’s coming next.

Drawing the Line: Clear Boundaries

Knowing the difference between ethical research and illegal activity is non-negotiable. Your entire program’s integrity depends on staying firmly on the right side of that line. In short, ethical intelligence sticks to information that is accessible to the public.

It’s about what you can find, not what you can take. Anything that involves misrepresentation, hacking, stealing trade secrets, or pressuring employees to break non-disclosure agreements is strictly off-limits. That’s corporate espionage, plain and simple.

By building your strategy around transparency and public data, you ensure your competitive edge is both powerful and principled.

How Technology Changed the Competitor Intelligence Game

It wasn’t that long ago that "competitor intelligence" meant a few analysts hunched over spreadsheets. Their days were spent manually checking a handful of rival websites, and by the time they delivered their findings, the insights were often already stale.

That world is long gone.

Technology has completely flipped the script, turning what was once a painstaking manual chore into a dynamic, automated source of strategic gold. The difference is night and day. Before, you might have been able to keep tabs on five competitors. Now, you can monitor an entire industry in real time.

Modern platforms are like a constant surveillance system for your market, catching every pricing tweak, product launch, and marketing shift the second it happens. This move from reactive data entry to proactive, real-time alerts is what it's all about.

The Rise of Automated Insight

The engine driving this change is automation, often supercharged with artificial intelligence. Instead of just dumping raw data on you, today's tools are built to analyze and interpret it. They can tell the difference between a minor typo fix on a webpage and a major pivot in a competitor’s value proposition.

This leap forward explains why the market for these tools is exploding. Valued at $53.2 billion in 2023, the CI tools market is on track to hit $96 billion by 2030. A huge part of this growth comes from cloud-based solutions that put powerful, real-time intelligence within reach for businesses of all sizes.

The biggest shift isn't just about the speed or amount of data we can collect. It's the ability of technology to connect the dots, delivering strategic insights that were once only available to the biggest corporations with the deepest pockets.

These tools don't just tell you what changed; they give you the context to understand why it matters. This is where tools like sales intelligence platforms come in, giving teams a clear strategic edge.

From Data Points to Actionable Strategy

Modern competitor intelligence tools feed insights directly to your team, cutting out the tedious manual research. This frees up your best minds to focus on what they do best: making smart decisions. If you're weighing your options, our business intelligence tools comparison can help.

Platforms like ChampSignal are a perfect example of this new reality. They help by:

- Filtering the Noise: Using AI to spot meaningful changes, so you only get alerts that actually matter.

- Providing Context: Showing you exactly what changed with before-and-after screenshots and historical data.

- Automating Monitoring: Tracking hundreds of signals across websites, ads, and search rankings, 24/7.

This evolution makes deep competitive intelligence not just possible, but a practical and essential part of staying ahead of the curve.

Putting AI to Work in Your Competitive Strategy

Let's be honest, artificial intelligence can sound like a buzzword from a sci-fi movie. But for competitive strategy, it's very real and already here. Think of AI as a tireless analyst, working around the clock to spot signals your human team could never catch on their own. It handles the mind-numbing data crunching that used to bog everyone down.

Imagine the impossible task of manually sifting through thousands of new customer reviews for five of your competitors every single week. It just can't be done. An AI tool, on the other hand, can run sentiment analysis on that entire mountain of data in minutes, giving you an instant read on whether a rival's reputation is trending up or down.

From Data Overload to Predictive Insight

The real magic of AI-driven platforms isn't just about collecting data; it's about finding the hidden story within it. These systems are smart enough to tell the difference between a minor website typo correction and a major strategic shift, filtering out all the noise so your team can focus on what actually matters.

This isn't just a small change—it’s completely reshaping how businesses compete. The market for AI-powered competitive intelligence is expected to reach $14.4 billion by 2025. Even more telling is that companies using these tools are 2.5 times more likely to pull ahead of their peers. They're turning raw data into a real-world advantage. You can dig deeper into these platforms in this guide to AI competitor analysis tools.

An AI system can connect dots that seem totally unrelated. For example, it might notice a competitor has new job postings for logistics experts, slightly tweaked the price of a key product, and launched new ad copy aimed at a new region. To a human, these are just separate events. To an AI, it’s a clear signal of a potential market expansion, giving you a crucial heads-up to prepare.

Instead of just reporting on what has already happened, AI provides predictive alerts that help you see what’s coming. It’s the difference between reading yesterday's news and getting tomorrow's headlines today.

When you let intelligent systems handle the tedious monitoring, your team is freed up to do what they do best: think strategically. You can make decisions faster and with more confidence, keeping you consistently one step ahead of the competition.

Common Questions About Competitor Intelligence

Even with a solid plan, it's natural for questions to pop up when you start putting competitor intelligence into practice. Let's tackle some of the most common ones to help you move forward with confidence.

Is Competitor Intelligence Legal And Ethical?

Yes, absolutely. This is probably the most common question, and it's an important one. True competitor intelligence is all about gathering and analyzing publicly available information. We're talking about things like news reports, their company website, official press releases, social media posts, and industry publications.

This is a world away from corporate espionage, which relies on illegal activities like hacking or stealing information. The whole point of ethical CI is to make smarter decisions based on what’s already out in the open—not to get your hands on protected trade secrets.

How Often Should I Conduct CI Activities?

Think of competitor intelligence not as a one-off project, but as a continuous loop. How often you run that loop really depends on the speed of your industry.

- Fast-Paced Sectors: If you're in a field like tech or e-commerce where things change overnight, you need real-time, continuous monitoring. Automated tools are your best friend here.

- Stable Industries: For more traditional or slower-moving markets, a deep-dive analysis every quarter, backed up by monthly check-ins, might be all you need.

The goal is simple: stay consistently aware so a competitor's move never catches you completely off guard.

The biggest mistake is treating intelligence as a checklist item. True strategic advantage comes from making it a continuous, embedded part of your company’s culture and decision-making rhythm.

What Is The Difference Between CI And Competitive Analysis?

It's easy to see why these two get mixed up, but there's a key distinction.

Competitive analysis is usually a self-contained project with a clear beginning and end. You might do one to compare your product features or pricing against your top three rivals. It’s a snapshot in time.

Competitor intelligence (CI), on the other hand, is the ongoing process of gathering, analyzing, and acting on information about your entire competitive environment. It's not just about your direct rivals; it includes emerging trends, potential market disruptors, and even shifts in customer behavior.

To put it simply, analysis is the snapshot; intelligence is the live video feed.

Ready to turn competitor monitoring from a chore into a strategic advantage? ChampSignal delivers automated, high-signal alerts directly to you, so you only react when it truly matters. Start your free 30-day trial today.